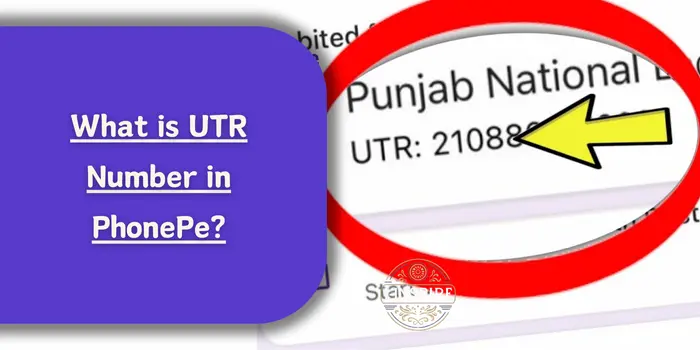

What is UTR Number in PhonePe?

In the rapidly evolving landscape of digital payments, PhonePe has emerged as a leading platform in India, offering a seamless and secure way to conduct financial transactions.

Among the various features that ensure the smooth functioning of these transactions is the UTR number.

This unique identifier plays a crucial role in tracking and verifying transactions, providing users with a reliable means to manage their financial activities.

Whether you’re transferring money, paying bills, or making purchases, understanding the significance of the UTR number within the PhonePe ecosystem is essential for resolving any potential issues and ensuring the accuracy of your transactions.

This article delves into the importance of the UTR number in PhonePe, guiding users on locating and utilising this critical piece of information effectively.

What is UTR Number in PhonePe?

A UTR number, or Unique Transaction Reference Number, is a 12-digit code that uniquely identifies financial transactions made through NEFT, RTGS, or UPI.

This number is automatically generated by the banking system once a transaction is initiated.

The UTR number is crucial for tracking the status and history of a transaction, providing proof of when a transaction took place, and serving as an authentic reference when lodging a complaint with PhonePe customer care.

Importance of UTR Number

The significance of a UTR number lies in its ability to prove when a transaction occurred.

It can also be an authentic reference when lodging a complaint with PhonePe customer care.

Unlike other transaction details that may be duplicated, the UTR number remains unique to each transaction. By utilizing this number, one can easily track the status of a financial transaction.

How to Find the UTR Number in PhonePe

To find the UTR number within PhonePe transactions, follow these simple steps:

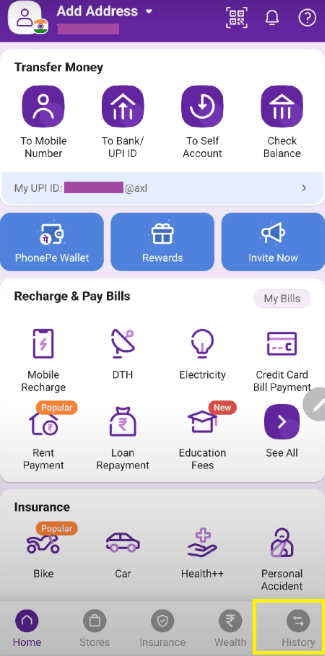

Launch the PhonePe application on your mobile phone, enter the necessary login information, and click on the “History” option at your screen’s bottom right corner.

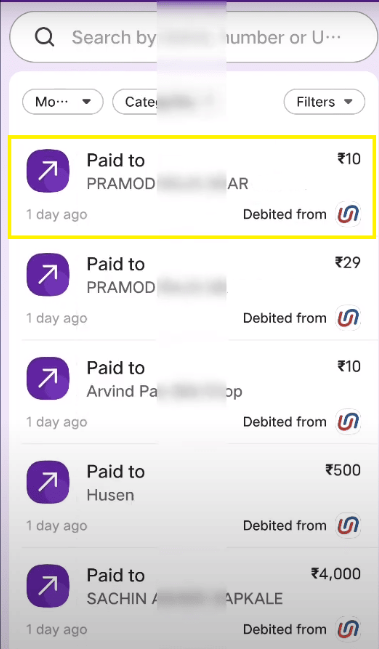

The application will then display a new interface with transaction details. Select the transaction you want to find the UTR number and click on it.

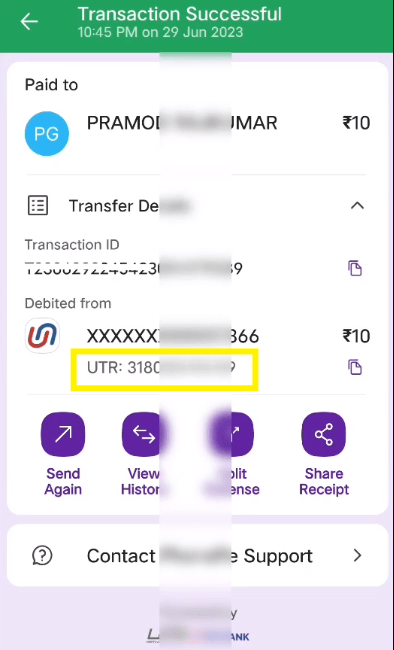

On the subsequent page, you will find the transfer details, including the specific UTR number, under the “Debited from” section.

