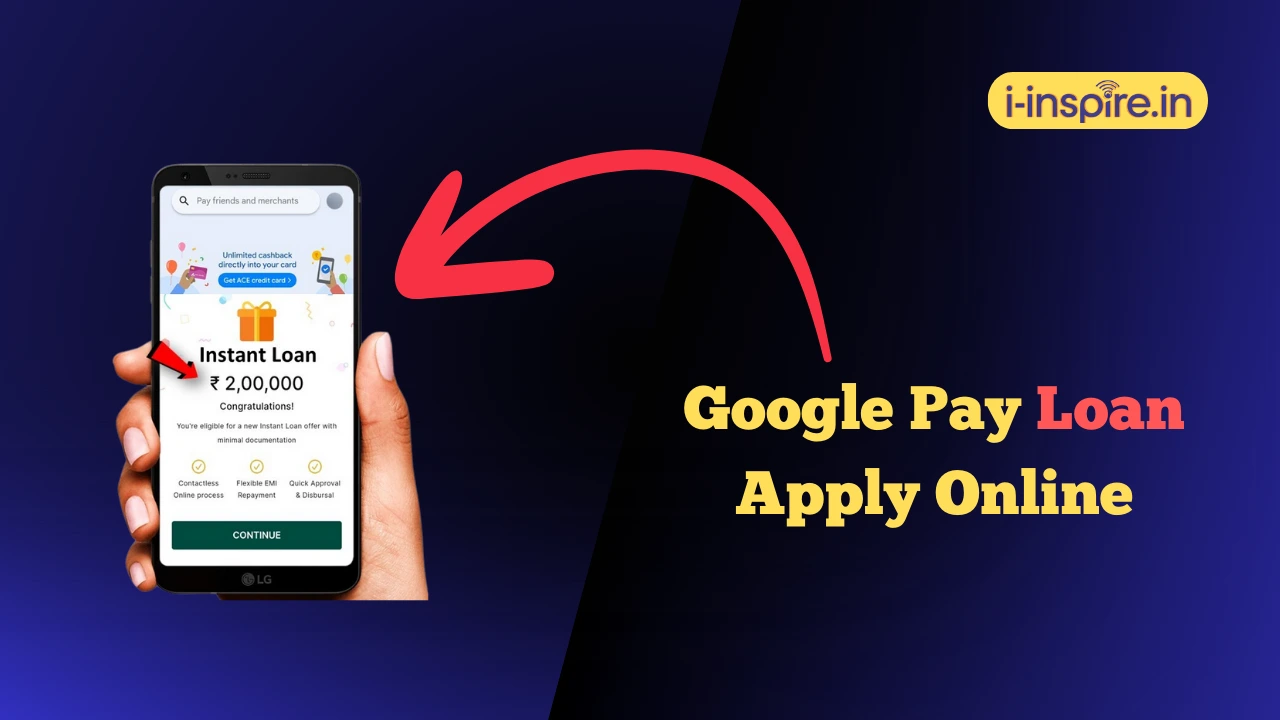

Google Pay Loan Apply Online

Applying for a loan through Google Pay has become a convenient option for many users seeking quick financial assistance.

The Google Pay Loan feature allows eligible users to access personal loans without the need for extensive paperwork or branch visits.

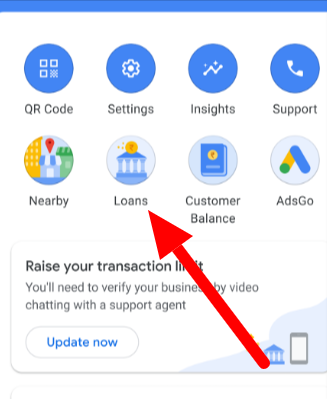

By simply navigating to the “Loans” section within the app, users can find pre-approved loan offers from various lending partners.

This process is designed to be straightforward, enabling users to select their desired loan amount and duration with just a few taps.

