UPI Cash Withdrawal ATM Near Me: Cardless Banking in 2024

In an era where digital convenience is king, the banking sector continues to evolve rapidly. One of the most exciting developments in recent years has been the introduction of UPI cash withdrawal at ATMs. If you’ve ever wondered, “Is there a UPI cash withdrawal ATM near me?” you’re about to discover a world of cardless banking that’s revolutionizing how we access our money.

Also Read:

1. Google Pay Pending Transaction Error

2. Delete Your Google Pay Transaction History

3. How to Disable Autopay in PhonePe

4. PhonePe Screenshots

5. What is UTR Number in PhonePe?

6. How to Change PhonePe Pin

7. How to Download PhonePe Statement

UPI Cash Withdrawal ATM Near Me: Cardless Banking

UPI Cash Withdrawal: A Game-Changer in Banking

UPI cash withdrawal, also known as cardless cash withdrawal or UPI-ATM, is a cutting-edge service that allows you to withdraw money from ATMs using your smartphone instead of a physical debit or credit card. This innovative feature leverages the power of the Unified Payments Interface (UPI), India’s real-time payment system that has already transformed the digital payments landscape.

The Evolution of ATM Withdrawals

To appreciate the significance of UPI cash withdrawal, let’s take a quick look at how ATM technology has evolved:

- Traditional Card-Based Withdrawals: The standard method we’ve all used for decades.

- Contactless Card Withdrawals: Introduced for quicker transactions.

- Mobile Wallet ATM Withdrawals: Limited to specific banks and wallets.

- UPI Cash Withdrawal: The latest innovation, offering universal compatibility.

What Sets UPI Cash Withdrawal Apart?

UPI cash withdrawal is not just another banking feature; it’s a paradigm shift in how we interact with ATMs. Here’s what makes it special:

- Universal Compatibility: Unlike bank-specific cardless withdrawal systems, UPI works across multiple banks and ATM networks.

- Enhanced Security: Reduces the risk of card skimming and theft.

- Convenience: No need to carry multiple cards for different accounts.

- Speed: Transactions can be faster once you’re familiar with the process.

- Flexibility: Access multiple bank accounts through a single UPI app.

The Mechanics of UPI Cash Withdrawal: How It Works

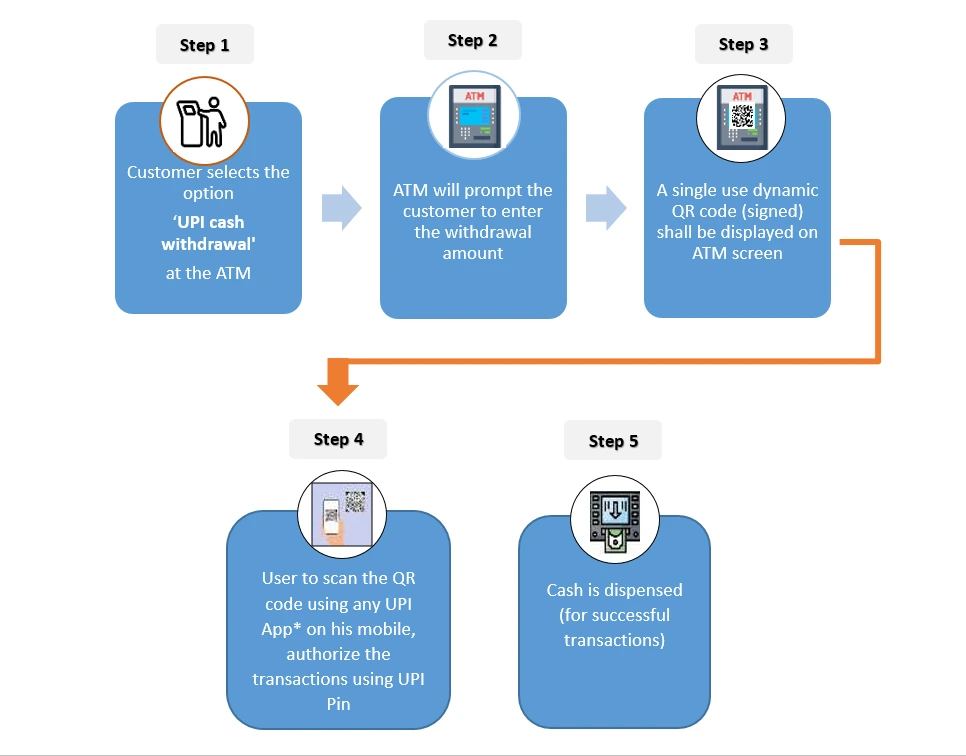

Understanding the process of UPI cash withdrawal is crucial for anyone looking to embrace this technology. Let’s break it down step by step.