By following these steps, you can easily access the UTR number within PhonePe transaction history.

Role of UTR Number in PhonePe

| Aspect | Details |

|---|---|

| Unique Identification | Each transaction is uniquely identified by the UTR number. |

| Tracking Transactions | Helps in tracking the status and history of financial transactions. |

| Proof of Transaction | Serves as proof of when a transaction took place. |

| Complaint Resolution | Essential for lodging complaints with PhonePe customer care. |

| Technical Glitches | Useful in resolving issues caused by technical glitches. |

| Sender’s Account | Indicates the account from which money is sent. |

| Recipient’s Account | Indicates the account to which money is sent. |

| Transaction History | Helps in maintaining a record of all transactions. |

| Failed Transactions | Assists in tracking and resolving failed transactions. |

| Merchant Transactions | Important for merchants to track the status of settlements. |

| Reversing Payments | Crucial for reversing incorrect or pending transactions. |

| Banking System | Generated by the banking system for each transaction. |

| Privacy | Ensures the protection of sensitive transaction information. |

| Account Statement | Appears in the account statement for verification purposes. |

| Transaction Status | Provides the current state of a financial transaction. |

This table summarizes the various roles and importance of the UTR number in the context of PhonePe transactions.

UTR Number in Failed Transactions

If your money is deducted from your bank account for a failed payment, there is no need to worry, as your money is safe with your bank.

The amount will be refunded to your account within 3 to 5 days from the payment date.

You can check your relevant bank account statement after 5 days for a refund confirmation.

If your bank fails to refund the amount within 5 days from the payment date, please contact them with the UTR number for the payment. They will help you with this.

UTR Number in Successful Transactions

PhonePe marks payments as successful when they receive confirmation from the receiver’s bank that the money has reached them. This is because the receiver’s banks do not inform PhonePe about depositing the money into the receiver’s account.

If you see that your money has left your bank account but hasn’t reached the receiver yet, please do not worry. Your money is safe with the receiver’s bank.

The receiver will get the money within 5 days from the date you made the payment. You can ask the receiver to check their bank account statement for a deposit confirmation.

The money should reach their account at any time within 5 days from the date you made the payment.

UTR Number in Reversing UPI Payments

In case of an incorrect money transfer or a pending transaction, you can get your payment reversed by following the procedure detailed below:

- Contact your bank directly and raise a wrong credit chargeback with the UTR number of the payment.

- If the person you’ve incorrectly sent money to holds an account with your bank, your bank can directly contact them on your behalf and request that the money be reversed to you.

- If the person you’ve incorrectly sent money to holds an account with another bank, your bank can only act as a facilitator and provide you with some details of the branch. You must visit the branch and speak to the manager for further assistance.

- The money can only be reversed if the receiver agrees. If they do, the money will be transferred to your account within 7 days.

- If the receiver fails to respond to your request or the bank cannot retrieve the amount, you can file a complaint on the NPCI portal.

- After following the above processes, if the complaint remains unresolved after 30 days, you can escalate the issue to the Banking Ombudsman.

UTR Number in Merchant Transactions

For merchants using PhonePe, the UTR number is essential for tracking the status of settlements.

To find the 12-digit UTR number and track the status of your settlement, check the Settlements tab in the History section of your PhonePe Business app.

UTR Number in CoinDCX Transactions

For users of CoinDCX, the UTR number is required for deposits. Once you have made a transaction via PhonePe, click on done. Go to history and select the particular transaction.

The UTR number (as shown in the screenshot) is the correct transaction ID. UPI transaction reference numbers are always 12 digits.

UTR Number in Wise Transactions

A UTR number (unique transaction reference) is a unique reference code attached to every transfer sent to India. The UTR number is visible on the recipient bank statement of the transfer.

The exact format of the number can differ according to the payment method. The UTR number can also trace a payment if the money hasn’t been received.

If that’s the case, and your transfer has been held up, please download your PDF transfer receipt (click on your transfer in Activity, then View transfer details, then Get PDF receipt). You can also find your UTR number on the email Wise sends you when you make a transfer.

UTR Number in DBS Bank Transactions

A UTR or Unique Transaction Reference number is a reference number for identifying an NEFT, IMPS, or RTGS transaction.

