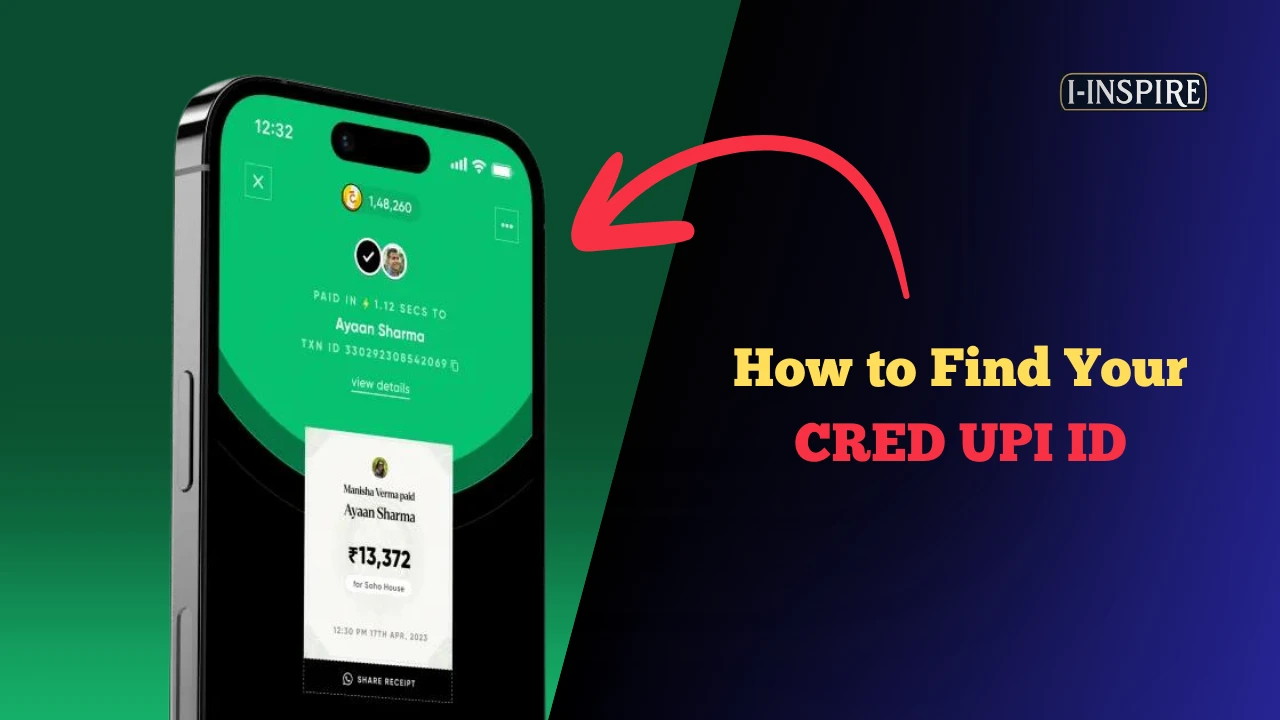

How to Find Your CRED UPI ID: A Friendly Guide

Hey there, fellow CRED enthusiast! Remember the last time you were trying to split a bill with friends, and everyone was fumbling with their phones, trying to find their UPI IDs? Yeah, I’ve been there too. It’s like trying to find your keys when you’re already late for work – frustrating and time-consuming. But what if I told you that finding your CRED UPI ID is actually super easy? Stick with me, and I’ll show you how to become the go-to financial guru in your friend group.

Also Read:

What is UTR Number in PhonePe?

PhonePe Screenshots

How to Disable Autopay in PhonePe

Where to Find UPI ID in PhonePe?