Also Read:

Couldn’t Register Google Pay Error

Can We Send Money from Phonepe to Google Pay

U66 Error in Google Pay

VPA Address in Google Pay

How to Hide Mobile Number in Google Pay

How to Fix Error Code U28 in Google Pay

Fake Google Pay Screenshot

Google Pay Pending Transaction Error

Delete Your Google Pay Transaction History

Google Pay Loan Apply Online

Once a loan offer is chosen, users are required to complete some basic KYC (Know Your Customer) information and provide necessary personal details.

It’s important to note that Google Pay itself does not issue loans; rather, it connects users with lending institutions that handle the approval and disbursement of funds.

This means that the terms, interest rates, and eligibility criteria can vary depending on the lender.

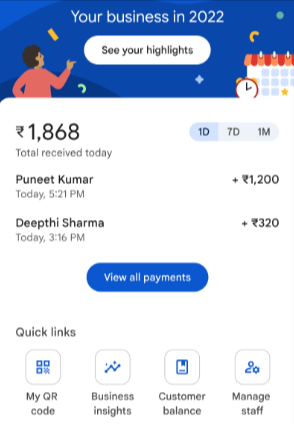

With automatic monthly deductions set up for repayments, managing a Google Pay loan is designed to be seamless and user-friendly, making it a popular choice for those in need of immediate financial support.

Who Can Apply for a Google Pay Loan?

To apply for a loan through Google Pay, users must meet specific eligibility criteria set by participating lending partners.

Google Pay acts as a facilitator, connecting users with these lenders, rather than providing loans directly. Here’s a detailed overview of who can apply for a Google Pay loan.

Eligibility Criteria

- Age Requirements: Applicants must typically be between the ages of 21 and 57. This age range ensures that borrowers are likely to have a stable income and a reasonable credit history.

- Income Level: A minimum income threshold is often required. For instance, some lenders may stipulate that applicants must earn at least ₹13,500 per month. This requirement helps ensure that borrowers can manage repayment obligations.

- Credit Score: A decent credit score is crucial for loan approval. Most lenders require a credit score of at least 600 on CIBIL or 650 on Experian. This score reflects the applicant’s creditworthiness and repayment history.

- Employment Verification: Applicants need to provide details about their employment, including the name of the employer, type of employment, and income verification. This information helps lenders assess the applicant’s financial stability.

- KYC Compliance: Know Your Customer (KYC) documentation is mandatory. Applicants must provide personal identification documents, such as a PAN card and Aadhaar-linked mobile number, for verification purposes.

Application Process

To apply for a loan, users must follow a straightforward process within the Google Pay app:

- Access the Loans Section: Users can find loan offers by navigating to the “Money” section and selecting “Loans.” Here, they can view pre-qualified offers based on their eligibility.

- Submit Personal Information: Applicants will need to fill out a form with personal details, including employment information, and agree to the terms and conditions.

- OTP Verification: After submitting the application, an OTP (One-Time Password) will be sent via SMS for verification.

- Loan Selection: Users can choose their desired loan amount and repayment duration from the available offers.

- Final Submission: After reviewing the loan details and completing any additional KYC requirements, users submit their application for processing.

Additional Considerations

Google Pay has also introduced initiatives for “new-to-credit” customers, allowing individuals without a prior credit history to apply for loans.

This broadens access to financial services, enabling more users to benefit from personal loans.

In summary, anyone who meets the outlined criteria can apply for a loan through Google Pay, making it a convenient option for those seeking financial assistance.

The platform’s user-friendly interface simplifies the loan application process, promoting financial inclusion across diverse demographics.

Required Documents and Information

To apply for a loan through Google Pay, you will need to provide the following documents:

- PAN Card: Your Permanent Account Number card is essential for identity verification.

- Aadhar Card: This document is required for KYC (Know Your Customer) verification.

- Bank Account Details: You need to provide your bank account number and the IFSC code for loan disbursement and EMI deductions.

- Mobile Number: Your mobile number must be linked to your Aadhar card for KYC purposes.

- Income Proof: This may include salary slips, bank statements, or any other document that verifies your income.

