PhonePe Screenshots: Capturing, Using, and Staying Safe

In today’s digital age, PhonePe has become an integral part of our financial lives, offering convenient ways to make payments, transfer money, and manage finances. As we increasingly rely on this popular digital payment app, the need to capture and share screenshots of transactions has also grown. Whether it’s for record-keeping, troubleshooting, or simply sharing payment confirmations, knowing how to take and use PhonePe screenshots effectively is crucial.

This comprehensive guide will walk you through everything you need to know about PhonePe screenshots – from capturing them correctly to using them safely and avoiding potential scams. We’ll explore the technical aspects, best practices, and important safety measures to ensure you can make the most of this feature while protecting yourself from fraud.

PhonePe Screenshots: Capturing, Using, and Staying Safe

Understanding PhonePe Screenshots

Before we dive into the specifics, let’s clarify what we mean by PhonePe screenshots. A screenshot, also known as a screengrab or screen capture, is an image that shows the contents of a digital device’s screen at a specific moment. In the context of PhonePe, this typically refers to capturing images of transaction details, payment confirmations, or account balances within the app.

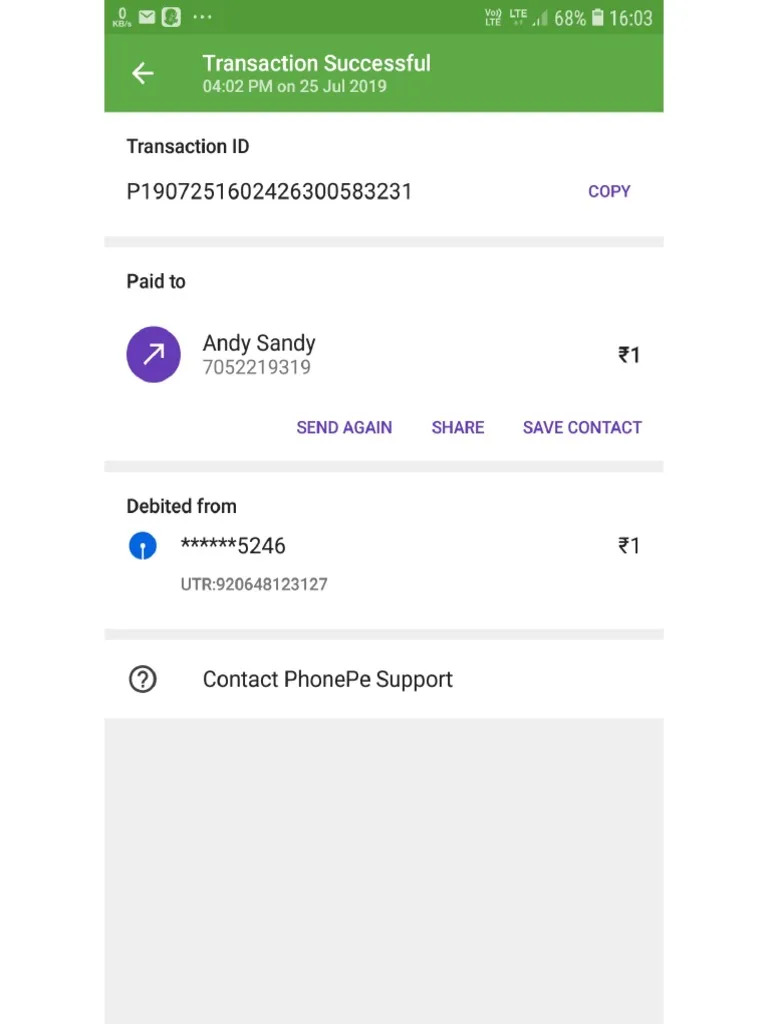

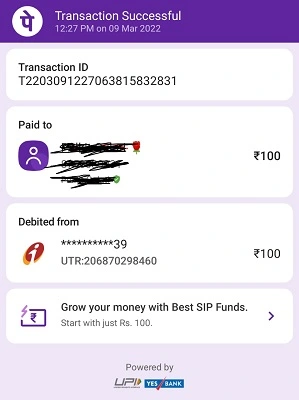

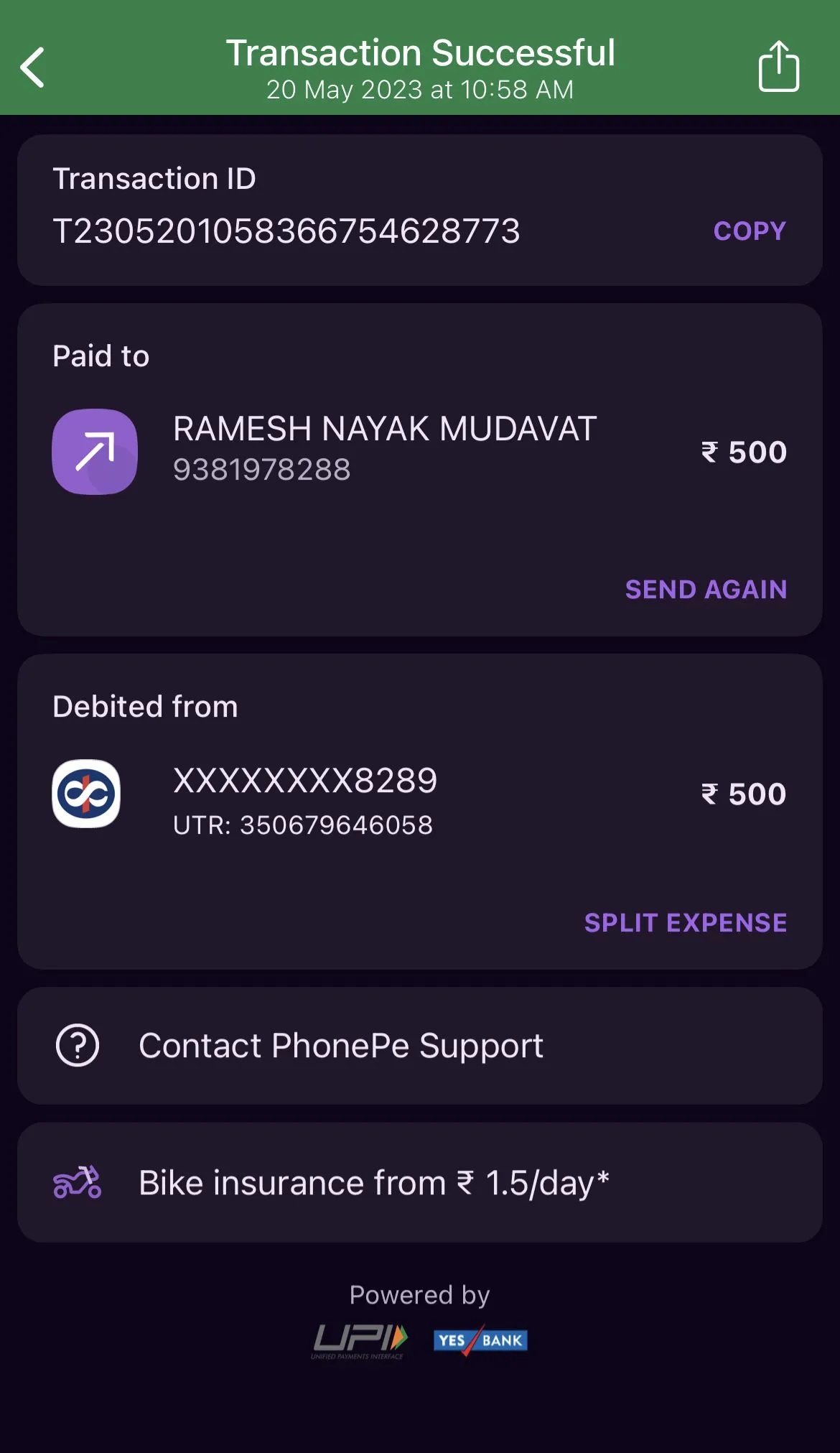

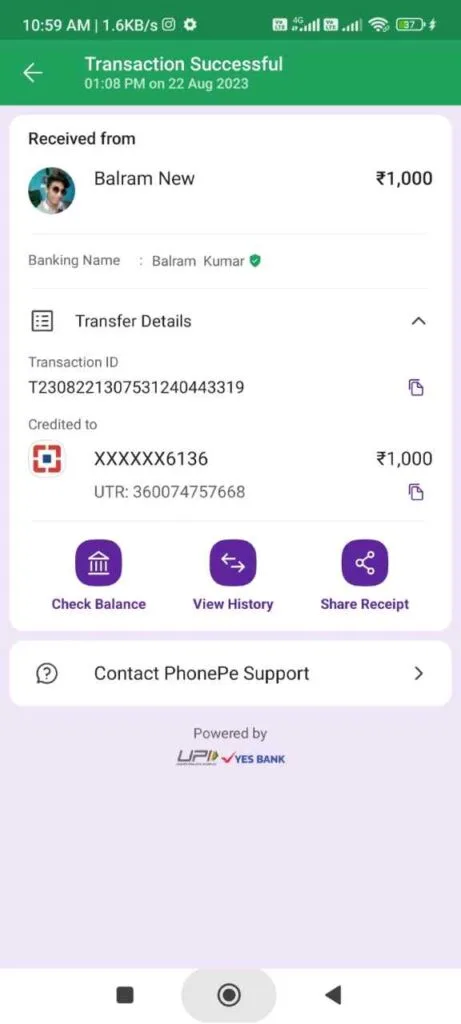

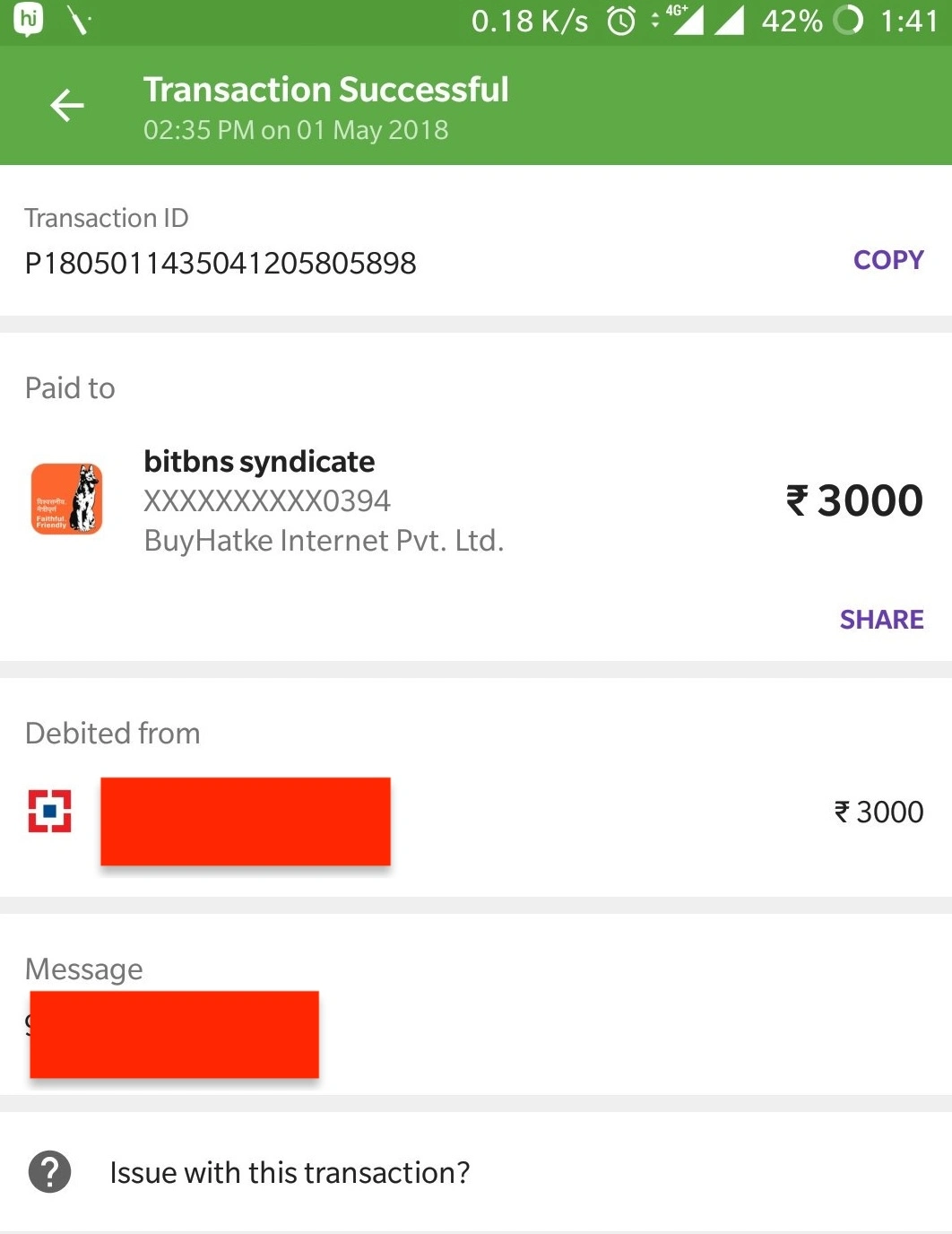

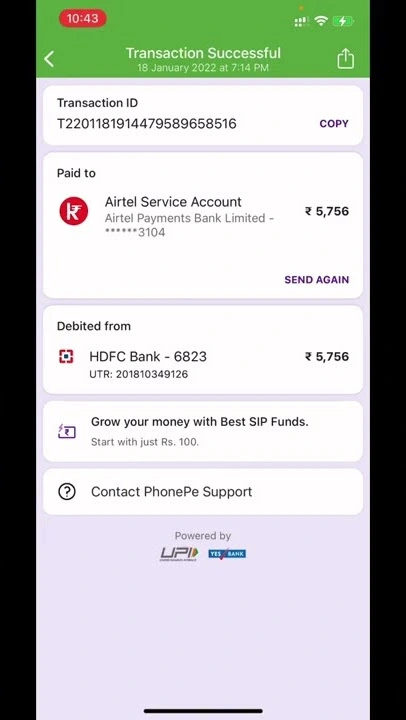

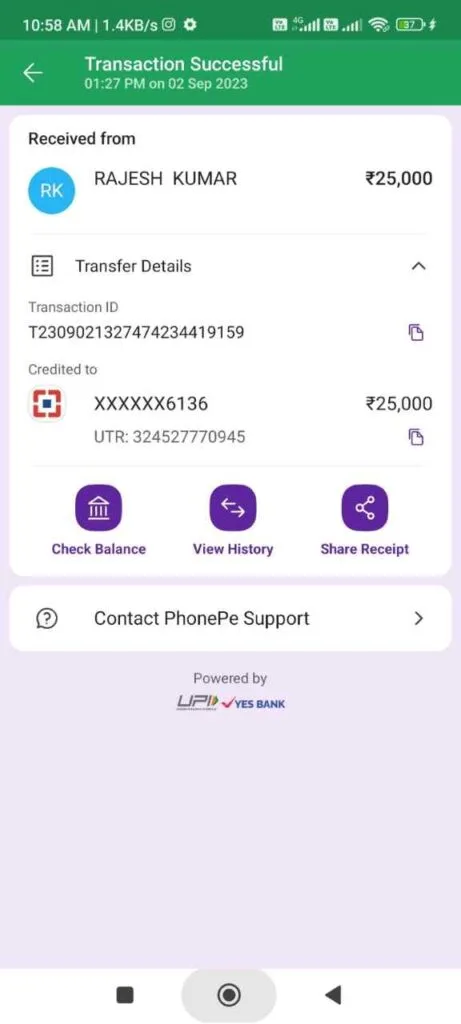

PhonePe Screenshots Of 1-300-5000-10000-15000-20000-20000-25000-30000 Inr

PhonePe screenshots serve several purposes:

- Proof of Payment: They provide visual evidence of completed transactions.

- Record Keeping: Screenshots help maintain a personal record of financial activities.

- Troubleshooting: When facing issues, screenshots can be shared with customer support for quicker resolution.

