How to Get Loan from PhonePe

Getting a loan from PhonePe is a straightforward and convenient process designed to meet the financial needs of its users quickly and efficiently.

PhonePe, a popular digital payments platform in India, offers personal loans through its lending partners, making it easy for users to access funds without the hassle of traditional banking procedures.

Whether you need money for an emergency, a big purchase, or to manage your expenses, PhonePe provides a seamless way to apply for and receive a loan directly into your bank account.

To get started, you must install the PhonePe app on your smartphone. The application process is entirely digital, requiring minimal documentation, primarily your PAN card details.

Once you meet the eligibility criteria, which include having a good credit score and an active bank account linked to your Aadhaar card, you can apply for a loan by selecting a pre-approved offer on the app.

The loan amount is typically disbursed within 48 hours of approval, making it a quick solution for your financial needs.

This guide will walk you through the detailed steps, eligibility requirements, and key features of getting a loan from PhonePe.

How to Get a Loan from PhonePe

PhonePe offers personal loans through its lending partners. These loans are designed to be easily accessible, with a completely digital application process.

The platform provides loans ranging from small amounts to larger sums, catering to various financial needs.

Steps to Apply for a Loan on PhonePe

- Install the PhonePe App: Download and install the PhonePe app from the Google Play Store or the App Store on your smartphone.

- Register on PhonePe: Sign up using your mobile number, which should be linked to your Aadhaar card and bank account.

- Access the Loan Section: Open the PhonePe app and navigate to the Loan section on the home screen.

- Select a Loan Offer: Tap on the pre-approved loan banner displayed at the top of the screen and select the loan offer that best suits your requirements. Alternatively, you can tap the Personal loan icon and choose a loan offer.

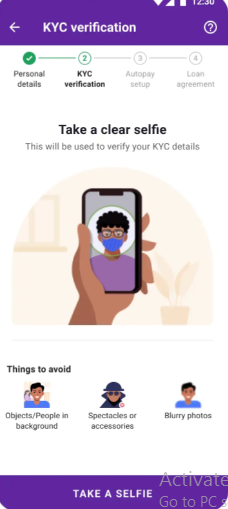

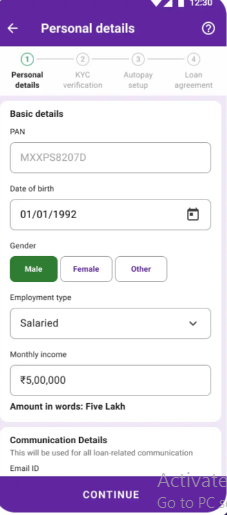

- Complete KYC Process: Provide the necessary documents for the KYC (Know Your Customer) process. This typically includes your Aadhaar card, PAN card, and other relevant documents.

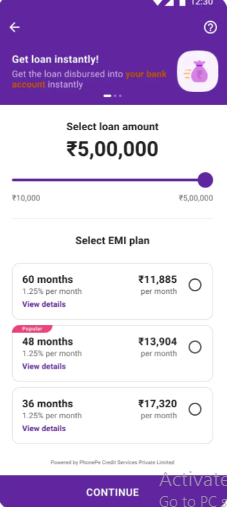

- Enter Loan Details: Enter the desired loan amount and select the EMI (Equated Monthly Installment) option for repayment.

- Submit Application: Click on the Submit button to complete the application process. Your application will be reviewed by the lending partner.

- Loan Approval and Disbursal: Once approved, the loan amount will be credited to your bank account, usually within 48 hours.

Eligibility Criteria

To apply for a loan on PhonePe, you need to meet the following eligibility criteria:

- Aadhaar Card: Must be linked to your mobile number and bank account.

- PAN Card: Required for identity verification.

- CIBIL Score: Should be more than 700.

- Bank Account: Must have an active bank account.

- Age Requirement: Must meet the minimum age requirement (usually 18 years).

- No Previous Loan Debts: Should not have any outstanding loan debts.

Required Documents

The documents required for applying for a loan on PhonePe are minimal, making the process hassle-free. Here are the key documents you need:

- Aadhaar Card: Linked to your mobile number and bank account.

- PAN Card: For identity verification.

- Bank Account Details: To facilitate loan disbursal.

- Salary Slip: Last 6 months’ salary slips may be required for income verification.

- Employment Information: Experience letter or employment letter.

Key Features of PhonePe Loans

PhonePe loans come with several attractive features that make them a preferred choice for many users:

- Digital Process: The entire application process is online and paperless, ensuring convenience and speed.

- Instant Loan Disbursal: Funds are disbursed in near real-time upon approval, typically within 48 hours.

- Pre-Approved Loans: Offers pre-approved loan amounts for faster processing.

- Competitive Interest Rates: Loans come with competitive interest rates, making them affordable.

- No Foreclosure Charges: Flexibility to repay the loan early without extra charges.

- Daily Repayment Options: Convenient daily installment repayment options for merchants.

- Collateral-Free Loans: No need for collateral to secure the loan.

- Credit Score Services: Free credit reports and insights to help improve your credit score.