Step-by-Step Guide to UPI Cash Withdrawal

- Locate a UPI-Enabled ATM: Use your bank’s app or a UPI app to find a compatible ATM.

- Select UPI Withdrawal: At the ATM, choose the “UPI Cash Withdrawal” or “Cardless Withdrawal” option.

- Enter Withdrawal Amount: Input the amount you wish to withdraw (usually in multiples of 100).

- Generate QR Code: The ATM will display a unique QR code for your transaction.

- Scan with UPI App: Open your UPI-enabled app and scan the QR code.

- Authorize Transaction: Confirm the amount and enter your UPI PIN in the app.

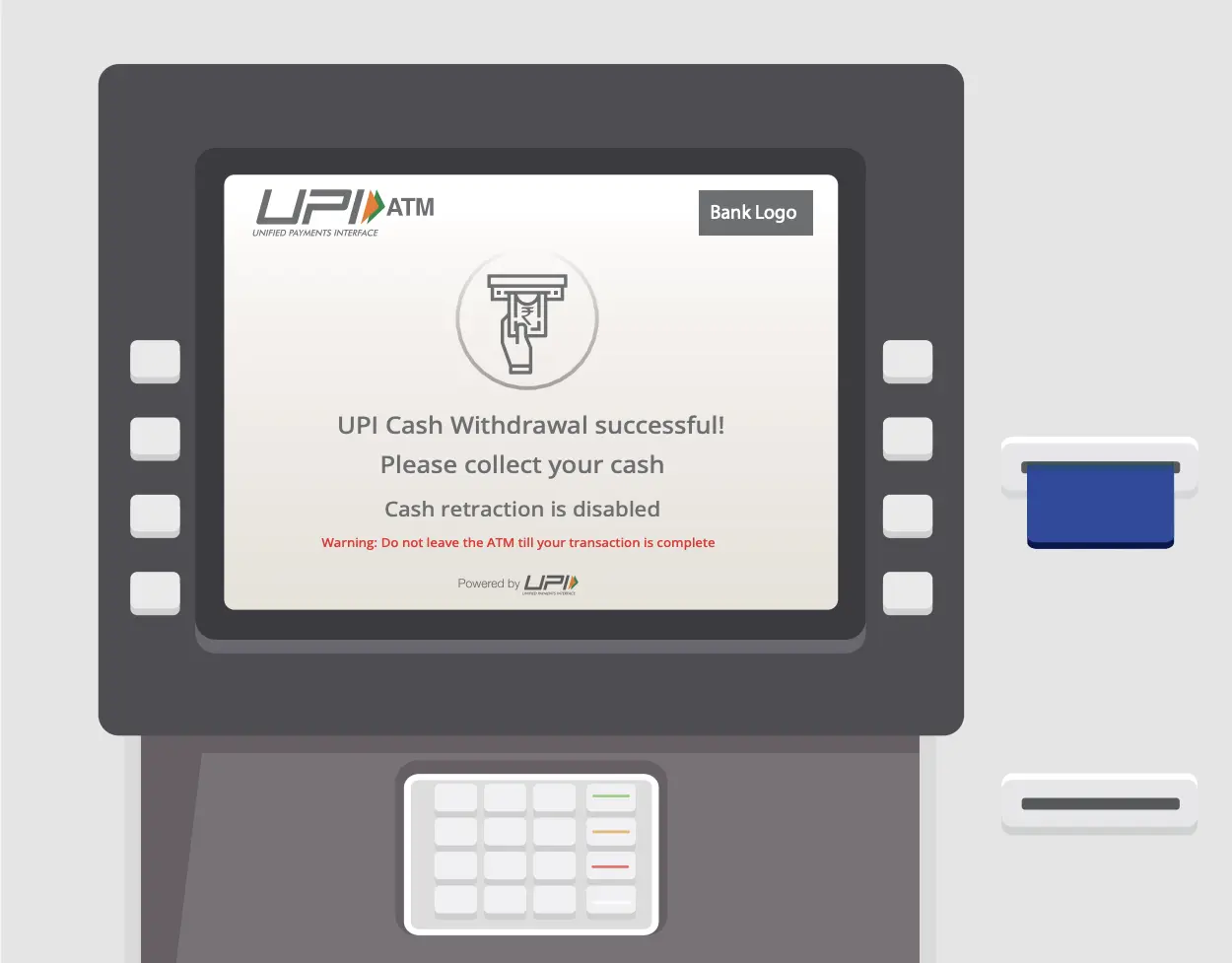

- Collect Cash: Once authorized, the ATM will dispense your cash.