These documents are necessary to complete the application process and ensure that your loan application is processed smoothly.

| Category | Required Documents |

|---|---|

| Know Your Customer (KYC) | – Passport – Aadhaar Card – Voter ID Card – Driving License – PAN Card |

| Address Proof | – Utility Bills (Electricity, Water) – Bank Statements (showing your address) |

| Income Proof | – Salary Slips – Income Tax Returns (ITR) – Bank Statements showcasing regular income deposits |

Step-by-Step Guide to Applying for a Loan Online via Google Pay

To apply for a loan online via Google Pay, follow this detailed step-by-step guide.

This process allows users to access personal loans conveniently through the app, leveraging partnerships with various lending institutions.

Step 1: Install Google Pay

Begin by ensuring that you have the Google Pay app installed on your Android smartphone.

You can download it from the Google Play Store if it’s not already on your device.

Step 2: Log In to Google Pay

Open the Google Pay app and log in using your Google account credentials. If you’re a new user, you will need to set up your account by following the on-screen instructions.

Step 3: Navigate to the Loan Section

Once logged in, scroll down to the ‘Businesses’ section on the home page. Here, you will find various services offered through Google Pay. Click on ‘Explore’ to access these services.

Step 4: Select a Lending Partner

In the ‘Finances’ segment, you will see a list of lending partners. Choose the option that suits your needs, such as ‘moneyview’ or any other available lender offering personal loans.

Step 5: Start Your Loan Application

After selecting a lender, click on ‘Get Credit’ or the equivalent option. This action will redirect you to the lender’s webpage where you can start your loan application process.

Step 6: Check Eligibility

Before proceeding, you must agree to the terms and conditions presented. Next, click on ‘Check your Eligibility.’

This step is crucial as it will determine the loan amount you can apply for based on your financial profile. You can receive updates regarding your application via WhatsApp if you wish.

Step 7: Choose Loan Amount and Tenure

Based on your eligibility, select the loan amount you need (typically between ₹10,000 and ₹1 lakh) and the repayment tenure that fits your financial situation.

Step 8: Complete KYC and Verification

To finalize your application, complete the Know Your Customer (KYC) process. This usually involves verifying your identity and income.

You will need to provide your PAN number and ensure your mobile number is linked to your Aadhaar card for seamless verification.

Step 9: Submit Your Application

After filling in all required details and uploading necessary documents, review your application carefully. Once satisfied, submit your application for processing.

Step 10: Await Approval

After submission, the lender will review your application. If approved, you can expect the loan amount to be credited to your bank account within 24 hours.

Applying for a loan through Google Pay is a straightforward process that allows users to leverage digital technology for financial needs.

By following these steps, you can secure a personal loan quickly and efficiently, making financial management more accessible than ever.

Understanding Interest Rates for Google Pay Loans

Understanding interest rates is crucial for anyone considering a loan through Google Pay, particularly for business loans.

Interest rates determine the cost of borrowing money and can significantly affect the overall financial burden of a loan.

Types of Interest Rates

Interest rates on Google Pay loans can be categorized into two main types: fixed and variable rates.

A fixed-rate loan maintains the same interest rate throughout the loan term, providing predictability in monthly payments.

In contrast, a variable-rate loan has an interest rate that can fluctuate based on market conditions, which may lead to lower initial payments but can increase over time, making budgeting more challenging.

Factors Influencing Interest Rates

Several factors influence the interest rates offered on loans through Google Pay. These include:

- Loan Amount: Larger loans may have different rates compared to smaller ones.

- Borrower’s Creditworthiness: Lenders assess the risk associated with lending to a borrower by examining their credit score. A higher credit score often results in lower interest rates, as the borrower is deemed less risky.

- Type of Business: Different industries may face varying risks, which can affect the interest rates offered. For instance, startups may have higher rates compared to established businesses due to perceived risks.

- Market Conditions: Economic factors, such as inflation and central bank policies, can lead to fluctuations in interest rates across the lending market.

Typical Interest Rates for Google Pay Loans

For loans accessed through the Google Pay for Business app, interest rates typically range from 1.5% to 3%.

