Add Money to PhonePe Wallet from a Credit Card

PhonePe is one of India’s most popular digital payment platforms, offering a range of services, including money transfers, bill payments, and online shopping.

Adding money to your PhonePe wallet from a credit card is a convenient way to ensure you always have funds available for various transactions.

This comprehensive guide will walk you through the steps to add money to your PhonePe wallet using a credit card, providing detailed instructions, tips, and important considerations to ensure a smooth and secure process.

PhonePe Wallet is a digital wallet service integrated within the PhonePe app. It allows users to store money digitally and use it for a variety of transactions such as paying for goods and services, transferring money to friends and family, and more. The wallet is linked to your PhonePe account and can be funded through different methods, including bank transfers, debit cards, and credit cards.

Steps to Add Money to PhonePe Wallet from a Credit Card

Step 1: Open the PhonePe App

First, you need to open the PhonePe app on your smartphone. Ensure that the app is updated to the latest version for the best experience and security features. If you do not have the app installed, download it from the Google Play Store or Apple App Store and register an account.

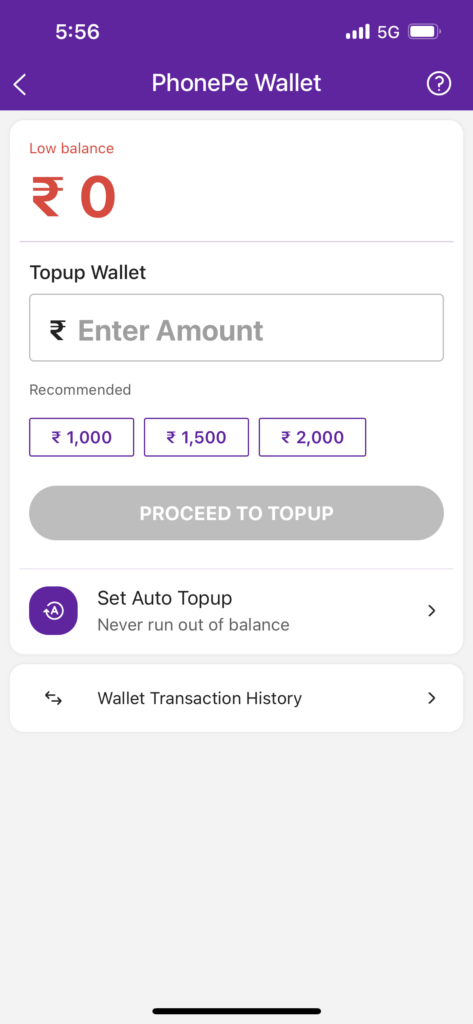

Step 2: Navigate to the ‘Add Money’ Section

Once you have the app open, log in to your PhonePe account if you aren’t already. On the homepage, you will find various options. Look for the ‘Add Money’ button, usually under the ‘My Money’ section. Tap on it to proceed.

