3 Best UPI Apps for Teenagers in India

Hey there, fellow parents and tech-savvy teens! Today, we’re diving into the world of UPI apps designed specifically for our younger generation. As someone who’s been navigating the tricky waters of parenting in the digital age, I’ve seen firsthand how important it is for teenagers to learn about money management early on. And let’s face it, in today’s India, digital payments are the way to go!

Also Read:

How to Find Your CRED UPI ID

UPI Cash Withdrawal ATM Near Me

Where to Find UPI ID in PhonePe?

How to Reset Upi Pin in PhonePe without Debit Card

How to Change Upi Pin in PhonePe without Debit Card

How to Change PhonePe UPI Id

Why Our Teens Need Their Own UPI Apps

Now, you might be wondering, “Can’t my kid just use my UPI app?” Well, not so fast! Most regular UPI apps have age restrictions that leave our teens out in the cold. Plus, let’s be honest – we parents like to keep an eye on things, don’t we? That’s where specialized UPI apps for teenagers come in handy.

These apps are like training wheels for the world of digital finance. They give our kids the freedom to make transactions while we get to set the rules and keep tabs on their spending. It’s a win-win!

Top UPI Apps That Are Rocking the Teen World

Let’s check out some of the coolest UPI apps that are making waves among Indian teenagers:

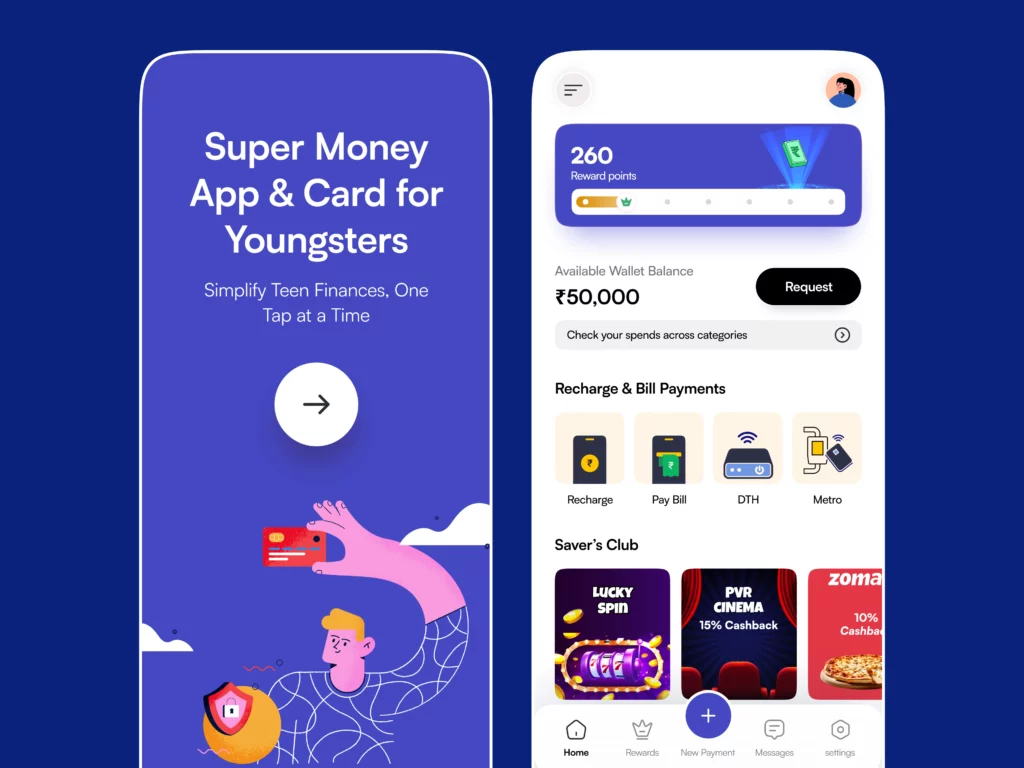

1. FamPay: The Teen Favorite

FamPay is like the cool kid on the block when it comes to teen UPI apps. Here’s why it’s winning hearts:

- It comes with a snazzy numberless card that teens can flash at their favorite stores.

- The app is super user-friendly – even I could figure it out!

- Parents can set spending limits and get real-time notifications.

But here’s the kicker – FamPay lets teens earn cashback and redeem offers. It’s like teaching them to hunt for bargains, but in a fun, digital way!

2. Omnicard: The All-Rounder

Next up is Omnicard, and let me tell you, it’s not just another pretty face in the UPI app crowd:

- It offers both virtual and physical cards.

