How to Add New Bank Account in PhonePe

Adding a new bank account in PhonePe is a simple and essential process that allows you to make seamless digital payments, receive money, and manage your finances efficiently.

PhonePe, a popular digital payments platform in India, leverages the Unified Payments Interface (UPI) to facilitate quick and secure transactions directly from your bank account.

To get started, you need to ensure that your PhonePe app is installed and updated, and that your registered mobile number is linked to both your PhonePe account and your bank account.

The process involves a few straightforward steps: navigating to the My Money section in the app, selecting Bank Accounts under Payment Methods, and then tapping on Add New Bank Account.

You will need to select your bank from a comprehensive list, and PhonePe will automatically fetch your account details based on your registered mobile number.

Setting up a UPI PIN is crucial for authorizing transactions, and this can be done using your debit/ATM card details and an OTP sent to your mobile number.

Once these steps are completed, your bank account will be successfully linked to PhonePe, enabling you to enjoy a wide range of digital payment services.

Prerequisites for Adding a Bank Account

Before you begin, ensure you have the following in place:

- PhonePe App: Download the PhonePe app from the Google Play Store or Apple App Store if you haven’t already.

- Registered Mobile Number: The mobile number linked to your PhonePe account must be the same as the one registered with your bank.

- Active Bank Account: The bank account you want to add should be active and operational.

- UPI (Unified Payments Interface): Your bank should support UPI to link with PhonePe.

- Debit/ATM Card: Have your debit or ATM card handy for setting up the UPI PIN.

Steps to Add a Bank Account in PhonePe

Follow these steps to add a new bank account in PhonePe:

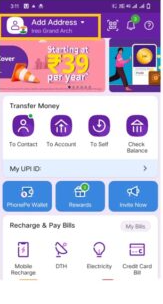

Step 1: Launch the PhonePe App

Open the PhonePe app on your smartphone and log in to your account using your fingerprint scan or 4-digit MPIN.

Step 2: Navigate to My Money

In the bottom navigation bar of the PhonePe app, you’ll find a section named My Money. Tap on it.

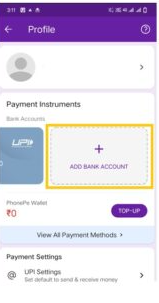

Step 3: Access Payment Methods

Under the Payment Methods section, locate and tap on Bank Accounts. You will see a list of your existing linked accounts, if any.

Step 4: Add New Bank Account

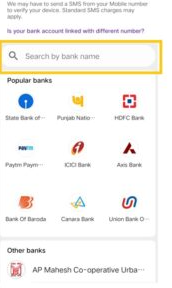

Tap on the Add New Bank Account option to proceed. PhonePe offers a comprehensive list of supported banks. Scroll through the list to find your bank or use the search bar for a quick lookup.

Step 5: Automatic Account Details Fetch

PhonePe will automatically fetch your account details based on the linked mobile number. This process only takes a few seconds.

Step 6: Set UPI PIN

Your UPI PIN is essential for authorizing transactions. If you already have a UPI PIN for the bank account you’re adding, it will be linked automatically.

If you don’t have a UPI PIN, tap Set UPI PIN. You’ll need to enter your debit/ATM card details (last 6 digits and expiry date) and an OTP sent to your registered mobile number to create a new UPI PIN.

Important Things to Remember

- You can link multiple bank accounts to your PhonePe app. However, you can set only one account as your primary transaction account.

- PhonePe prioritizes security, and your bank details are safe. Ensure you never share your UPI PIN or OTPs with anyone.

- Different banks may have individual daily transaction limits for UPI payments. Check with your bank for the specific limits.

Why Link Your Bank Account with PhonePe?

There are numerous benefits to linking your bank account with PhonePe:

- Effortlessly pay bills, recharge your phone, order food, book tickets, and do much more with just a few taps.

- Instantly send and receive money directly to and from bank accounts through UPI.

- Enjoy exclusive deals, discounts, and cashback offers available to PhonePe users.