The Technology Behind UPI Cash Withdrawal

UPI cash withdrawal is powered by a combination of technologies:

- QR Code Technology: Generates a unique code for each transaction.

- UPI Framework: Facilitates secure communication between your app and the bank.

- Real-Time Processing: Ensures instant verification and fund transfer.

- Encryption: Protects your financial data throughout the transaction.

Security Measures in Place

Security is paramount in financial transactions. UPI cash withdrawal incorporates multiple layers of protection:

- Dynamic QR Codes: Each code is unique and valid only for a short time.

- UPI PIN: Your personal identification number known only to you.

- Two-Factor Authentication: Combines device verification with your UPI PIN.

- End-to-End Encryption: Secures data transmission from your device to the bank.

Finding UPI-Enabled ATMs Near You: Your Local Guide

One of the most common questions is, “How do I find a UPI cash withdrawal ATM near me?” Here’s a comprehensive guide to locating these next-gen ATMs.

Methods to Locate UPI-Enabled ATMs

- Bank Websites and Mobile Apps: Most banks now offer ATM locators with UPI withdrawal filters.

- UPI Apps: Apps like BHIM, Google Pay, and PhonePe often have built-in ATM locators.

- Google Maps: Some banks have listed their UPI-enabled ATMs on Google Maps.

- Third-Party ATM Locator Apps: Apps specifically designed to find ATMs with various features, including UPI withdrawal.

Popular Apps for Finding UPI ATMs

| App Name | Features | User Rating |

|---|---|---|

| BHIM | UPI-specific, real-time updates | 4.3/5 |

| Google Pay | Wide coverage, user reviews | 4.6/5 |

| PhonePe | Comprehensive filters, nearby offers | 4.5/5 |

| Paytm | ATM + other services locator | 4.4/5 |

Tips for Effective ATM Searching

- Use specific search terms like “UPI ATM” or “Cardless cash withdrawal”

- Check user reviews for the most up-to-date information

- Look for ATMs in high-traffic areas, as they’re more likely to support UPI

- Verify operating hours, especially for ATMs in less populated areas

Participating Banks and Their UPI ATM Services

The network of banks offering UPI cash withdrawal is expanding rapidly. Let’s explore the major players and what they offer.

Major Banks Offering UPI Cash Withdrawal

- State Bank of India (SBI)

- Largest network of UPI-enabled ATMs

- Available nationwide

- Transaction limit: ₹10,000 per day

- ICICI Bank

- Pilot phase in select cities

- Plans for nationwide rollout

- Transaction limit: ₹20,000 per day

- Punjab National Bank (PNB)

- Available at most PNB ATMs

- Transaction limit: ₹10,000 per day

- Bank of Baroda

- Rapidly expanding UPI ATM network

- Transaction limit: ₹10,000 per day

- Union Bank of India

- Available at all UBI ATMs

- Transaction limit: ₹10,000 per day

Regional and Cooperative Banks Joining the UPI Revolution

Many smaller banks are also embracing UPI cash withdrawal:

- Fincare Small Finance Bank

- Equitas Small Finance Bank

- Ujjivan Small Finance Bank

- Suryoday Small Finance Bank

- Various Urban Cooperative Banks

Comparison of UPI ATM Services Across Banks

| Bank | Transaction Limit | Fees | Availability | Special Features |

|---|---|---|---|---|

| SBI | ₹10,000 per day | Free | Nationwide | 24/7 customer support |

| ICICI | ₹20,000 per day | Free | Select cities | Higher withdrawal limit |

| PNB | ₹10,000 per day | Free | Nationwide | Integration with PNB One app |

| BoB | ₹10,000 per day | Free | Major cities | Cashback offers on first use |

| UBI | ₹10,000 per day | Free | All UBI ATMs | Multi-lingual support |

Setting Up Your UPI App for ATM Withdrawals: A Step-by-Step Guide

Before you can start using UPI for ATM withdrawals, you need to set up your app correctly. Here’s a detailed guide to get you started.