- Loan Management: Manage loans, view statements, and get “no dues certificates” within the app.

Lending Partners

PhonePe collaborates with several lending partners to provide loans to its users. Some of the key lending partners include:

- LenDenClub

- Aditya Birla Finance Ltd.

- PayU Finance India Private Limited

- Muthoot FinCorp Ltd.

Loan Amount and Interest Rates

PhonePe offers loans ranging from Rs 10,000 to Rs 5,00,000. The interest rates are competitive, and some loans offer a 0% interest rate for the first 45 days.

Loan Application Process

The loan application process on PhonePe is straightforward and can be completed in a few simple steps:

- Open the PhonePe App: Ensure you have an active internet connection and open the PhonePe app on your smartphone.

- Select Loan Repayment Section: Navigate to the loan repayment section from the app dashboard.

- Choose a Bank: Select a bank based on their loan proposal displayed on your phone screen.

- Provide KYC Information: Enter the necessary document information for KYC purposes and the OTP sent to your registered mobile number.

- Enter Loan Amount and EMI: Enter the desired loan amount and select the EMI option for repayment.

- Submit Application: Apply for approval from the partner bank by clicking on the submit link.

Loan Approval and Disbursal

Once you have submitted your loan application, it will be reviewed by the lending partner.

If approved, the loan amount will be credited to your bank account within 48 hours.

Merchant Loans

PhonePe also offers loans specifically tailored for merchants. These loans are designed to help merchants grow their businesses by providing quick and easy access to credit. Here are some key features of merchant loans on PhonePe:

- Loan Amount Range: Loans range from Rs 15,000 to Rs 5,00,000.

- Eligibility Criteria: Merchants should have used the app actively over the last six months and processed more than Rs 25,000 per month through their PhonePe QR code stickers.

- Loan Disbursal Run Rate: PhonePe has an annualized loan disbursal run rate of Rs 1,000 crore.

- Credit Scoring System: PhonePe is developing its own credit scoring system using data science models to evaluate the creditworthiness of businesses.

Consumer Lending

PhonePe is set to launch consumer lending services by January 2024.

Initially, the company will work as a distributor for personal loans, integrating with multiple lenders to build its credit underwriting capabilities.

Summary Table

| Feature | Details |

|---|---|

| Loan Amount Range | Rs 10,000 to Rs 5,00,000 |

| Interest Rate | 0% interest for the first 45 days |

| Eligibility Criteria | Aadhaar card, PAN card, CIBIL score > 700, active bank account, age > 18 |

| Required Documents | Aadhaar card, PAN card, bank account details, salary slip, employment info |

| Loan Disbursal Time | Within 48 hours |

| Lending Partners | LenDenClub, Aditya Birla Finance Ltd., PayU Finance India Pvt. Ltd., Muthoot FinCorp Ltd |

| Application Process | Completely online and paperless |

| Repayment Options | Daily installments for merchants, flexible EMIs for individuals |

| Special Features | Pre-approved loans, no foreclosure charges, credit score services |

By leveraging the comprehensive services offered by PhonePe, you can access the financial support you need quickly and efficiently.

Whether you are an individual looking for a personal loan or a merchant seeking to grow your business, PhonePe provides a reliable and user-friendly platform to meet your needs.

QNAs

How can I apply for a loan on PhonePe?

To apply for a loan on PhonePe, open the app and go to the My Money section. Select Loans & Credit Cards, choose a suitable loan product, and follow the on-screen instructions to complete the application process.

What are the eligibility criteria for getting a loan from PhonePe?

The eligibility criteria for getting a loan from PhonePe typically include having a good credit score, stable income, and being a resident of India. Specific criteria may vary depending on the loan provider partnered with PhonePe.

What documents are required to apply for a loan on PhonePe?

The documents required to apply for a loan on PhonePe usually include Proof of Identity (like Aadhar Card or PAN Card), Proof of Address, and Proof of Income (like salary slips or bank statements).

How long does it take to get a loan approved on PhonePe?

Loan approval time on PhonePe can vary based on the loan provider and your application details. Generally, it can take anywhere from a few minutes to a couple of days for the loan to be approved and disbursed.

Can I check my loan status on PhonePe?

Yes, you can check your loan status on PhonePe. Go to the Loans & Credit Cards section in the My Money tab, select your loan application, and you will see the current status of your loan.

What types of loans are available on PhonePe?

PhonePe offers various types of loans through its partner lenders, including Personal Loans, Business Loans, and Consumer Durable Loans. Each type of loan has different terms and conditions.

Is it safe to apply for a loan through PhonePe?

Yes, it is safe to apply for a loan through PhonePe. PhonePe uses secure encryption methods to protect your personal and financial information during the loan application process.

Conclusion

PhonePe has made the process of obtaining a loan simple and convenient with its digital platform.

By following the steps outlined in this guide, you can easily apply for a loan on PhonePe and meet your financial needs.

With competitive interest rates, minimal documentation, and quick disbursal, PhonePe loans are an excellent option for both individuals and merchants.