This range reflects a competitive offering, especially for small business loans. The specific rate a borrower receives will depend on their eligibility and the lender they choose.

Additionally, Google Pay loans often utilize a reducing rate of interest calculation, which means that the interest charged decreases as the principal balance is paid down, making it more cost-effective over time.

Importance of Understanding Interest Rates

Understanding the implications of interest rates is essential for borrowers.

The interest charged on a loan is not merely an added cost; it represents the lender’s compensation for the risk of lending money.

Borrowers must consider how interest rates will impact their total repayment amount and their ability to manage monthly payments.

In conclusion, when considering a loan through Google Pay, it is vital to evaluate the type of interest rate, the factors influencing it, and the typical rates available.

This knowledge empowers borrowers to make informed decisions and choose loan options that align with their financial capabilities and business goals.

Repayment Plans: What Are Your Options?

When you take out a loan through Google Pay, understanding the repayment options is crucial for managing your finances effectively.

Google Pay connects users with various lending partners, allowing for a streamlined loan application process.

However, it is important to note that the actual loan terms, including repayment schedules and interest rates, are determined by the individual lenders.

One of the appealing features of loans obtained through Google Pay is the flexibility in repayment options.

Most lenders offer the ability to repay loans in Equated Monthly Installments (EMIs), which can range from a few months to several years.

For example, some loans allow repayment over a period of 3 to 18 months, depending on the amount borrowed and the lender’s policies.

This flexibility helps borrowers choose a repayment plan that aligns with their financial situation.

To manage repayments conveniently, users can set up auto-debit from their linked bank accounts.

This feature ensures that your monthly payments are automatically deducted on the agreed date, reducing the risk of missed payments.

Regular notifications and reminders sent through the Google Pay app help keep track of upcoming payments, making it easier to stay on top of your loan obligations.

The interest rates on loans taken through Google Pay can start as low as 13.99% per annum, but they may vary based on the lender and the borrower’s creditworthiness.

It’s advisable to compare different loan offers available in the app to find the most suitable option for your needs.

In case you wish to pay off your loan early, many lenders allow for this, but it’s essential to check for any prepayment penalties that may apply.

These penalties can vary by lender, so reviewing the loan terms before making an early payment is essential.

Tracking your loan details is straightforward within the Google Pay app. You can view your outstanding balance, repayment schedule, and payment history all in one place.

This transparency helps borrowers manage their loans effectively and plan for future financial needs.

In summary, Google Pay provides a user-friendly platform for managing loan repayments.

With flexible repayment options, automatic deductions, and easy tracking, borrowers can navigate their loan responsibilities with confidence.

Benefits of Using Google Pay for Loan Applications

Using Google Pay for loan applications offers numerous advantages that enhance the borrowing experience for users.

Here are some key benefits:

Convenience and Accessibility

Google Pay simplifies the loan application process by allowing users to apply directly through the app.

This eliminates the need for lengthy paperwork and in-person visits to banks.

Users can access loan offers from various lending partners in one place, making it easy to compare options and choose the best fit for their financial needs.

The integration of Google Pay with other Google services, such as Gmail and Google Maps, further streamlines the process, allowing users to manage their finances more effectively.

Speed of Approval

One of the standout features of using Google Pay for loans is the speed of approval. The app utilizes advanced algorithms and automated verification systems to assess eligibility quickly.

This means that users can receive instant loan approvals, which is particularly beneficial in urgent financial situations.

The efficiency of the process reduces waiting times significantly compared to traditional loan applications, where approval can take days or even weeks.

Enhanced Security

Security is a primary concern for any financial transaction, and Google Pay addresses this with robust security measures.

The app employs multi-layered security protocols, including tokenization and strong encryption, to protect users’ personal and financial information.

This ensures that sensitive data is not shared with lenders, reducing the risk of identity theft and fraud.

Additionally, Google Pay requires users to authenticate transactions through PINs or biometric verification, adding an extra layer of security.

Transparent Loan Management

Google Pay provides users with a clear overview of their loan details, including payment schedules and outstanding balances.