Choosing the Right UPI App

Several apps support UPI cash withdrawal. Here are some popular options:

- BHIM: The government’s official UPI app

- Google Pay: Known for its user-friendly interface

- PhonePe: Offers a wide range of financial services

- Paytm: Combines UPI with a digital wallet

- Your Bank’s Mobile App: Many banks have integrated UPI into their apps

Linking Your Bank Account

- Open your chosen UPI app

- Select “Add Bank Account” or a similar option

- Choose your bank from the list provided

- Enter your debit card details for verification

- Set up your UPI PIN

Enabling ATM Withdrawal Feature

The exact steps may vary by app, but generally:

- Go to app settings or profile

- Look for “ATM Withdrawal” or “Cardless Cash”

- Enable the feature

- You may need to verify your identity again

- Set any additional security measures offered

Tips for Secure Setup

- Use a strong, unique UPI PIN

- Enable biometric authentication if available

- Keep your app updated to the latest version

- Don’t share your UPI PIN or OTP with anyone

Making Your First UPI Cash Withdrawal: A Practical Walkthrough

Ready to try your first UPI cash withdrawal? Here’s a detailed guide to ensure a smooth experience.

Before You Visit the ATM

- Ensure your phone is charged (at least 20% battery)

- Check your account balance

- Verify your daily transaction limit

- Make sure you have a stable internet connection

Detailed Withdrawal Process

- Locate a UPI-enabled ATM using your app’s locator

- At the ATM, select “UPI Withdrawal” or “Cardless Withdrawal”

- Enter the amount you wish to withdraw

- The ATM will display a QR code

- Open your UPI app and select “Scan QR” or “ATM Withdrawal”

- Scan the QR code displayed on the ATM screen

- Verify the amount in your app

- Enter your UPI PIN to authorize the transaction

- Wait for the ATM to process your request

- Collect your cash and transaction receipt

Troubleshooting Common Issues

- QR Code Not Scanning: Ensure proper lighting and a steady hand. Clean the ATM screen if necessary.

- Transaction Failing: Check your balance and daily limits. Ensure you’re within the ATM’s operational hours.

- Network Issues: Move to an area with better reception if possible. Some ATMs offer Wi-Fi connectivity.

- App Crashes: Force close and restart the app. If the issue persists, try using a different UPI app.

Security and Safety Considerations: Protecting Your Money and Data

While UPI cash withdrawal is designed with security in mind, it’s essential to take personal precautions.

Personal Safety Tips for ATM Use

- Choose ATMs in well-lit, populated areas

- Be aware of your surroundings

- Don’t count cash at the ATM

- Shield the keypad when entering any information

- Trust your instincts – if something feels off, leave and find another ATM

Digital Security Measures

- Use a complex UPI PIN that’s different from your debit card PIN

- Enable app lock or biometric authentication on your UPI app

- Avoid using public Wi-Fi for financial transactions

- Regularly update your UPI app and phone’s operating system

- Don’t store your UPI PIN on your phone

What to Do If Something Goes Wrong

- For failed transactions where money is deducted:

- Check your bank statement

- Contact your bank’s customer service

- File a complaint through the UPI app

- If you suspect fraud:

- Immediately block your UPI ID through the app

- Report to your bank and the police

- Change your UPI PIN and other related passwords

- For ATM malfunctions:

- Note down the ATM ID and transaction details

- Contact the bank that operates the ATM

- File a formal complaint if necessary

Limitations and Challenges of UPI Cash Withdrawal

While UPI cash withdrawal offers numerous benefits, it’s important to be aware of its limitations.

Transaction Limits

- Most banks impose a daily limit of ₹10,000 for UPI cash withdrawals

- Some banks may have lower limits for new users or during the initial rollout

- These limits are separate from your regular ATM withdrawal limits

Availability Issues

- Not all ATMs support UPI withdrawal yet

- Rural areas may have limited availability of UPI-enabled ATMs

- Some ATMs may have UPI functionality temporarily disabled for maintenance

Technical Challenges

- Dependence on internet connectivity

- Potential for app glitches or crashes

- QR code scanning issues in poor lighting conditions

User Adoption Hurdles

- Learning curve for less tech-savvy users

- Trust issues regarding new technology

- Preference for traditional methods among some users

The Future of UPI Cash Withdrawal: What’s Next?

