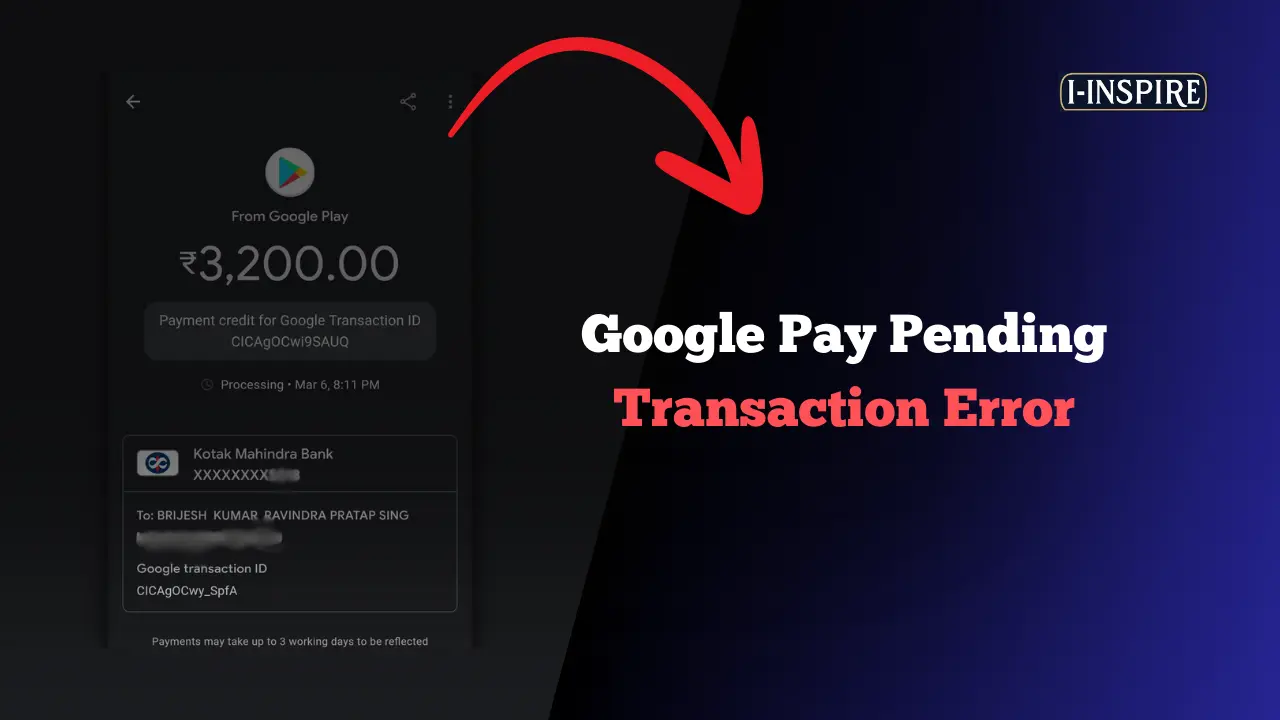

Google Pay Pending Transaction Error

Google Pay has become a leading digital wallet platform, making transactions convenient and efficient.

However, many users encounter issues when a transaction shows a pending status.

This situation can be frustrating, as it leaves users uncertain about whether their payment has been processed or if they need to take further action.

A pending transaction typically indicates that the payment is still being processed by the bank, which can take up to three business days.

Users cannot cancel the transaction or initiate a new payment for the same amount during this time.

Also Read: Can We Send Money from Google Pay to PhonePe

Google Pay Pending Transaction Error

Understanding how to check pending transactions on Google Pay is crucial for managing your finances effectively.

Users can easily view their transaction history within the app to identify any payments that are still pending.

If a transaction remains in this state for an extended period, raising a dispute through the app is advisable.

This process allows users to seek assistance and potentially resolve the issue with Google Pay’s support team.

In this article, we will explore the steps to check pending transactions and how to handle any potential complications.

Common Causes of Pending Transactions in Google Pay

Pending transactions in Google Pay can often lead to confusion and frustration for users.

Understanding the common causes of these pending transactions can help users address issues more effectively.