- Track your spending, set reminders, and get a consolidated view of your financial activity.

Adding your bank account to PhonePe unlocks a world of convenient digital transactions. You can streamline your financial experience with PhonePe by following the simple instructions outlined above.

Adding Multiple Bank Accounts

PhonePe allows you to add more than one bank account in the app. Adding another account is no different from adding a new one.

Therefore, you can use the abovementioned process to add multiple bank accounts with PhonePe.

Steps to Add Multiple Bank Accounts

- Open the PhonePe App: Launch the PhonePe app on your smartphone.

- Navigate to Profile: Tap the profile icon in the top left corner.

- Add New Bank Account: Tap the Add New Bank Account button under the Payment Instruments section.

- Select Bank: Choose the bank you want to link from the list of available banks.

- Set UPI PIN: Follow the same steps to set or reset the UPI PIN described earlier.

Troubleshooting Common Issues

SMS Verification Fails

If the SMS verification fails, ensure that:

- Your mobile number has enough balance to send a verification SMS.

- You have a strong internet connection and mobile network.

- You have allowed SMS permissions for the PhonePe app.

Bank Not Listed

If your bank is not listed, you cannot add your bank account on PhonePe. Contact your bank to check if they support UPI and request that they be added to the PhonePe platform.

Forgotten UPI PIN

If you have forgotten your UPI PIN, you can reset it by following these steps:

- Open PhonePe App: Launch the PhonePe app and log in.

- Navigate to Profile: Tap on the profile picture in the top-left corner of the home screen.

- Select Bank Account: Go to Bank Accounts and select your account to reset the UPI PIN.

- Reset UPI PIN: Tap Reset next to UPI PIN.

- Enter Debit Card Details: Enter the last 6 digits of your debit/ATM card and its expiry date.

- Enter OTP: An OTP will be sent to your registered mobile number. Enter this OTP.

- Set New UPI PIN: Enter your desired new UPI PIN and re-enter it to confirm.

Contacting PhonePe Customer Support

If you encounter any issues or need assistance, you can contact PhonePe customer support at 080 6872 7374 or +91 226 872 7374.

You can also reach out via email at [email protected] or [email protected].

QNAs

How can I add a new bank account in PhonePe?

To add a new bank account in PhonePe, open the app, go to the My Money section, select Bank Accounts, and tap on Add New Bank Account. Follow the on-screen instructions to complete the process.

What details are required to add a new bank account in PhonePe?

You need your Mobile Number registered with the bank, your Bank Account details, and access to the Mobile Banking services to verify and add the new bank account in PhonePe.

Can I add multiple bank accounts in PhonePe?

Yes, PhonePe allows you to add multiple bank accounts. You can manage and switch between different accounts within the app by following the same process for each new account.

Is it safe to add my bank account details to PhonePe?

Yes, adding your bank account to PhonePe is safe. PhonePe uses Secure Sockets Layer (SSL) encryption to protect your data and transactions, ensuring your banking information is secure.

What should I do if I cannot find my bank in the list while adding a new account in PhonePe?

If your bank is not listed in PhonePe, update your app to the latest version. If the bank is still not listed, PhonePe might be unable to support it. You can contact PhonePe Support for further assistance.

How long does it take to add a new bank account in PhonePe?

Adding a new bank account in PhonePe is usually instant. Once you complete the verification process through OTP sent to your registered mobile number, your new bank account should be linked immediately.

Will I receive a confirmation after adding a new bank account in PhonePe?

Yes, after successfully adding a new bank account, you will receive a confirmation message within the PhonePe app, and you will also get an SMS notification from your bank confirming the linkage of your account.

Conclusion

Adding a new bank account in PhonePe is a simple and secure process that enhances your digital payment experience.

Following the steps outlined in this guide, you can easily link your bank account, set up your UPI PIN, and enjoy the numerous benefits of PhonePe.

Whether you need to pay bills, transfer money, or track your spending, PhonePe provides a convenient and efficient solution for all your financial needs.