How to Hide Mobile Number in Google Pay

In today’s digital age, privacy is more important than ever, especially when it comes to managing your finances online.

With the increasing use of mobile payment apps like Google Pay, ensuring that your personal information, such as your mobile number, remains private is crucial.

While Google Pay requires a mobile number for account verification and security purposes, there may be instances where you prefer to keep this information hidden from other users during transactions.

This guide will walk you through the steps on how to protect your mobile number in Google Pay, ensuring that your privacy remains intact while still enjoying the convenience of the app.

Also Read:

Fake Google Pay Screenshot

How to Find Your CRED UPI ID

UPI Cash Withdrawal ATM Near Me

Delete Your Google Pay Transaction History

Google Pay Pending Transaction Error

How to Fix Error Code U28 in Google Pay

How to Hide Mobile Number in Google Pay

Whether you’re concerned about sharing your number with merchants or other users, or simply want an added layer of security, this article will help you understand the available options to safeguard your information.

Let’s dive into the simple steps you can take to manage your privacy settings effectively within Google Pay.

How to Hide Your Mobile Number in Google Pay

To hide your mobile number in Google Pay, you can follow a series of steps that ensure your personal information remains private.

This is particularly useful if you want to maintain a level of anonymity while using the app for transactions.

- Open Google Pay: Start by launching the Google Pay app on your Android or iOS device.

- Access Settings: Tap on your profile picture or the three horizontal lines in the upper right corner to access the settings menu.

- Manage Account Information: Look for an option that says “Account” or “Profile”. In this section, you will find details related to your account, including your mobile number.

- Edit Personal Information: Here, you may find the option to edit your personal information. Tap on it, and you should see your mobile number listed.

- Change Visibility Settings: Depending on the app version, you might have the option to change who can see your mobile number. Select “Only me” or “Private” to ensure that your number is not visible to others.

- Check Google Account Settings: Since Google Pay is linked to your Google Account, you may need to adjust settings there as well. Go to your device’s Settings, tap on Google, and then select Manage your Google Account.

- Personal Info Section: Navigate to the Personal info tab. Under the section titled “Choose what others see,” look for your mobile number. You can set it to be visible only to you.

- Confirm Changes: After making these adjustments, ensure to save any changes. This will help prevent your mobile number from being searchable by others on Google Pay.

- Review Privacy Settings Regularly: It’s advisable to periodically review your privacy settings in both Google Pay and your Google Account to ensure your information remains private.

By following these steps, you can effectively hide your mobile number in Google Pay, enhancing your privacy while using the app for transactions.

| Step | Action | Details |

|---|---|---|

| 1 | Open Settings | On your Android device, locate and open the Settings app. |

| 2 | Access Google Account | Tap on Google, then select Manage your Google Account. |

| 3 | Navigate to Personal Info | At the top of the screen, tap on Personal info. |

| 4 | Choose Visibility Settings | Under the section Choose what others see, tap on Go to About me. |

| 5 | Adjust Phone Number Visibility | Find your phone number and select who can see it: – Only you (to make it private) – Anyone (to make it visible to everyone) |

| 6 | Save Changes | Follow any on-screen instructions to save your changes. |

Remember that while hiding your number can prevent others from finding you through the app, it may also limit some functionalities, such as sending or receiving payments from contacts who rely on your number for identification.

Why Hide Your Mobile Number?

Hiding your mobile number in Google Pay can enhance your privacy and security, making it an important consideration for users of the platform.

Here are several reasons why you might want to conceal your mobile number when using Google Pay.

Privacy Protection

One of the primary reasons to hide your mobile number is to protect your privacy.

When your number is visible, it can be accessed by anyone using Google Pay, which may lead to unwanted contact or harassment.

By keeping your number private, you limit the exposure of your personal information to only those you trust.

Preventing Unwanted Searches

When your mobile number is public on Google Pay, others can search for you using that number.

This feature can be convenient for connecting with friends, but it also opens the door for strangers to find and potentially contact you.

Hiding your number ensures that you remain unsearchable, adding an extra layer of security against unsolicited interactions.