How to Change PhonePe Pin

How to Download PhonePe Statement

UPI Cash Withdrawal ATM Near Me

How to Reset Upi Pin in PhonePe without Debit Card

How to Change Upi Pin in PhonePe without Debit Card

How to Change UPI Limit in Phonepe

How to Find Your CRED UPI ID: A Friendly Guide for the Financially Savvy

The UPI Revolution: More Than Just a Buzzword

Before diving into the CRED-specific stuff, let’s chat about UPI briefly. You’ve probably heard this term thrown around a lot, right? UPI, or Unified Payments Interface, isn’t just another fintech buzzword – it’s a game-changer.

Picture this: It’s 2016, and sending money to your friend meant juggling with IFSC codes, account numbers, and those dreaded “transaction failed” messages. Then, like a superhero swooping in to save the day, UPI burst onto the scene. Suddenly, transferring money became as easy as sending a text message. No more awkward “I’ll pay you back later” moments or carrying wads of cash around.

UPI has become the backbone of digital payments in India. It’s like that reliable friend who’s always there when you need them – quick, efficient and doesn’t ask too many questions. Whether you’re paying for your morning chai or settling your monthly rent, UPI has got your back.

CRED and UPI: The Dynamic Duo of Your Wallet

Now, let’s talk about CRED. If you’re reading this, you’re probably already part of the CRED club. (High five, fellow responsible credit card user!) But for those who might be new to the party, let me break it down for you.

CRED is like that cool friend who rewards you for being financially responsible. Pay your credit card bills on time, and CRED showers you with points, exclusive offers, and a pat on the back. It’s like getting a gold star for adulting – and who doesn’t love that?

But here’s where it gets even better. CRED didn’t just stop at making credit card payments fun (yes, I said fun). They looked at UPI and thought, “Hey, why not add this to our toolkit?” And just like that, CRED UPI was born.

By integrating UPI, CRED transformed from a one-trick pony into a full-fledged financial Swiss Army knife. Now, you can manage your credit cards and zap money to your friends, pay bills, and even score some sweet deals – all from one app. It’s like having a personal finance assistant in your pocket, minus the hefty salary.

Why Your CRED UPI ID is Your New Best Friend

Okay, you’re probably thinking, “That’s all great, but why should I care about finding my CRED UPI ID?” I’m glad you asked! Let me paint you a picture:

- The Easy Money Receiver: Imagine you’re at a group dinner, and you graciously offered to pay the bill. (Look at you, big spender!) Now, instead of awkwardly asking for everyone’s bank details, you can share your CRED UPI ID. It’s like having a personal money magnet – funds come to you effortlessly.

- Speed Demon of Transactions: In today’s world, we want everything fast – our food, our internet, and definitely our money transfers. Your CRED UPI ID is like a express lane for your finances. No more waiting for bank servers to wake up from their nap.

- The All-in-One Financial Hub: CRED isn’t just playing in the UPI sandbox; they’re building an entire financial amusement park. Knowing your UPI ID, you’re holding the fast-pass to all of CRED’s cool features. It’s seamless, integrated, and makes managing your money feel less like a chore and more like a well-oiled machine.

- The Reward Hunter’s Secret Weapon: Let’s be real – we all love a good deal. CRED often rolls out special offers for UPI transactions. With your UPI ID at your fingertips, you’re always ready to pounce on these deals. It’s like being a financial ninja, always prepared to strike at the best offers.

The Treasure Hunt: Finding Your CRED UPI ID

Alright, enough build-up. Let’s get to the main event – finding your CRED UPI ID. Don’t worry, and it’s not like finding a needle in a haystack. It’s more like finding the TV remote – it’s always in the last place you look, but it’s there.