- Sharing Information: Users can easily share payment details or account information with others when needed.

However, it’s important to note that while screenshots are useful, they should be handled with care due to the sensitive financial information they often contain.

How to Take a PhonePe Screenshot

Taking a screenshot on PhonePe is similar to capturing any other screen on your smartphone. The exact method may vary slightly depending on your device, but here are the general steps:

For Android Devices:

- Open the PhonePe app and navigate to the screen you want to capture.

- Press and hold the Power button and Volume Down button simultaneously.

- You’ll hear a capture sound or see a visual indication that the screenshot was taken.

- The screenshot will be saved in your phone’s gallery or a dedicated Screenshots folder.

For iOS Devices:

- Open PhonePe and go to the desired screen.

- For iPhones with Face ID: Press the Side button and Volume Up button simultaneously.

- For iPhones with Home button: Press the Home button and Side (or Top) button simultaneously.

- You’ll see a flash on the screen and hear a camera shutter sound.

- The screenshot will be saved in your Photos app.

Tips for Clear PhonePe Screenshots:

- Ensure your screen brightness is adequate for a clear capture.

- Avoid taking screenshots while notifications are appearing on screen.

- If capturing a long conversation or transaction history, consider using the scrolling screenshot feature if your device supports it.

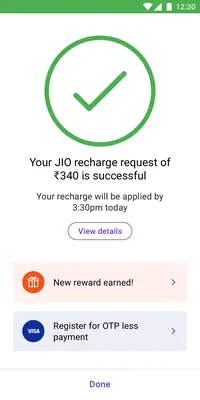

Common Uses of PhonePe Screenshots

PhonePe screenshots have become an essential tool for users in various scenarios. Let’s explore some of the most common uses:

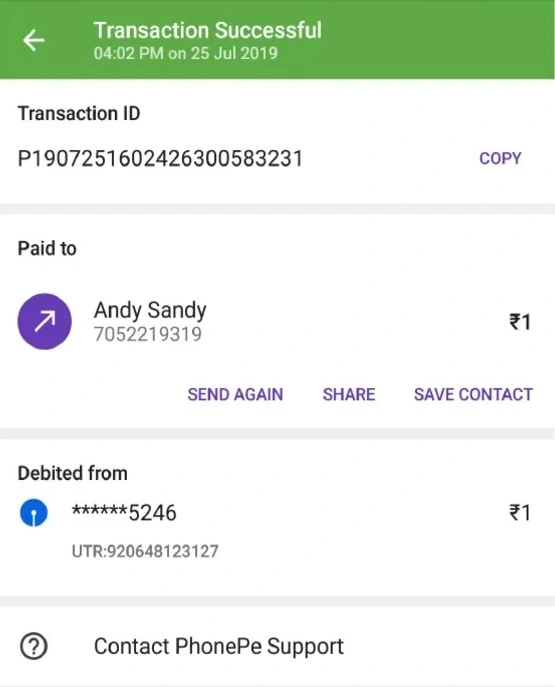

1. Transaction Verification

One of the primary uses of PhonePe screenshots is to verify transactions. When you make a payment or receive money, capturing a screenshot of the confirmation screen serves as immediate proof of the transaction. This can be particularly useful in situations where:

- You need to show proof of payment to a merchant or service provider.