Insufficient Funds

One of the most prevalent reasons for a pending transaction in Google Pay is insufficient funds in the linked bank account or payment method.

If the account balance does not cover the transaction amount, the payment will not be processed, resulting in a pending status.

Users should ensure adequate funds are available before initiating a transaction to avoid this issue.

Connectivity Issues

Another significant factor contributing to pending transactions is connectivity problems.

A weak or unstable internet connection can disrupt the payment process, causing transactions to remain pending.

Users should check their network connectivity and switch to a more stable connection if necessary to facilitate smoother transactions.

Outdated App Version

Using an outdated Google Pay app can also lead to transaction failures.

An updated app ensures optimal functionality and can help prevent issues related to payment processing.

Users should regularly check for updates in their app store and install the latest version to mitigate this risk.

Incorrect Payment Details

Errors in payment details, such as an incorrect UPI ID or bank account information, can cause transactions to be marked as pending.

Users should double-check their payment information before proceeding with a transaction.

Ensuring that all details are accurate can help prevent unnecessary delays in processing.

Security Concerns

Google Pay employs security measures to protect users from fraudulent activities.

If the system detects suspicious behavior or potential fraud, it may automatically decline or hold a transaction in a pending state until further verification is completed.

Users should regularly monitor their accounts for unauthorized transactions and ensure their account settings are secure to avoid this scenario.

Processing Times

Pending transactions can also occur due to the inherent processing times associated with financial transactions.

Typically, a transaction may remain pending for up to three to five business days while the payment is being processed by the receiving bank.

Users cannot cancel or modify the transaction during this time, leading to uncertainty regarding the payment status.

In summary, pending transactions in Google Pay can arise from various factors, including insufficient funds, connectivity issues, outdated app versions, incorrect payment details, security concerns, and standard processing times.

By being aware of these common causes, users can take proactive steps to ensure smoother transactions and minimize the likelihood of payments remaining in a pending state.

How Long Do Google Pay Transactions Stay Pending?

Pending transactions on Google Pay can be a source of confusion for users, particularly regarding how long they remain in this status.