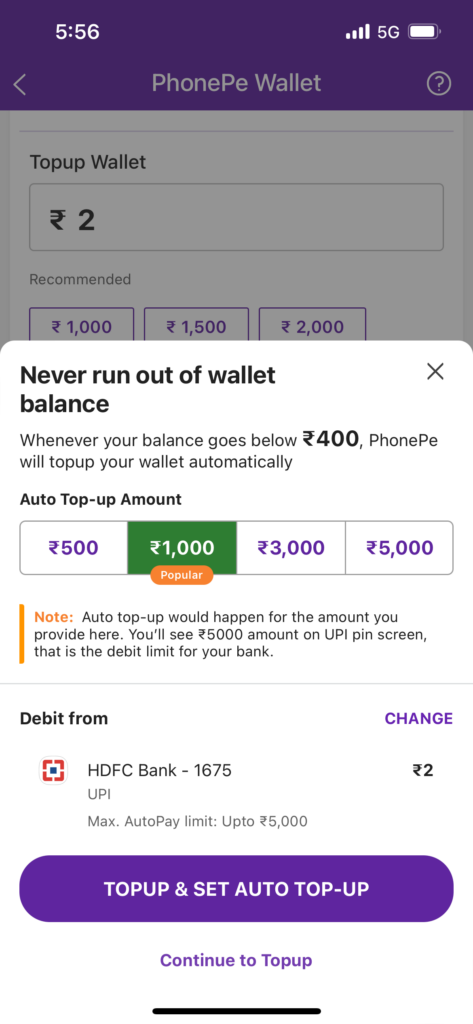

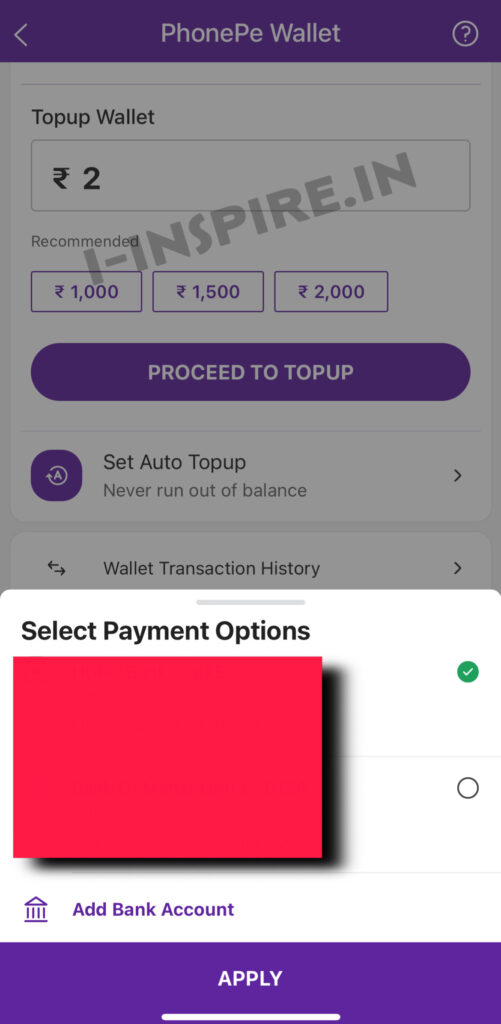

Step 3: Select ‘Credit Card’ as the Payment Method

In the ‘Add Money’ section, you will see multiple payment options such as UPI, Debit Card, and Credit Card. Select ‘Credit Card’ from the list of available methods.

Step 4: Enter the Amount to Add

After selecting ‘Credit Card’, you will be prompted to enter the amount of money you wish to add to your PhonePe wallet. Input the desired amount and ensure it falls within any limits set by PhonePe or your credit card provider.

Step 5: Enter Credit Card Details

Next, you need to provide your credit card information. This includes the card number, expiration date, CVV (Card Verification Value), and the name on the card. Double-check the details to ensure accuracy.

Step 6: Confirm and Complete the Transaction

Review the entered information and confirm the transaction. You may be required to complete an additional verification step, such as entering a One-Time Password (OTP) sent to your registered mobile number or email. This step ensures the security of your transaction. Once verified, the specified amount will be added to your PhonePe wallet.

Table: Summary of Steps to Add Money to PhonePe Wallet from Credit Card

| Step | Action |

|---|---|

| Step 1 | Open the PhonePe app on your smartphone. |

| Step 2 | Navigate to the ‘My Money’ section. |

| Step 3 | Select ‘Add Money to Wallet’. |

| Step 4 | Enter the amount you wish to add. |

| Step 5 | Choose ‘Credit Card’ as the payment method. |

| Step 6 | Enter your credit card details (number, expiry date, CVV, and cardholder name). |

| Step 7 | Authenticate the transaction using OTP or 3D Secure verification. |

| Step 8 | Receive confirmation and check that the amount has been added to your PhonePe wallet. |

Benefits of Adding Money Using a Credit Card

Convenience

Using a credit card to add money to your PhonePe wallet is extremely convenient. You can complete the transaction from anywhere, at any time, without the need to visit a bank or ATM.

Rewards and Cashback Offers

Many credit cards offer rewards points or cashback on digital transactions. By using your credit card, you can earn these benefits, making your transactions more rewarding.

Instant Transactions

Credit card transactions are processed instantly, ensuring that your PhonePe wallet is funded immediately. This is especially useful when you need to make urgent payments.

Safety and Security Measures

PhonePe employs advanced security measures to protect users’ financial information. Here are some tips to ensure your transactions are safe:

- Use a Secure Internet Connection: Avoid using public Wi-Fi for financial transactions. Use a secure and private connection to protect your data.