- You want to keep a record of a significant transaction for your personal accounting.

- There’s a dispute about whether a payment was made or received.

2. Customer Support

When facing issues with the app or a particular transaction, PhonePe screenshots can be invaluable for customer support. They allow you to:

- Provide visual evidence of an error message or glitch you’re experiencing.

- Show the exact stage of a transaction where a problem occurred.

- Give customer service representatives a clear picture of your issue, leading to faster resolution.

3. Record Keeping

For those who like to maintain detailed financial records, PhonePe screenshots offer a quick and easy way to document transactions. You can use them to:

- Keep track of regular bill payments or subscriptions.

- Monitor your spending patterns over time.

- Create a visual log of your PhonePe account activity.

4. Sharing Payment Information

Sometimes, you might need to share payment details with others. PhonePe screenshots make this process simple and efficient. For example:

- Sending proof of payment to a friend or family member.

- Providing transaction details to an employer for reimbursement.

- Sharing your UPI ID or QR code for receiving payments.

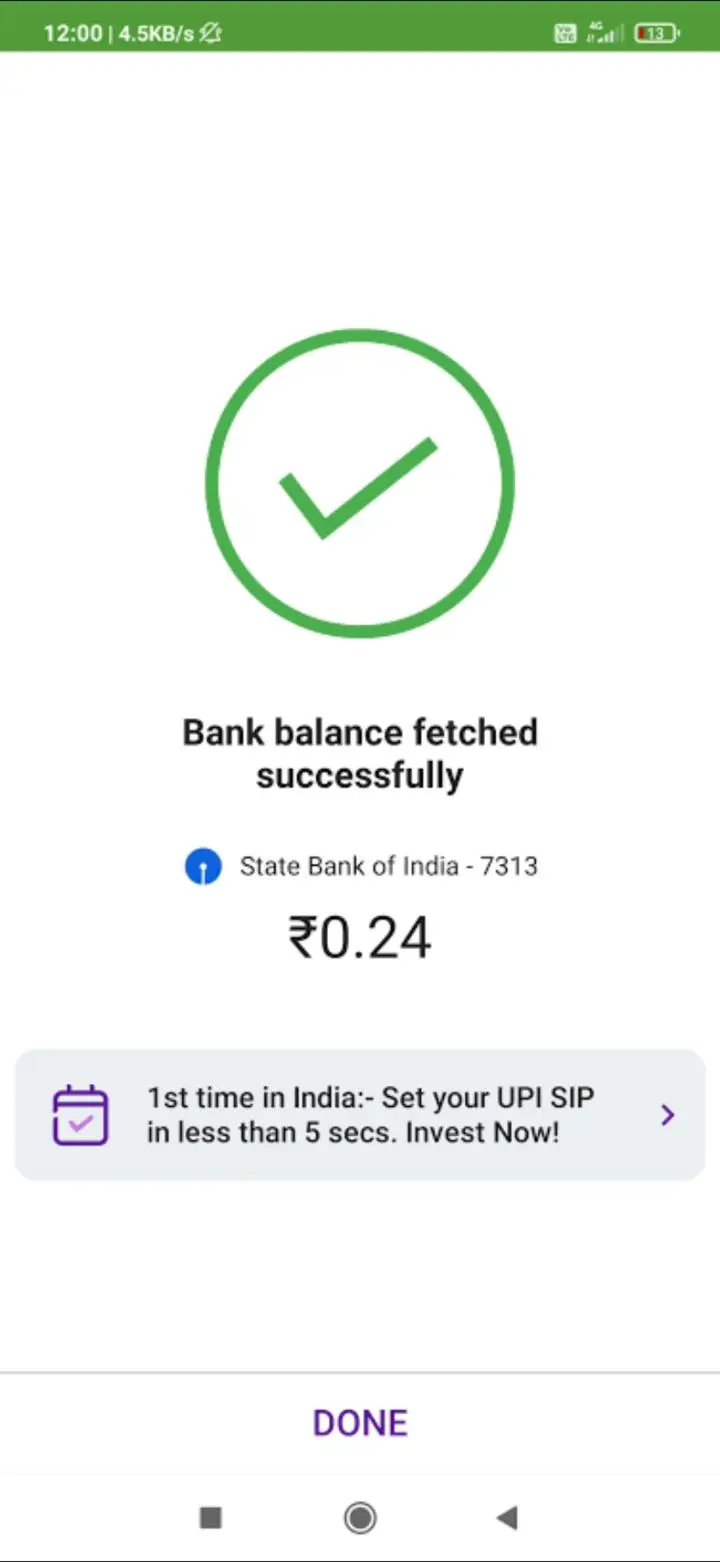

5. Personal Reference

Lastly, PhonePe screenshots serve as a quick reference for your own use. They can help you:

- Remember the exact amount of a past transaction.

- Quickly access your account balance without opening the app.

- Keep track of cashback or rewards earned from transactions.

While these uses highlight the convenience of PhonePe screenshots, it’s crucial to remember that they contain sensitive financial information. Always exercise caution when capturing, storing, and sharing these screenshots to protect your privacy and financial security.

Best Practices for Using PhonePe Screenshots

While PhonePe screenshots are undoubtedly useful, using them responsibly and safely is essential. Here are some best practices to keep in mind:

1. Protect Sensitive Information

When taking screenshots of your PhonePe transactions or account details, be mindful of the information displayed. Consider the following:

- Avoid capturing full card numbers or CVV codes.

- Blur or crop out personal details like your full name or address if sharing the screenshot.

- Be cautious about capturing your UPI PIN or any other security codes.

2. Secure Storage

If you’re keeping PhonePe screenshots for record-keeping purposes, ensure they’re stored securely:

- Use a password-protected folder or a secure cloud storage service.

- Regularly delete old screenshots that are no longer needed.

- Consider using apps that offer encrypted storage for sensitive images.

3. Responsible Sharing

When sharing PhonePe screenshots, follow these guidelines:

- Only share with trusted individuals or entities.

- Use secure messaging apps that offer end-to-end encryption.

- Avoid posting PhonePe screenshots on public social media platforms.

4. Regular Cleanup

Maintain good digital hygiene by regularly reviewing and deleting unnecessary PhonePe screenshots:

- Set a reminder to go through your screenshots monthly or quarterly.

- Delete screenshots of completed transactions that you no longer need for reference.

- Consider using a file management app to organize and purge old screenshots efficiently.

5. Verify Before Acting

If you receive a PhonePe screenshot from someone else:

- Don’t rely solely on the screenshot as proof of payment.

- Always cross-check the transaction in your PhonePe app or bank statement.

- Be wary of edited or fake screenshots, especially from unfamiliar sources.

6. Use Official Channels

For official purposes or disputes:

- Prefer using PhonePe’s in-app transaction history or official statements rather than screenshots.

- When dealing with customer support, ask if they have a secure method to view your transaction details directly.

By following these best practices, you can make the most of PhonePe screenshots while minimizing potential risks to your financial security and privacy.

Risks and Issues with PhonePe Screenshots

While PhonePe screenshots can be incredibly useful, they also come with certain risks and potential issues that users should be aware of. Understanding these challenges is crucial for safe and responsible use of this feature.

1. Fake Payment Screenshots

One of the most significant risks associated with PhonePe screenshots is the potential for fraud through fake payment screenshots. Scammers have found ways to create convincing fake screenshots that appear to show completed transactions. This can lead to several problems:

- Merchant Fraud: Unscrupulous customers might use fake screenshots to claim they’ve made a payment when they haven’t.

- Personal Scams: Individuals might use fake screenshots to deceive friends or family members about money transfers.

- Online Transaction Fraud: In online marketplaces or peer-to-peer sales, fake screenshots could be used to trick sellers into releasing goods without actual payment.

2. Privacy Concerns

Screenshots often contain more information than users intend to share:

- Personal Data Exposure: A PhonePe screenshot might inadvertently reveal your phone number, email address, or transaction history.

- Financial Information Leaks: Account balances, spending patterns, or financial relationships could be exposed through carelessly shared screenshots.

3. Security Vulnerabilities

Storing or sharing PhonePe screenshots can create security weak points:

- Device Security: If your device is lost or stolen, stored screenshots could give others access to your financial information.

- Digital Theft: Hackers gaining access to your cloud storage or messaging apps could potentially misuse stored PhonePe screenshots.

4. Misinterpretation of Information

Screenshots provide a static view of dynamic information, which can lead to misunderstandings:

- Outdated Information: A screenshot taken at one moment might not reflect the current status of a transaction or account balance.

- Incomplete Context: Screenshots might not show the full picture, leading to misinterpretations of financial situations or agreements.

5. Legal and Compliance Issues

In some contexts, relying on screenshots could lead to compliance problems:

- Insufficient Proof: For legal or official purposes, screenshots might not be considered valid proof of transactions.