Control Over Personal Information

Users have the ability to manage what information is visible across Google services, including Google Pay.

By adjusting your settings, you can choose to make your mobile number private, ensuring that only you can see it.

This control over your personal information is crucial in today’s digital age, where data breaches and privacy invasions are common.

To manage your visibility settings, navigate to your Google Account, select Personal info, and adjust the visibility options under “Choose what others see”.

Reducing Spam and Fraud Risks

Keeping your mobile number hidden can significantly reduce the risk of spam calls and messages.

When your number is public, it can be harvested by spammers and fraudsters, leading to unwanted solicitations.

By concealing your number on Google Pay, you can minimize these risks, allowing for a more secure transaction environment.

Enhancing Security for Transactions

When using Google Pay, security is paramount. Hiding your mobile number can prevent potential fraudsters from exploiting your information during transactions.

A hidden number means that even if someone gains access to your Google Pay account, they will not have easy access to your mobile number, which could be used for further identity theft or fraud attempts.

Limitations and Considerations

While hiding your mobile number in Google Pay is possible, there are some limitations and considerations to keep in mind:

- Your number may still be visible in some cases: If you have previously shared your mobile number with other users or have it listed in your Google Account profile, it may still be visible to those individuals.

- Certain features may be affected: Hiding your mobile number may impact certain features or functionalities within Google Pay that rely on your number for identification or communication purposes.

- Accessibility for support: If you need to contact Google Pay support or access certain account features, having your mobile number visible may be required for verification purposes.

In conclusion, hiding your mobile number in Google Pay is a straightforward process that can provide additional privacy and security for your account.

However, it’s essential to consider the potential limitations and ensure that hiding your number does not interfere with your ability to use the app effectively.

Managing Privacy Settings in Google Pay

Managing privacy settings in Google Pay is crucial for users who want to maintain control over their personal information and transaction data.

With the recent overhaul of the Google Pay app, users are provided with a streamlined interface to manage their privacy settings effectively.

Accessing Privacy Settings

To begin managing your privacy settings in Google Pay, follow these steps:

- Open the Google Pay app on your mobile device.

- Tap your profile icon located in the top-right corner.

- Select Settings from the menu.

- Navigate to Privacy & security.

In this section, you will find several options that allow you to customize how your data is handled.

Key Privacy Options

Within the Privacy & security menu, users can explore various features:

- Data & personalization: Here, you can manage how your information is saved and utilized. This includes options to disable personalized offers and control the sharing of your Google Pay status with third parties.

- Blocked people: This feature allows you to view and manage individuals you have blocked from interacting with you on Google Pay.

- How people find you: You can adjust your profile preferences, including whether others can find you through your phone number or email.

- Linked transaction data: This section provides insight into your connections with other Google services, such as Gmail and Google Photos. Users can disable these integrations if they prefer not to share data across platforms.

Managing Personal Information

In addition to privacy settings, users can also manage their personal information:

- Edit personal info: Update your phone number or profile picture as needed.

- Control visibility: You can choose who can see your name and profile photo. If you wish to hide this information from specific users, you can block them directly in the app.

Personalization and Data Control

While some features may be disabled for enhanced privacy, users can still enjoy a tailored experience by selectively enabling personalization options.

For instance, turning on personalization allows Google Pay to provide more relevant offers based on your transaction history.

However, even with personalization off, the app remains fully functional, ensuring that users can still make payments and manage transactions without compromising their privacy.

Using Google Pay without hiding your mobile number raises important considerations regarding privacy and security. While Google Pay implements robust security measures, understanding the implications of sharing your mobile number is crucial for safe usage.

Security Features of Google Pay

Google Pay employs several security features to protect users’ payment information. One of the most significant is the use of virtual account numbers.

When you add a payment card to Google Pay, it generates a unique virtual account number that is used for transactions instead of your actual card number.

This means that even if your mobile number is visible, your financial details remain secure from merchants and potential fraudsters.

Additionally, Google Pay requires users to set up a secure screen lock on their devices.