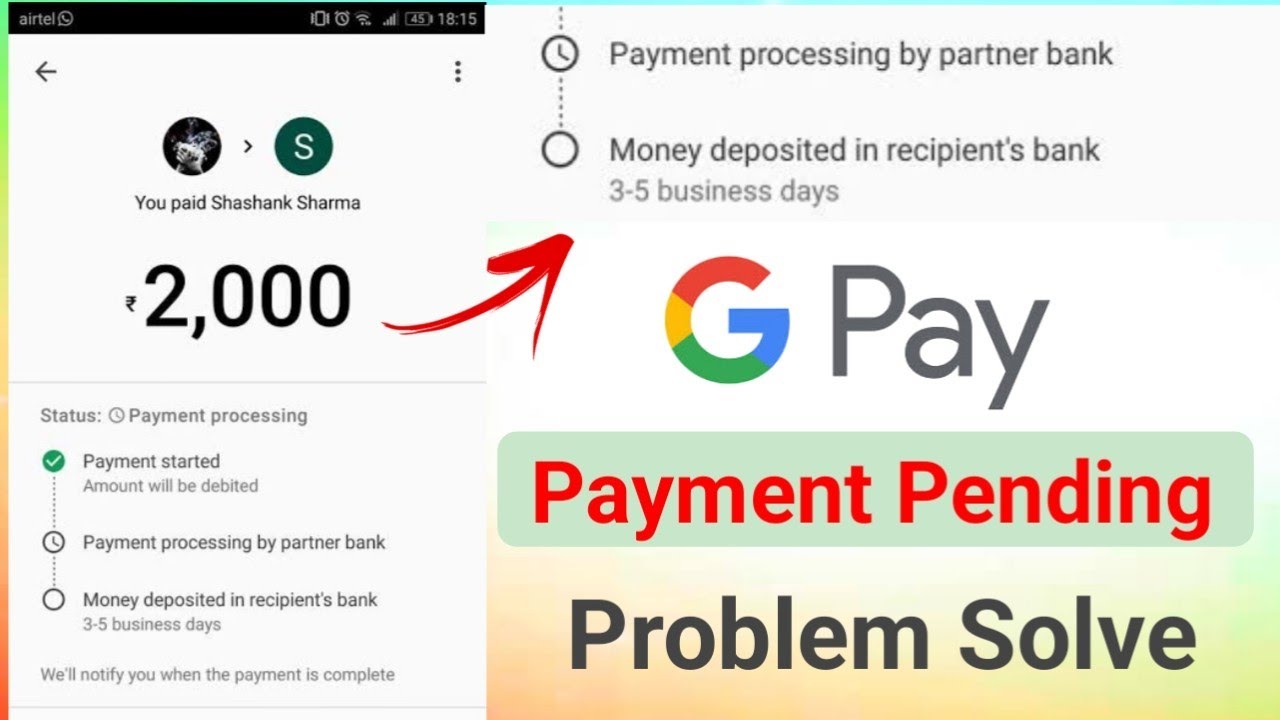

When a transaction is marked as ‘pending,’ it indicates that the payment is being completed but has not yet been finalized.

Typically, the time frame for a Google Pay transaction to transition from pending to successful or failed is around 3 to 5 business days.

During this period, the involved banks are working to process the transaction, which can sometimes lead to delays.

If the transaction remains pending for more than three business days, the funds are generally returned to the user’s account, although this can vary depending on the bank’s policies and processing times.

In some cases, if a transaction is still pending after a few hours, users are advised to check their internet connection or contact their bank for assistance.

This is particularly relevant if a user has sent money to someone else and the transaction has not been completed as expected.

Users can take further action if the payment remains pending beyond the typical processing time.

They can dispute the transaction directly through the Google Pay app.

To do this, users should navigate to their transaction history, select the pending transaction, and follow the prompts to report the issue.

Google aims to resolve disputes within 14 days, but this can depend on the case’s complexity.

It is crucial for users to refrain from attempting to resend the payment while it is still marked as pending.

Doing so can complicate the situation further. Instead, waiting for the transaction to either complete or fail is recommended.

Users should check their bank statements to confirm whether the funds were deducted from their account if a transaction is marked as failed.

Users may need to file a chargeback with their bank if the funds were debited but not credited to the recipient.

In summary, pending transactions on Google Pay typically take 3 to 5 business days to resolve.

Users are encouraged to monitor their transaction status and utilize the app’s dispute features if necessary.

Understanding these time frames and processes can help users navigate their transactions more effectively and reduce stress associated with pending payments.

Steps to Resolve a Pending Transaction in Google Pay

To resolve a pending transaction in Google Pay, follow these systematic steps to check the status and take appropriate actions if necessary.

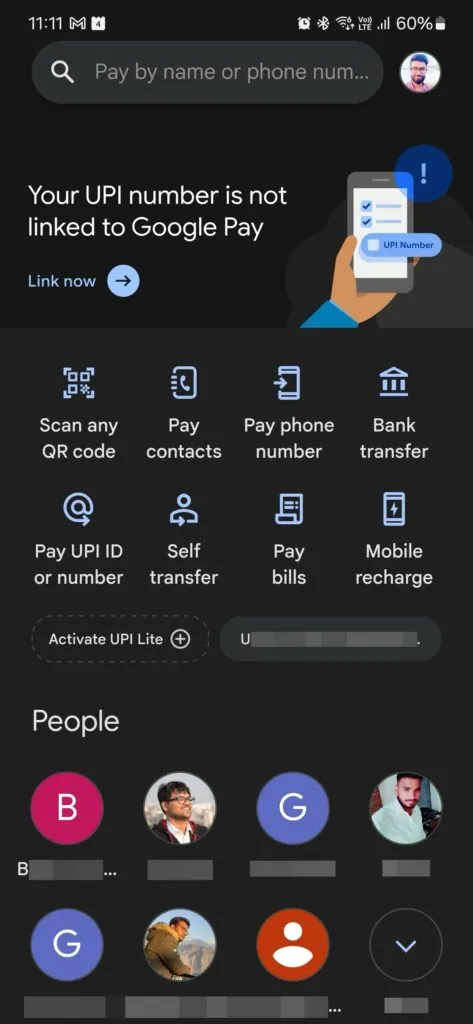

Step 1: Open Google Pay

Start by launching the Google Pay app on your mobile device. Ensure that you are logged into your account to access your transaction history.