The landscape of UPI cash withdrawal is rapidly evolving. Here’s what we might expect shortly.

Upcoming Features and Improvements

- Higher Transaction Limits: Banks may increase daily limits as the system proves reliable.

- Integration with Wearable Devices: Smartwatches could be used for UPI ATM transactions.

- Voice-Activated Withdrawals: AI assistants might facilitate hands-free ATM interactions.

- Biometric Authentication: Fingerprint or facial recognition could replace PINs.

Expansion Plans

- Increased Rural Penetration: More UPI-enabled ATMs in rural and semi-urban areas.

- Cross-Border Withdrawals: Potential for UPI withdrawals in foreign countries.

- Integration with Micro ATMs: Bringing UPI withdrawal to small businesses and rural areas.

Integration with Other Financial Services

- Investment Platforms: Direct cash withdrawal from investment accounts.

- Budgeting Tools: ATM withdrawals could automatically update budgeting apps.

- Cryptocurrency Exchange: Potential for crypto-to-cash withdrawals via UPI.

Comparing UPI Cash Withdrawal with Other Methods

Let’s compare UPI cash withdrawal with other withdrawal methods to appreciate it truly.

UPI vs. Traditional Card-Based Withdrawals

| Aspect | UPI Withdrawal | Card-Based Withdrawal |

|---|---|---|

| Speed | Generally faster | Can be slower due to card insertion |

| Security | Higher (no card skimming risk) | Vulnerable to skimming |

| Convenience | No physical card needed | Requires carrying a card |

| Versatility | Access multiple accounts | Limited to card’s account |

| Learning Curve | Steeper for new users | Familiar to most users |

UPI vs. Mobile Banking App Withdrawals

While both use smartphones, UPI withdrawal offers:

- Cross-bank compatibility

- Potentially faster processing

- More widespread availability

UPI vs. Other Cardless Systems

Compared to bank-specific cardless systems, UPI offers:

- Universal acceptance across participating banks

- Standardized user experience

- Potential for more features and integrations

Tips for Maximizing UPI Cash Withdrawal Benefits

Make the most of this innovative feature with these expert tips.

Managing Multiple Bank Accounts

- Link all your accounts to a single UPI app for easy management

- Set primary and secondary accounts for withdrawals

- Use different UPI IDs for different purposes (e.g., personal, business)

Utilizing Offers and Cashbacks

- Keep an eye out for promotional offers from banks and UPI apps

- Some apps offer cashback for first-time UPI ATM users

- Look for partner offers that combine UPI withdrawals with other services

Integrating with Personal Finance Management

- Use UPI withdrawal data to track your cash expenses

- Integrate with budgeting apps for a complete financial picture

- Set up alerts for large withdrawals to maintain budget discipline

Optimizing for Convenience and Security

- Save frequently used withdrawal amounts in your UPI app

- Set up biometric authentication for quicker access

- Regularly review your transaction history for any discrepancies

Real User Experiences and Case Studies

Let’s hear from some users who’ve embraced UPI cash withdrawal in their daily lives.

Success Stories

- Rahul, 28, Software Engineer

“I forgot my wallet at home but needed cash urgently for a client meeting. UPI cash withdrawal saved the day! It was quick and easy, and I didn’t have to rush back home.” - Priya, 35, Teacher

“As someone who often misplaces things, UPI withdrawal has been a game-changer. I no longer worry about losing my ATM card. Plus, it’s so much faster than traditional withdrawals.”

Challenges Faced by Users

- Amit, 45, Business Owner

“The first time I tried UPI withdrawal, the app crashed midway. It was a bit nerve-wracking, but I contacted customer support, and they guided me through the process. Now, I always make sure my app is updated before making a withdrawal.” - Sneha, 30, Freelance Designer

“Finding a UPI-enabled ATM was initially challenging in my area. I had to travel a bit further than usual. However, as more ATMs are being upgraded, it’s becoming much more convenient.”

Lessons Learned

- Practice in Low-Stress Situations: Try your first UPI withdrawal when you’re not in a hurry.

- Have a Backup Plan: Always keep a physical card handy, just in case.

- Stay Informed: Keep up with your bank’s latest UPI features and limits.

- Network Matters: Ensure you have a stable internet connection before initiating a transaction.