This means that even if someone gains access to your phone, they cannot make payments without unlocking it first.

Furthermore, the app uses encryption to protect your data, ensuring that it is only accessible when your device is unlocked.

Risks of Sharing Your Mobile Number

Despite these security features, sharing your mobile number can expose you to certain risks.

Scammers often use phishing techniques, where they impersonate legitimate entities to obtain sensitive information.

If your mobile number is publicly accessible, you may receive fraudulent calls or messages asking for personal information, including your UPI PIN or verification codes.

It is essential to remain vigilant and never share your UPI PIN or any sensitive information over the phone or through messages, especially if prompted by someone claiming to be from Google Pay.

FAQs

Can I hide my mobile number in Google Pay?

- As of now, Google Pay requires your mobile number for account verification and communication. Unfortunately, there isn’t a direct feature to completely hide your mobile number within the app. However, you can use privacy settings and other methods to protect your phone number from being displayed to others during transactions.

Why does Google Pay need my mobile number?

- Google Pay uses your mobile number primarily for verification, security, and communication purposes. It helps ensure that your account is secure and that you receive important transaction notifications.

Can I use a different number or a virtual number with Google Pay?

- Yes, you can register a different mobile number or use a virtual number with Google Pay. However, this number will still need to be valid and capable of receiving SMS for verification purposes.

How can I prevent my mobile number from being visible to merchants in Google Pay?

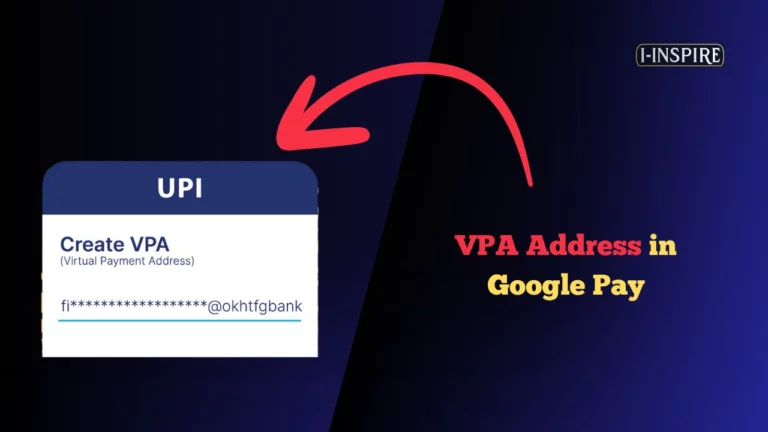

- To protect your privacy, you can use a Virtual Payment Address (VPA) instead of your mobile number for transactions. This way, your phone number won’t be shared with merchants or other users.

Will hiding my mobile number affect my Google Pay transactions?

- Using a VPA instead of your mobile number doesn’t affect your Google Pay transactions. You can still send and receive money seamlessly while keeping your mobile number private.

Is my mobile number secure on Google Pay?

- Google Pay implements robust security measures to protect your personal information, including your mobile number. However, taking additional steps like using a VPA can further enhance your privacy.

How do I update my mobile number in Google Pay if I want to change it?

- You can update your mobile number in Google Pay by accessing your account settings and following the prompts to add or verify a new number. Make sure the new mobile number is active and can receive SMS for verification.

Final Words

In conclusion, maintaining your privacy while using Google Pay is essential, especially when it comes to protecting your mobile number.

Although the app requires your phone number for verification and security purposes, there are ways to minimize its exposure to others.

By utilizing options like a Virtual Payment Address (VPA), you can conduct transactions without directly sharing your mobile number with merchants or other users.

This approach adds an extra layer of security and helps you maintain greater control over your personal information.

It’s important to regularly review and update your privacy settings within the app to ensure that your information is as secure as possible.

While Google Pay offers a convenient way to manage your finances, taking these additional steps can help you use the app with confidence, knowing that your personal data is well-protected.

Remember, your privacy is in your hands, and being proactive about it is the best way to ensure that your mobile number remains safe while you enjoy the benefits of Google Pay.