Step 2: Access Payment Activity

On the homepage, scroll down and select the option labeled See all payment activity. This will direct you to a detailed list of completed, pending, and failed transactions.

Step 3: Review Transaction Status

In the list of transactions, identify the one marked as pending. Click on this transaction to view more details about its status.

Pending status indicates that the transaction is still being processed and has not yet been completed.

Step 4: Wait for Processing

Typically, if a transaction is pending, it may take up to three business days for the payment to either complete or fail.

During this time, avoid attempting to make the same payment again, as this could complicate the situation further.

Step 5: Raise a Dispute if Necessary

If the transaction remains pending beyond the usual processing time, you can take action by raising a dispute.

To do this, click on the Raise a dispute option associated with the transaction. This will initiate a process in which Google investigates the issue. Generally, disputes are resolved within two weeks.

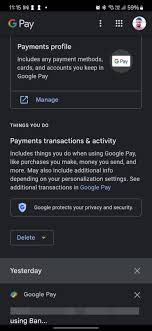

Step 6: Contact Customer Support

You can contact Google Pay’s customer support if you prefer immediate assistance or if the issue persists.

Navigate to the Help and feedback section within the app.

Here, you can request a call from a customer support executive or chat with a service agent to resolve your issue more efficiently.

Important Considerations

- Do not attempt to cancel a pending transaction. Once a payment is marked as pending, you cannot cancel it or take further action until it is processed or fails.

- Verify your payment details before making transactions to minimize the chances of errors that could lead to pending statuses.

- Check for app updates regularly to ensure you are using the latest version of Google Pay, as this can help prevent transaction issues.

Following these steps, you can effectively manage and resolve pending transactions in Google Pay, ensuring a smoother payment experience.

What to Do If a Pending Transaction Doesn’t Clear?

When dealing with a pending transaction that doesn’t clear, it can be a source of frustration.

Here’s a guide on what steps to take if you find yourself in this situation.

Check Your Account Regularly: Monitor your bank account to see if the pending transaction has cleared.

Most banks provide an option to view pending transactions in their online banking or mobile app. This will help you keep track of your available balance and any pending payments.

Contact the Merchant: If a pending transaction takes longer than expected, contact the merchant directly.

They may be able to provide insight into why the transaction hasn’t cleared and whether any action is needed on your part. Sometimes, they can expedite the process or cancel the transaction if necessary.

Wait for the Transaction to Clear: In many cases, the best course of action is to wait.

Pending transactions are often resolved automatically, and the funds will either be deducted from your account or released back to you if the merchant fails to claim them within a specific timeframe, typically up to 30 days.

Consider Canceling the Transaction: If you no longer want the transaction to go through, you may need to ask the merchant to release the hold on the funds.

However, this can be tricky since both your bank and the merchant have approved the payment. If the merchant is unresponsive, contact your bank for further assistance.

Monitor for Unauthorized Transactions: If you don’t recognize a pending transaction, investigate it immediately. It could be a sign of fraud.

Check if the merchant operates under a different name or if someone else with access to your account made the purchase. If you suspect fraud, report it to your bank immediately.

Pending transactions can be a normal part of banking, but it’s essential to take proactive steps when they linger.

By monitoring your account, communicating with the merchant, and knowing your rights, you can manage pending transactions effectively and minimize potential disruptions to your finances.

How to Avoid Pending Transactions in Google Pay

Users can follow several best practices and troubleshooting steps to avoid pending transactions in Google Pay.

Pending transactions can be frustrating, as they often delay access to funds and may require additional actions to resolve.

Here’s how to minimize the occurrence of these transactions and handle them effectively when they arise.

Best Practices to Avoid Pending Transactions

- Ensure Accurate Payment Details: Double-check the recipient’s UPI ID or mobile number before initiating a transaction. Incorrect details can lead to payment failures or pending statuses.