Here’s your step-by-step treasure map:

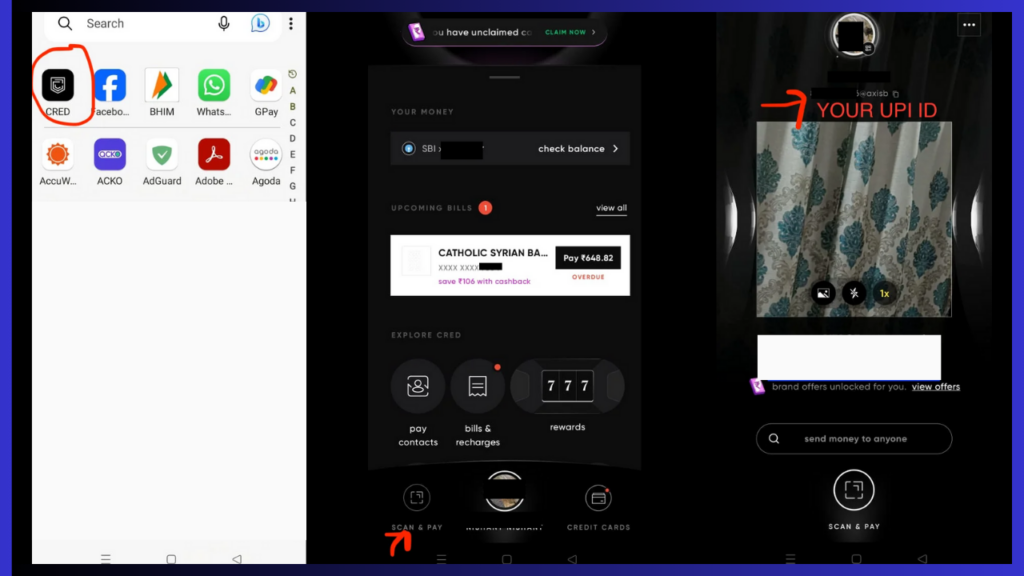

- Fire Up the CRED App: First things first, grab your smartphone and open the CRED app. Now might be a good time if you haven’t updated it in a while. You know, to ensure you’re working with the latest and greatest version.

- Navigate to the Land of ‘Scan and Pay’: Look at the bottom of your screen once you’re in the app. You should see an option that says ‘Scan and Pay’. Tap on that. It’s like the “You Are Here” marker on a mall directory – it’s where your journey begins.

- Eureka Moment: Now, you’ll see a QR code scanner pop up. But hold your horses – don’t start scanning anything yet. Instead, look for your profile photo. It should be right there, probably looking all dapper. Right below your photo, like a name tag at a networking event, you’ll see your CRED UPI ID.

And there you have it! You’ve just uncovered your CRED UPI ID. No secret handshakes or complex rituals are required. CRED keeps it simple because, let’s face it, adulting is complicated enough as it is.

Decoding Your CRED UPI ID: It’s Not Rocket Science

Now that you’ve found your UPI ID, let’s decode it. Don’t worry; you don’t need to be a cryptographer for this. Your CRED UPI ID typically follows this format:

yournumber@credFor example, it might look something like 9876543210@cred. The first part is usually your registered mobile number, and the ‘@cred’ part is like your digital surname, telling everyone you’re part of the CRED family.

Think of it as your financial email address. It’s unique to you, easy to remember, and makes receiving money a breeze. No more fumbling with long account numbers or worrying about typos in IFSC codes. Just share your CRED UPI ID, and watch the money roll in. (Okay, maybe not “roll in” – unless you’re way cooler than I am.)

When Technology Decides to Play Hide and Seek

We’ve all been there – technology sometimes has a mind of its own. If you’re having trouble finding your UPI ID, don’t throw your phone out the window just yet. Here are some troubleshooting tips that have saved my sanity more times than I’d like to admit:

- Update, Update, Update: App developers are constantly tweaking things. Make sure you’re running the latest version of the CRED app. It’s like getting a software update for your car – sometimes it just makes everything run smoother.

- Check Your Internet Connection: I know, I know – it sounds obvious. But you’d be surprised how often this is the culprit. If your internet is being as reliable as a chocolate teapot, your app might not load properly.

- The Classic Restart: Ah, the “turn it off and on again” trick. It’s not just for your Wi-Fi router. Close the CRED app completely (and I mean completely – swipe it away) and then reopen it. It’s like giving your app a quick power nap.