This transparency helps users manage their finances more effectively, as they can easily track their repayment progress and understand the terms of their loans.

Notifications and reminders within the app also assist users in staying on top of their payments, reducing the likelihood of missed deadlines and late fees.

Rewards and Offers

Using Google Pay for loan applications can also come with financial incentives.

Users may receive cashback or rewards for using the app to manage their loans, which can help offset some of the costs associated with borrowing.

This feature not only encourages users to choose Google Pay for their financial transactions but also enhances their overall experience by providing tangible benefits.

In summary, Google Pay offers a modern, efficient, and secure way to apply for loans.

Its convenience, speed, security, transparency, and potential rewards make it an attractive option for individuals seeking financial assistance.

As digital payment solutions continue to evolve, Google Pay stands out as a leader in facilitating seamless loan applications.

What to Do if Your Loan Application is Rejected

If your application is rejected, there are several reasons this may have occurred.

The lending partner might have found that your credit score was too low, or you may not meet other eligibility criteria set by the lender.

It’s essential to check your credit report and understand your financial standing. Improving your credit score can enhance your chances of approval in the future.

You can also reach out to the lender directly for specific feedback on why your application was rejected.

This information can be valuable as you work to improve your financial profile or consider applying again later.

If you are eligible for a loan but did not receive a notification, you can still explore the Loans section in the Google Pay app to see available offers.

Additionally, ensure that your Google Pay account is set up correctly and that you have completed all necessary KYC requirements.

In summary, while applying for a loan through Google Pay is straightforward, a rejection does not mean you cannot secure a loan in the future.

By understanding the reasons for rejection and taking steps to improve your financial situation, you can increase your chances of approval next time.

FAQs

What is the eligibility criteria for applying for a loan on Google Pay?

- To be eligible for a loan on Google Pay, you must be an Indian citizen aged 21-60 years, have a stable income source, and maintain a good credit history. The specific criteria may vary depending on the lending partner.

How do I check the status of my loan application on Google Pay?

- You can check the status of your loan application directly in the Google Pay app. Navigate to the “Loans” section, where you’ll find updates from the lending partner regarding your application.

What is the maximum loan amount I can apply for through Google Pay?

- The maximum loan amount varies depending on your creditworthiness and the lending partner. Typically, Google Pay offers loans ranging from ₹10,000 to ₹2,00,000.

How long does it take for the loan amount to be credited to my account?

- Once approved, the loan amount is typically credited to your linked bank account within a few hours to 1 business day, depending on the lending partner and processing time.

Can I repay my Google Pay loan early?

- Yes, most lending partners associated with Google Pay allow early repayment without any prepayment penalties. However, it’s advisable to check the specific terms with your lender.

What should I do if my loan application on Google Pay is rejected?

- If your loan application is rejected, review the rejection reason provided by the lending partner. Common reasons include poor credit score, insufficient income, or incomplete application. Ensure all details are correct before reapplying.

Is it safe to apply for a loan via Google Pay?

- Yes, applying for a loan through Google Pay is safe. The platform uses high-end encryption and secure servers to protect your personal and financial information, ensuring a secure transaction.

Final Words

Applying for a loan through Google Pay is a simple and convenient process that offers users quick access to funds directly through their mobile devices.

With Google Pay, you can explore different loan options provided by various lending partners, ensuring that you find a solution that meets your financial needs.

The process is streamlined, allowing you to complete the application, verification, and approval steps all within the app.

Once approved, the loan amount is swiftly transferred to your linked bank account, making it an efficient option for those in need of immediate financial assistance.

One of the significant advantages of using Google Pay for loans is the platform’s strong emphasis on security.

Your personal and financial information is protected through high-end encryption, ensuring that your data remains safe throughout the entire process.

Additionally, Google Pay provides clear terms and conditions, making it easier for you to understand the loan repayment schedule and manage your finances effectively.

In conclusion, Google Pay offers a reliable, secure, and user-friendly way to apply for loans online.

Whether you need funds for personal expenses, business needs, or emergencies, Google Pay serves as a trustworthy platform to meet your financial goals.