Expert Opinions on UPI Cash Withdrawal

To gain a broader perspective, let’s hear from industry experts about the impact and future of UPI cash withdrawal.

Banking Professionals’ Views

Amit Gupta, Senior Bank Executive

“UPI cash withdrawal is more than just a convenience feature. It’s a step towards a more inclusive, digital banking ecosystem. We’re seeing increased adoption, especially among younger customers who prefer smartphone-based solutions.”

Priya Sharma, ATM Network Manager

“From an operational standpoint, UPI withdrawals can potentially reduce the wear and tear on ATM machines. This could lead to lower maintenance costs in the long run.”

Fintech Experts’ Predictions

Dr. Sneha Patel, Fintech Analyst

“We’re likely to see UPI withdrawal become the norm rather than the exception within the next five years. The next big leap could be integrating this technology with AI and machine learning for personalized financial advice at the point of withdrawal.”

Rajesh Kumar, Blockchain Specialist

“The success of UPI withdrawals paves the way for more innovative solutions. We might soon see integration with cryptocurrency exchanges, allowing for seamless conversion and withdrawal of digital assets.”

Consumer Advocates’ Perspectives

Meera Joshi, Consumer Rights Activist

“While UPI withdrawal offers convenience, it’s crucial that banks and app developers prioritize user education. Clear, accessible information about security practices and troubleshooting should be readily available to all users.”

Vikram Singh, Financial Literacy Educator

“UPI withdrawals can be a powerful tool for teaching younger generations about responsible cash management. It bridges the gap between digital transactions and physical currency, offering a holistic understanding of money.”

The Global Context: UPI Cash Withdrawal on the World Stage

While UPI is primarily an Indian innovation, its impact is being felt globally. Let’s explore how UPI cash withdrawal compares to international cardless withdrawal systems and its potential for global adoption.

International Cardless Withdrawal Systems

- USA: Major banks offer cardless ATM access through their mobile apps, but it’s not as unified as UPI.

- UK: Some banks provide cardless withdrawals through smartphone apps or one-time codes.

- China: WeChat and Alipay offer similar services, integrated with their vast digital payment ecosystems.

UPI’s Unique Advantages

- Interoperability: Unlike many international systems, UPI works across multiple banks and apps.

- Government Backing: Strong support from Indian authorities has accelerated adoption.

- Scalability: Designed to handle a high volume of transactions, making it suitable for populous countries.

Potential for Global Adoption

- Cross-Border Collaborations: Discussions are underway for UPI integration with payment systems in other countries.

- Model for Developing Nations: Many countries are looking at UPI as a blueprint for their own digital payment systems.

- International Remittances: Future iterations could facilitate easier international money transfers and withdrawals.

The Environmental Impact of UPI Cash Withdrawal

As we move towards a more digital future, it’s worth considering the environmental implications of UPI cash withdrawal.

Reduced Plastic Usage

- Fewer plastic cards need to be produced and replaced.

- Potential reduction in paper receipts if users opt for digital transaction records.

Energy Considerations

- Increased reliance on smartphones and data centers may lead to higher energy consumption.

- However, this could be offset by reduced transportation needs for cash management.

Long-Term Sustainability

- Potential for integration with green banking initiatives.

- Opportunity to use transaction data for better resource allocation in ATM networks.

Regulatory Framework and Compliance

Understanding the regulatory landscape is crucial for both users and service providers in the UPI cash withdrawal ecosystem.

Current Regulations

- Overseen by the Reserve Bank of India (RBI) and the National Payments Corporation of India (NPCI).

- Subject to the same KYC (Know Your Customer) norms as traditional banking services.

- Transaction limits set by RBI to manage risk and prevent misuse.

Data Protection and Privacy

- Governed by India’s data protection laws and RBI guidelines.

- Encryption standards for data transmission and storage.

- User consent requirements for data collection and usage.

Future Regulatory Considerations

- Potential for specific UPI withdrawal regulations as the service grows.

- Ongoing discussions about cross-border transaction regulations.

- Evolving cybersecurity requirements to address emerging threats.

Accessibility and Inclusion: UPI Cash Withdrawal for All

One of the key promises of digital banking is greater financial inclusion. Let’s examine how UPI cash withdrawal contributes to this goal.

Benefits for Rural and Underbanked Populations

- Easier access to cash without needing a physical bank branch nearby.