Every bank in India uses UTR numbers for all local modes of money transfer, and they are beneficial for recipients in case there has been no recent update or credit corresponding to your transaction.

The quickest way to get a transaction’s UTR number is from your NRI savings account statement.

You can view or download this statement from your bank’s mobile app or through internet banking. It is the 16 or 22 character number next to the transaction date.

Benefits and Limitations of UTR Numbers

UTR numbers provide several benefits in digital payments, including:

- Unique Identification: Each transaction is processed accurately and effectively with unique identifiers like UTR numbers and Transaction IDs.

- Tracking of Payments: UTR numbers help track the transaction of funds from one account to another, ensuring quick and accurate processing of funds and lowering the risk of errors or fraud.

- High Transparency: With UTR numbers, the payment process is more transparent, the payment status can be easily tracked, and updates can be received instantly.

- Fraud Prevention: UTR numbers help lower the risk of fraud and unauthorized access in each transaction.

- Improved Payment Processing: UTR numbers account for faster and more accurate transaction processing.

However, there are also some limitations:

- Potential of Human Error: If UTR numbers are entered incorrectly, it causes delays or errors in the payment process.

- Technical Issues: It can prevent UTR numbers from being generated or used correctly, causing payment delays and errors.

Best Practices for Using UTR Numbers

Here are the best practices for using UTR numbers in digital payments:

- Always Double-Check: Ensure that the UTR number is entered correctly to avoid any delays or errors in the payment process.

- Keep Records: Keep records of all UTR numbers for future reference, especially in disputes or issues.

- Use Secure Channels: Use secure and trusted channels to share or enter UTR numbers to prevent unauthorized access or fraud.

- Monitor Transactions: Regularly monitor your transaction history and account statements to ensure all transactions are accurately recorded and processed.

Frequently Asked Questions (FAQs) on UTR Number in PhonePe

1. What is a UTR number in PhonePe?

A UTR number (Unique Transaction Reference number) is a 12-digit code uniquely identifying a financial transaction made through NEFT, RTGS, or UPI.

It is automatically generated by the banking system once a transaction is initiated and can be used to track the status and history of the transaction.

2. How can I find the UTR number for a transaction in PhonePe?

To find the UTR number for a transaction in PhonePe, follow these steps:

- Open the PhonePe application on your mobile phone.

- Enter your login information and navigate to the “History” section at the bottom right corner of the screen.

- Select the transaction for which you want to find the UTR number.

- On the subsequent page, the transfer details, including the specific UTR number, are under the “Debited from” section.

3. Why is the UTR number important in PhonePe transactions?

The UTR number is crucial for tracking and verifying transactions.

It provides proof of when a transaction occurred and serves as an authentic reference when lodging a complaint with PhonePe customer care.

It helps resolve issues related to technical glitches, failed transactions, and disputes.

4. What should I do if my transaction fails but the amount is deducted from my account?

If your transaction fails but the amount is deducted from your account, you can track and resolve the issue using the UTR number.

Contact PhonePe customer care or your bank with the UTR number to get assistance in resolving the problem. The amount is usually refunded within 3 to 5 days.

5. Can I use the UTR number to reverse a wrong UPI payment?

If you have transferred money to the wrong account, you can use the UTR number to raise a credit chargeback with your bank.

The bank can contact the recipient’s bank to request a reversal of the funds. The reversal process may take up to 7 days, depending on the recipient’s response.

6. How does the UTR number help in resolving transaction disputes?

The UTR number helps resolve transaction disputes by providing a unique identifier for each transaction.

This allows banks and customer support teams to track the transaction accurately and address any issues related to failed or disputed transactions. It ensures transparency and accountability in the resolution process.

7. Where can I find the UTR number for a failed payment in PhonePe?

To find the UTR number for a failed payment in PhonePe:

- Tap on the “History” option on the PhonePe app home screen.

- Select the failed payment for which you want to view the UTR number.

- You will see the 12-digit UTR number in the “Debited from” section on the screen.

Conclusion

Understanding the UTR number and its significance within PhonePe transactions can greatly assist in resolving any issues or inquiries.

The UTR number is a vital tool for tracking the status and history of transactions, providing proof of when a transaction took place, and serving as an authentic reference when lodging a complaint with PhonePe customer care.

Following the steps outlined above, users can easily access the UTR number within PhonePe transaction history and use it to resolve any transaction-related issues.

Suppose further confusion or complaints persist regarding finding the UTR number. In that case, users are encouraged to navigate to the appropriate section within the PhonePe application or contact PhonePe Customer Support at 080 – 68727374 or 022 – 68727374 for prompt assistance.

By understanding and utilizing the UTR number, users can ensure a smoother and more secure experience with digital transactions on PhonePe.