How to Increase PhonePe Limit

Increasing the transaction limit on PhonePe can be crucial for users who frequently make large transactions or multiple payments daily.

This article will guide you through the steps and considerations for increasing your PhonePe limit, incorporating key entities and providing a comprehensive understanding of the process.

Understanding PhonePe Transaction Limits

PhonePe is a popular digital payment platform in India, allowing users to make convenient transactions using various services.

However, certain transaction limits have been put in place to ensure safety and compliance with regulations.

These limits are influenced by several factors, including the type of KYC (Know Your Customer) verification completed, the bank linked to the PhonePe account, and regulatory guidelines set by the NPCI (National Payments Corporation of India).

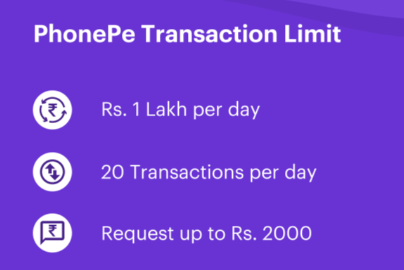

Daily and Monthly Limits

The general daily transaction limit on PhonePe is ₹1 lakh. Users can make a maximum of 10 to 20 transactions per day, depending on their bank’s policies.

Additionally, the PhonePe Wallet has a monthly limit of ₹10,000 and an annual limit of ₹1,20,000.

Factors Influencing Limits

- Bank: The specific bank linked to PhonePe may have its own additional limits that are lower than the standard PhonePe limit.

- KYC Status: Users with full KYC verification typically have higher transaction limits compared to those with minimal KYC.

- NPCI Regulations: The NPCI may occasionally propose changes to transaction limits on UPI apps like PhonePe.

Steps to Increase PhonePe Limit

1. Complete Full KYC

Completing full KYC is one of the most effective ways to increase your PhonePe transaction limit.

Full KYC involves verifying your personal identification details, which can be done through the PhonePe app.

Documents Required for Full KYC

- PAN Card

- Aadhaar Card

- Any one of the following current address proofs (if the address on your Aadhaar is different from your current address):

- Voter ID

- Driving License

- Passport

- NREGA job card

- Letter from the National Population Register

Steps to Complete Full KYC

- Tap PhonePe Wallet on your home screen.

- Tap Upgrade Wallet.

- Verify your PAN, Aadhaar, and address.

- Complete your Video Verification (Video KYC).

2. Link Multiple Bank Accounts

If you need to increase your UPI transaction limit, linking multiple bank accounts to your PhonePe account is a viable solution.

Each bank account linked to PhonePe has its own transaction limit, and by linking more than one bank account, you can effectively increase your overall transaction limit.

Example of Bank Limits

| Bank | Per Transaction Limit (INR) | Daily Limit (INR) |

|---|---|---|

| SBI | 1,00,000 | 1,00,000 |

| HDFC | 1,00,000 | 1,00,000 |

| ICICI | 1,00,000 | 1,00,000 |

| Bank of Baroda | 25,000 | 50,000 |

3. Use PhonePe Wallet

The PhonePe Wallet allows users to store and use money for various transactions. While the wallet has its limits, completing full KYC can significantly increase these limits.

Wallet Transaction Limits

| KYC Status | Per Transaction Limit (INR) | Daily Limit (INR) |

|---|---|---|

| Full KYC | 2,00,000 | 4,00,000 |

| Min KYC | 10,000 | 10,000 |

| No KYC | NA | NA |

4. Contact Customer Support

If you encounter any issues or need further assistance increasing your PhonePe limit, contacting PhonePe customer support can be helpful.

They can provide specific guidance based on your account and transaction history.

Additional Considerations

Security Measures

PhonePe implements various security measures to protect users’ funds and prevent fraud.

These include transaction limits, OTP (One-Time Password) verification, and monitoring for suspicious activities.

Regulatory Compliance

PhonePe adheres to the RBI (Reserve Bank of India) and the NPCI norms, rules, and laws.

These regulations are designed to ensure the safety and security of digital transactions in India.

Transaction Types

PhonePe supports various types of transactions, including:

- P2P (Person-to-Person): Transferring money to friends and family.

- P2M (Person-to-Merchant): Making payments to merchants for goods and services.

- NEFT (National Electronic Funds Transfer) and RTGS (Real-Time Gross Settlement): For higher value transactions.

Business Accounts

For businesses, PhonePe offers special accounts with higher transaction limits to accommodate the need for frequent and large transactions.

Businesses can register with PhonePe and complete the necessary KYC to avail of these benefits.

Conclusion

Increasing your PhonePe limit involves understanding the factors influencing transaction limits and taking the necessary steps to comply with regulatory requirements.

By completing full KYC, linking multiple bank accounts, and utilizing the PhonePe Wallet, users can effectively increase their transaction limits and enjoy a seamless digital payment experience.

For further assistance, users can always contact PhonePe customer support or refer to the detailed guides available on the PhonePe website and app.