- Simplified process that can be more approachable for first-time bank users.

- Potential for integration with micro-ATMs and banking correspondents.

Challenges in Universal Adoption

- Digital literacy barriers, especially among older and rural populations.

- Smartphone dependency may exclude those without access to such devices.

- Internet connectivity issues in remote areas.

Initiatives for Inclusive Access

- Government and bank-led digital literacy programs.

- Development of feature phone-based UPI services.

- Efforts to expand internet connectivity in rural areas.

The Role of UPI Cash Withdrawal in a Cashless Society

As India and many other countries move towards a more cashless economy, UPI cash withdrawal plays an interesting role.

Bridging Digital and Physical Transactions

- Provides a crucial link between digital balances and physical cash.

- Helps users transition gradually from cash-dependent to digital-first financial habits.

Impact on Cash Circulation

- Potential for more efficient cash management in the banking system.

- May lead to a gradual reduction in cash usage as users become more comfortable with digital transactions.

Future Scenarios

- Integration with digital currencies, including potential Central Bank Digital Currencies (CBDCs).

- Evolution into a hub for various financial services beyond just cash withdrawal.

Conclusion: The Future of Banking at Your Fingertips

As we’ve explored throughout this comprehensive guide, UPI cash withdrawal represents more than just a new way to get cash from an ATM. It’s a glimpse into the future of banking – a future where the lines between digital and physical finance are increasingly blurred.

From its user-friendly interface to its robust security measures, UPI cash withdrawal addresses many of the pain points associated with traditional ATM usage. It offers convenience, speed, and flexibility, all while maintaining the familiar aspect of cash transactions that many still prefer.

However, like any technological advancement, it comes with its own set of challenges. Issues of accessibility, digital literacy, and universal adoption remain hurdles to be overcome. The ongoing efforts by banks, fintech companies, and regulatory bodies to address these challenges will be crucial in shaping the future of this technology.

As users, staying informed and adapting to these changes will be key. Whether you’re a tech-savvy early adopter or someone just starting to explore digital banking, UPI cash withdrawal offers something for everyone. It’s a technology that’s continuously evolving, promising even more innovative features and integrations in the future.

So, the next time you find yourself asking, “Is there a UPI cash withdrawal ATM near me?” remember that you’re not just looking for a convenient way to get cash – you’re participating in a financial revolution that’s unfolding right before our eyes.

Embrace the change, stay informed, and most importantly, use these tools responsibly to manage your finances in this exciting new era of digital banking.

FAQs

To wrap up this comprehensive guide, let’s address some frequently asked questions about UPI cash withdrawal:

- Q: Is UPI cash withdrawal available 24/7?

A: Yes, UPI cash withdrawal is available 24/7, subject to ATM availability and functionality. - Q: Can I use UPI cash withdrawal at any bank’s ATM?

A: You can use UPI cash withdrawal at any participating bank’s ATM that supports this feature, regardless of where you hold your account. - Q: What happens if the ATM runs out of cash during a UPI withdrawal?

A: The transaction will be cancelled, and any deducted amount will be refunded to your account, usually within 3-5 business days. - Q: Are there any additional charges for UPI cash withdrawal?

A: Currently, most banks offer this service free of charge, but it’s always best to check with your bank for the most up-to-date information. - Q: Can I set a separate PIN for UPI cash withdrawals?

A: No, UPI cash withdrawals use the same UPI PIN you use for other UPI transactions. - Q: What should I do if my UPI cash withdrawal transaction fails but money is deducted?

A: Contact your bank immediately. Most failed transactions are reversed automatically within 5-7 working days. - Q: Can I use UPI cash withdrawal if I don’t have a smartphone?

A: Currently, UPI cash withdrawal requires a smartphone with a UPI-enabled app. However, there are ongoing efforts to develop feature phone-based UPI services. - Q: Is there a limit to the number of UPI cash withdrawals I can make in a day?

A: Yes, there are usually daily limits on both the number of transactions and the total amount. These limits vary by bank and account type. - Q: Can I use UPI cash withdrawal internationally?

A: Currently, UPI cash withdrawal is limited to Indian ATMs. However, there are discussions about potential international expansions in the future. - Q: How does UPI cash withdrawal affect my account statement?

A: UPI cash withdrawals will appear on your account statement similar to regular ATM withdrawals, usually with a specific UPI or cardless withdrawal notation.