- The app has a sleek interface that even the most tech-challenged parents can navigate.

- Teens can create savings goals – a great way to learn about budgeting!

One thing I really love about Omnicard is its family account feature. It’s like having a digital family piggy bank!

3. Fyp (For Your Parents): The New Kid on the Block

Don’t let the name fool you – Fyp is all about empowering teens while keeping parents in the loop:

- It offers customizable cards that teens can design themselves.

- The app includes financial literacy modules – sneaking in some education, clever!

- Parents can set tasks and reward their kids with money upon completion.

Fyp’s task-reward system is genius. It’s like giving your teen an allowance, but with a modern, productive twist!

Setting Up These Apps: A Piece of Cake!

Now, I know what you’re thinking – “This all sounds great, but is it a hassle to set up?” Fear not! I’ve been through the process, and it’s easier than teaching my teenager to clean their room.

Let’s take FamPay as an example:

- Download the app (available on both Android and iOS).

- Sign up with your teen’s details.

- Complete the KYC process – it’s mostly online and painless, I promise!

- Link your bank account for easy transfers.

- Set up parental controls and spending limits.

And voila! Your teen is ready to enter the world of digital transactions.

Safety First: Keeping Our Kids’ Money Secure

Now, I know we’re all thinking about safety. After all, we’re talking about our kids’ money here! But let me put your mind at ease. These apps come with some serious security features:

- Two-factor authentication: It’s like having a double lock on your digital wallet.

- Parental controls: You can set spending limits faster than your teen can say “Can I borrow some money?”

- Real-time notifications: You’ll know about every transaction quicker than your teen can hit ‘buy now’.

The Perks of Letting Teens Use UPI Apps

Alright, so we’ve covered the ‘what’ and the ‘how’, but let’s talk about the ‘why’. Why should we let our teens use these apps?

- Financial responsibility: It’s like giving them training wheels for adulting.

- Convenience: No more “Mom, I need cash for the canteen!”

- Budgeting skills: They learn to manage money without the risk of real financial trouble.

- Tech-savviness: Let’s face it, in today’s world, this is a must-have skill.

Comparing the Contenders

Now, I know you’re probably wondering how these apps stack up against each other. Well, wonder no more! I’ve done the legwork for you:

| Feature | FamPay | Omnicard | Fyp |

|---|---|---|---|

| Physical Card | Yes | Yes | Yes |

| Virtual Card | Yes | Yes | Yes |

| Cashback | Yes | Limited | Yes |

| Parental Controls | Extensive | Good | Extensive |

| Financial Education | Limited | Yes | Yes |

| Task-Reward System | No | No | Yes |

What the Experts (and Real Users) Are Saying

I reached out to some financial experts and fellow parents to get their take on these apps. Here’s what they had to say:

“These UPI apps for teens are a great way to introduce financial literacy early on. It’s practical education at its best.” – Rajesh Kumar, Financial Advisor

And from a parent’s perspective:

“FamPay has been a game-changer for us. My son is learning to budget his allowance, and I love being able to track his spending.” – Priya Sharma, Mother of a 15-year-old

The Future is Bright (and Digital)!

As we wrap up, let’s take a quick peek into the crystal ball. What’s next for teen banking in India?

- More personalized financial advice built into these apps.

- Integration with educational platforms for a holistic approach to teen finance.

- Enhanced AI-driven insights to help both teens and parents make smarter financial decisions.

Wrapping It Up

So there you have it, folks! A deep dive into the world of UPI apps for teenagers. Whether you go for the cool vibes of FamPay, the all-round approach of Omnicard, or the parent-friendly Fyp, you’re setting your teen up for financial success.

Remember, it’s not just about the transactions – it’s about teaching our kids to navigate the financial world confidently. So why not give one of these apps a try? Trust me, your future self (and your teen’s future self) will thank you!

FAQs: Your Burning Questions Answered

Q: Are these apps really safe for my teenager to use?

A: Absolutely! They come with robust security features and parental controls. Just make sure to set them up properly.

Q: Can my child overspend using these apps?

A: Not if you don’t want them to! You can set spending limits and get notifications for every transaction.

Q: Do these apps work at all stores?

A: Most of them work wherever UPI is accepted, which is pretty much everywhere these days!

Q: What if my teen loses their physical card?

A: No worries! You can easily block the card through the app. Plus, most transactions can be done via the app anyway.

Q: Are there any fees involved?

A: Most of these apps are free to use, but do check for any premium features or card issuance fees.