- Don’t Be Shy, Ask for Help: If all else fails, it’s time to call in the cavalry. CRED’s customer support is there for a reason. They’re usually pretty helpful and won’t judge you for not being able to find your UPI ID. We’ve all been there!

Maximizing Your CRED UPI Experience: Become a Power User

Now that you’ve got your UPI ID sorted, let’s talk about how to use it like a pro. It’s time to graduate from UPI newbie to financial wizard:

- Automate Your Life: Use your CRED UPI ID to set up automatic payments for bills. It’s like having a personal assistant who never forgets to pay your electricity bill. Future you will thank present you for this one.

- Become a Rewards Ninja: Keep your eyes peeled for special UPI-related offers on CRED. They often have deals that can save you some serious cash. It’s like being a coupon clipper, but way cooler and without the paper cuts.

- Be the Bill-Splitting MVP: Next time you’re out with friends, volunteer to pay the bill and use your CRED UPI ID to collect everyone’s share. You’ll look like a tech-savvy financial guru, and you might even snag some extra rewards points.

- Diversify Your Financial Portfolio: Okay, that sounds fancier than it is. What I mean is, link multiple bank accounts to your CRED UPI ID. It gives you more flexibility in managing your money. It’s like having multiple pockets in your digital wallet.

Keeping Your Financial Superhero Identity Safe

With great UPI power comes great responsibility. Here are some tips to keep your CRED UPI ID as safe as Fort Knox:

- Guard Your PIN Like a Secret Recipe: Your UPI PIN is the key to your financial kingdom. Treat it like your grandmother’s secret cookie recipe – don’t share it with anyone.

- Be a Phishing Detective: Only enter your UPI details on the official CRED app. It probably is if you get a message asking for your UPI info that seems fishy. Trust your gut – it’s usually right about these things.

- Embrace Your Inner Spy: Enable biometric authentication if your device supports it. It’s like having a personal bodyguard for your finances, except it’s just your own fingerprint or face.

- Channel Your Inner Accountant: Regularly check your transactions. It’s not the most exciting task, but it’s like flossing – a little effort goes a long way in preventing bigger problems.

The Crystal Ball: What’s Next for CRED UPI?

I don’t have a crystal ball (if I did, I’d be using it to predict lottery numbers), but I can make some educated guesses about the future of CRED UPI:

- Rewards on Steroids: CRED might introduce even more exciting rewards for UPI transactions. Imagine getting cashback to pay your friend back for that coffee. The future is bright (and potentially profitable).

- CRED UPI Everywhere: We might see CRED UPI being accepted online and offline at more places. It could become as ubiquitous as cash (but way cooler).

- Your Personal Financial Analyst: CRED could start offering more detailed insights into your spending patterns through UPI transactions. It’s like having a financial advisor, but one that fits in your pocket and doesn’t charge by the hour.

- Going Global: While CRED UPI is currently focused on India, who knows what the future holds? We might see CRED going international, making it easier to split bills on your next vacation in Bali.

Wrapping It Up: You’re Now a CRED UPI Pro!

And there you have it, folks! You’re now equipped with everything you need to know about finding and using your CRED UPI ID. It’s not just about knowing where to find it – it’s about using it to make your financial life smoother, more rewarding, and dare I say, a bit more fun.

CRED has done a fantastic job of integrating UPI into its platform, giving you a powerful tool right at your fingertips. So go ahead, find that UPI ID, and start flexing your newfound financial muscles. Use it to pay bills, split expenses with friends, or just bask in the glory of being the most tech-savvy person in your group.

Remember, managing your money doesn’t have to be a chore. With tools like CRED UPI, it can be as easy as ordering your favorite takeout. So go forth, transact with confidence, and may your wallet always be full (or at least your CRED rewards balance).

Got any cool CRED UPI stories or tips of your own? Drop them in the comments below. Let’s build a community of savvy CRED users who know how to make their money work for them. After all, personal finance is always more fun when it’s a team sport!

Stay awesome, stay financially savvy, and keep CREDing on!