- Maintain a Stable Internet Connection: A reliable internet connection is crucial for processing transactions smoothly. If you experience connectivity issues, try switching between Wi-Fi and mobile data to see which provides a better connection.

- Keep the App Updated: Regularly update the Google Pay app to the latest version. Updates often include bug fixes and improvements that can enhance transaction reliability.

- Monitor Bank Account Status: Ensure your bank account linked to Google Pay is in good standing. Insufficient funds or restrictions from your bank can lead to pending transactions.

- Avoid Duplicate Payments: If a transaction is marked as processing, do not attempt to make the same payment again. This can complicate the situation and lead to further delays.

Google Pay Transaction Safety and Security Measures

| Security Measure | Description |

|---|---|

| Virtual Account Number | Google Pay generates a unique virtual account number for transactions, ensuring that merchants do not receive the user’s actual card number, enhancing security during contactless payments. |

| Device-Specific Tokenization | When a payment card is added to Google Pay, it creates a device-specific token, which means the real card number is not stored on the device or shared with merchants. |

| Strong Authentication | Google Pay does not sell personal information or transaction history to third parties, giving users transparency and control over their data. |

| Remote Locking and Data Erasure | If a device is lost or stolen, users can remotely lock it or erase their data using Google Find My Device, protecting payment information from unauthorized access. |

| Fraud Detection and Prevention | Google employs fraud detection teams and protocols that monitor for suspicious activity, helping to prevent unauthorized transactions and hacking attempts. |

| Encryption of Data | All data is encrypted both in transit and at rest, ensuring that sensitive information remains secure and inaccessible to unauthorized parties. |

| Privacy Controls | Payment information is securely stored on Google servers and monitored continuously to prevent unauthorized access and ensure data integrity. |

| Security Checkups | Users are encouraged to regularly review their security settings and perform security checkups to ensure their accounts are protected against potential threats. |

| Two-Factor Authentication | Google Pay supports two-factor authentication, requiring users to confirm their identity before completing transactions, enhancing account security. |

| Secure Storage of Payment Data | Payment information is securely stored on Google servers, monitored continuously to prevent unauthorized access and ensure data integrity. |

This table summarizes the key safety and security measures implemented by Google Pay to protect users’ payment information and enhance transaction security.

FAQs

Why is my *Google Pay* transaction showing as pending?

- A Google Pay pending transaction usually occurs due to network issues, insufficient funds, or verification requirements from either the bank or Google itself.

How long will a pending transaction stay on Google Pay?

- Pending transactions on Google Pay typically last up to 24 hours but can extend to 3-5 business days depending on the bank’s processing time and verification steps.

What should I do if my Google Pay transaction is still pending after several days?

- If your transaction remains pending after several days, you should contact your bank and the Google Pay support team for assistance in resolving the issue.

Can I cancel a pending transaction on Google Pay?

- Generally, pending transactions cannot be canceled directly through Google Pay. You would need to wait until the bank completes or reverses the transaction.

Is a pending transaction in Google Pay a sign of a security issue?

- No, a pending transaction is not necessarily a security issue. It’s often due to processing delays by the bank or Google’s verification steps.

What happens if a pending transaction fails to process in Google Pay?

- If a pending transaction fails, the amount is usually reversed to your bank account or card within 7-10 business days depending on the bank’s policies.

Can Google Pay hold my money if a transaction is pending?

- Google Pay does not hold funds; the pending status indicates that the bank or merchant has not yet completed the transaction. The funds will either be returned to your account, or the transaction will eventually be complete.

Final Words

Pending transactions on Google Pay can often cause confusion and frustration for users.

Understanding the nature of these transactions is crucial for effectively managing your finances.

When a transaction is marked as ‘pending,’ it indicates that the payment has been initiated but not yet completed.

Typically, it takes about three business days for the funds to be processed and reflected in your account. Users cannot cancel the transaction or take further action during this time.

While pending transactions are common, they highlight the importance of monitoring your payment activities closely.

Users should refrain from making duplicate payments while a transaction is still processing.

Being informed about how to handle pending transactions can enhance your experience with Google Pay, ensuring that you manage your finances smoothly and efficiently.