- Data Protection Laws: Sharing screenshots containing others’ financial information could potentially violate data protection regulations.

6. Technical Limitations

There are some technical challenges associated with PhonePe screenshots:

- Image Quality: Poor quality screenshots might be unclear or illegible, causing confusion or disputes.

- Editing and Manipulation: With widely available editing tools, altering screenshots is becoming easier, making verification more challenging.

Understanding these risks is the first step in mitigating them. In the next section, we’ll explore identifying fake PhonePe screenshots and protecting yourself from related scams.

Identifying Fake PhonePe Screenshots

As digital payment apps like PhonePe have increased, so has the sophistication of scams involving fake payment screenshots. Identifying a fake PhonePe screenshot is crucial for protecting yourself from fraud. Here are some key strategies and indicators to help you spot fake screenshots:

1. Check the Details

Carefully examine the details in the screenshot:

- Transaction ID: Every PhonePe transaction has a unique ID. If you’re suspicious, ask for this ID and verify it in your own app.

- Time and Date: Ensure the timestamp on the screenshot matches the expected transaction time.

- Amount: Verify that the amount shown matches the agreed-upon payment.

- Sender and Recipient Names: Check if the names are correct and spelled properly.

2. Look for Visual Inconsistencies

Fake screenshots often have subtle visual flaws:

- Font Discrepancies: Look for any differences in font style or size compared to the official PhonePe app.

- Color Variations: The colors in the screenshot should match the PhonePe app’s color scheme exactly.

- Layout Issues: Any misalignments or unusual spacing could indicate tampering.

3. Verify Through Official Channels

Don’t rely solely on the screenshot:

- Check Your PhonePe App: Always verify the transaction in your PhonePe app or linked bank account.

- Use PhonePe’s Transaction History: This official record is more reliable than screenshots.

- Contact PhonePe Support: If in doubt, contact PhonePe’s customer service for verification.

4. Be Wary of Unusual Requests

Be cautious if:

- Someone insists on using a screenshot as the only proof of payment.

- You’re pressured to accept a screenshot quickly without time for verification.

- The screenshot is sent via an unusual or unsecured channel.

5. Use Technology to Your Advantage

Consider using tools to help spot fake screenshots:

- Image Analysis Tools: Some software can detect if an image has been edited.

- Reverse Image Search: This can help you find if the screenshot has been used elsewhere online.

6. Educate Yourself on Common Scams

Stay informed about prevalent PhonePe-related scams:

- Overpayment Scams: Where someone claims to have overpaid and requests a refund.

- Urgent Payment Scams: Pressuring you to accept a screenshot quickly without proper verification.

- Phishing Attempts: Be cautious of links or requests for personal information accompanying screenshots.

7. Trust Your Instincts

If something feels off about a transaction or screenshot:

- Take your time to verify thoroughly.

- Don’t hesitate to refuse a transaction if you’re unsure.

- Consult with someone you trust if you need a second opinion.

By staying vigilant and following these guidelines, you can significantly reduce the risk of falling victim to fake PhonePe screenshot scams. Remember, it’s always better to take extra verification time than rush into a potentially fraudulent transaction.

Protecting Yourself from Fake Screenshot Scams

While identifying fake PhonePe screenshots is crucial, taking proactive steps to protect yourself from such scams is equally important. Here are comprehensive strategies to safeguard your finances and personal information:

1. Implement Strict Verification Procedures

Develop a personal protocol for verifying payments:

- Always Check Your App: Never rely solely on a screenshot. Always verify the transaction in your PhonePe app or bank account.

- Use Multiple Confirmation Methods: Combine app verification with SMS alerts or email notifications for transactions.

- Set Up Instant Notifications: Enable real-time alerts for all PhonePe transactions to spot any unauthorized activity quickly.

2. Educate Yourself and Others

Knowledge is your first line of defense:

- Stay Informed: Keep up-to-date with the latest PhonePe features and security measures.

- Learn About Common Scams: Familiarize yourself with typical tactics used by scammers.

- Share Knowledge: Educate friends and family about the risks of relying on screenshots for payment verification.

3. Use PhonePe’s Security Features

Take advantage of the security measures offered by PhonePe:

- Enable Two-Factor Authentication: This adds an extra layer of security to your account.

- Regularly Update the App: Ensure you always use the latest version with the most up-to-date security features.

- Use PhonePe’s In-App Communication: Use PhonePe’s official channels rather than external communication methods for disputes or queries.

4. Practice Safe Digital Habits

Adopt general cybersecurity best practices:

- Use Strong, Unique Passwords: Ensure your PhonePe account has a strong password.

- Be Cautious with Public Wi-Fi: Avoid making transactions or accessing your PhonePe account on public networks.

- Keep Your Device Secure: Use device locks, update your operating system, and install reputable antivirus software.

5. Be Skeptical of Unusual Requests

Maintain a healthy level of skepticism:

- Question Urgency: Be wary of anyone pressuring you to accept a payment quickly without proper verification.

- Be Cautious of Overpayments: If someone claims to have overpaid and requests a refund, verify the original transaction thoroughly.

- Trust Your Instincts: If a transaction or request feels suspicious, it probably is. Don’t hesitate to decline or seek help.

6. Use Official Channels for Disputes

In case of any issues:

- Contact PhonePe Support: Use official channels to report suspicious activities or seek clarification.

- Document Everything: Keep records of all communications and transactions related to any disputed payments.

- Report Scams Promptly: If you encounter a scam, report it to PhonePe and relevant authorities immediately.

7. Implement Personal Security Measures

Add extra layers of personal security:

- Limit Screenshot Sharing: Avoid sharing PhonePe screenshots unnecessarily.

- Use Secure Storage: If you must keep screenshots, store them in encrypted or password-protected folders.

- Regularly Clean Up: Periodically delete old screenshots that are no longer needed.

8. Stay Updated on PhonePe’s Policies

Keep yourself informed about PhonePe’s official stance:

- Read Policy Updates: Stay aware of any changes in PhonePe’s security policies or user guidelines.

- Follow Official PhonePe Channels: Keep an eye on PhonePe’s official social media and communication channels for important updates.

Implementing these protective measures significantly reduces your risk of falling victim to fake screenshot scams. Remember, your financial security is ultimately in your hands, and a cautious, informed approach is your best defence against fraudsters.

Legal and Ethical Considerations

When dealing with PhonePe screenshots, it’s crucial to understand the legal and ethical implications involved. This knowledge protects you and ensures that you’re using digital payment tools responsibly.

Based on the search results and additional context, I’ll continue the article by covering the legal and ethical considerations related to PhonePe screenshots:

Legal Implications of Using Fake Screenshots

Creating or using fake PhonePe screenshots is a serious offense that can have severe legal consequences:

- Fraud: Fabricating payment screenshots to deceive merchants or individuals is considered fraud under the Indian Penal Code. This can lead to criminal charges and potential imprisonment.

- Cybercrime: Using fake screenshots falls under cybercrime laws in India. The Information Technology Act, 2000 (as amended) covers such offenses, with penalties including fines and imprisonment.

- Civil Liability: Victims of fake screenshot scams can pursue civil lawsuits against perpetrators for damages incurred.

PhonePe’s Policies and Stance

PhonePe takes a strong stance against fraudulent activities and has implemented various measures to combat fake screenshots:

- Zero Tolerance Policy: PhonePe maintains a strict policy against any form of fraud on its platform.

- User Agreement: Using PhonePe, users agree to not engage in any fraudulent activities, including creating or using fake payment screenshots.

- Reporting Mechanisms: PhonePe provides multiple channels for users to report suspicious activities or fraudulent transactions.

Ethical Considerations

Beyond legal implications, there are important ethical considerations to keep in mind:

- Trust in Digital Payments: Using fake screenshots erodes trust in digital payment systems, potentially hindering the growth of cashless transactions in India.

- Impact on Small Businesses: Many small merchants rely on digital payments. Fake screenshots can significantly impact their livelihoods.

- Personal Integrity: Creating or using fake screenshots reflects poorly on one’s personal ethics and can damage relationships and reputation.

PhonePe’s Fraud Prevention Initiatives

To combat fraud, including fake screenshot scams, PhonePe has implemented several measures:

- Account and Transaction Security: PhonePe validates all accounts and transactions through various stages, including OTP verification and MPIN/Password setup.

- Risk Investigations: A dedicated team handles fraud incidents and provides assistance to customers, vendors, and partners.

- Advanced Technology: PhonePe uses real-time signals like IP and location coordinates to flag suspicious transactions.

- Partnerships with Law Enforcement: PhonePe collaborates with cybercrime cells across India to intercept fraudulent transactions and block malicious users.

Best Practices for Ethical Use of Screenshots

To ensure you’re using PhonePe screenshots ethically and legally:

- Verify Before Sharing: Always double-check transaction details in your PhonePe app before sharing screenshots.

- Protect Personal Information: Redact sensitive information from screenshots before sharing them.

- Use Official Channels: For disputes or proof of payment, rely on PhonePe’s in-app transaction history or official statements rather than screenshots.

- Educate Others: Spread awareness about the risks of relying solely on screenshots for payment verification.

By understanding and adhering to these legal and ethical considerations, users can contribute to a safer digital payment ecosystem. Remember, the convenience of digital payments comes with the responsibility of using them ethically and securely.