- Update Your PhonePe App Regularly: Ensure that you are using the latest version of the PhonePe app to benefit from updated security features.

- Enable Two-Factor Authentication (2FA): Adding an extra layer of security can protect your account from unauthorized access.

- Monitor Your Account Activity: Regularly check your transaction history for any unauthorized activity and report suspicious transactions immediately.

Troubleshooting Common Issues

Despite the ease of use, you might encounter issues while adding money to your PhonePe wallet. Here are some common problems and their solutions:

Failed Transactions

- Ensure your credit card has sufficient funds.

- Check if your card is enabled for online transactions.

- Retry the transaction after some time, or use an alternative method.

Incorrect Card Details

- Double-check the card details you have entered.

- Ensure the card is not expired and the CVV is correct.

Insufficient Funds

- Verify that your credit card has enough available credit.

- If your card has a spending limit, ensure you are within the limit.

Important Tips and Considerations

Credit Card Charges

Be aware that some credit card issuers may charge a fee for adding money to digital wallets. These fees can vary depending on the bank and the type of credit card you are using. It’s important to check with your credit card provider for any applicable fees to avoid any surprises.

Security

Ensure that your PhonePe app is updated to the latest version for security enhancements. Avoid using public Wi-Fi when performing financial transactions to protect your sensitive information. Using a secure and private internet connection can prevent potential data breaches and unauthorized access.

Transaction Limits

PhonePe has set limits on the amount of money you can add to your wallet. These limits are in place to prevent fraudulent activities and ensure the security of transactions. Make sure to stay within these limits to avoid transaction failures. You can check the current limits in the ‘My Money’ section of the app.

Credit Card Information

Do not save your credit card information on shared devices. Always log out of your PhonePe account if you are using a shared or public device to prevent unauthorized access to your account and financial information.

Detailed Guide: Adding Money to PhonePe Wallet

Understanding the Interface

The PhonePe app is designed to be user-friendly, with a clean and intuitive interface. When you open the app, the home screen displays various options such as ‘Recharge & Pay Bills’, ‘Transfer Money’, ‘My Money’, and more. For adding money to your wallet, you will primarily use the ‘My Money’ section.

Navigating to the ‘My Money’ Section

The ‘My Money’ section is a hub for all financial transactions on PhonePe. Here, you can manage your wallet, view your transaction history, and access linked bank accounts and cards. Tapping on ‘My Money’ takes you to a screen where you can select ‘PhonePe Wallet’ to proceed with adding money.

Entering the Amount

When entering the amount to add to your wallet, consider your immediate needs and future transactions. It’s advisable to add an amount that covers your expected expenses without exceeding the daily or monthly limits set by PhonePe.

Choosing the Payment Method

Selecting ‘Credit Card’ as your payment method prompts you to enter your card details. Ensure that your credit card is active and has sufficient credit limit to cover the transaction amount. Double-check the details to avoid any errors that could lead to transaction failure.

Completing the Transaction

After entering your credit card details, you will be prompted to authenticate the transaction. Authentication methods can vary by bank but typically involve entering an OTP sent to your registered mobile number or completing a 3D Secure verification. Follow the instructions carefully to complete the process.

Common Issues and Solutions

Transaction Failure

If your transaction fails, it could be due to several reasons such as incorrect card details, insufficient credit limit, or issues with the bank’s server. Double-check the information entered and try again. If the problem persists, contact your bank for assistance.

Delayed Confirmation

In some cases, there may be a delay in receiving the confirmation message. This can happen due to network issues or server delays. If you do not receive a confirmation within a few minutes, check your transaction history in the PhonePe app to see if the amount has been added to your wallet.

Alternatives to Using Credit Cards

If you prefer not to use a credit card, PhonePe offers several alternative methods to add money to your wallet:

Debit Cards: Use your bank’s debit card for direct transactions without worrying about credit limits.

Net Banking: Transfer money directly from your bank account through net banking. This method is secure and widely accepted.

UPI (Unified Payments Interface): Utilize UPI for seamless transactions. UPI allows you to transfer money directly between bank accounts without needing to enter card details.

FAQs

Q: Is it safe to add money to PhonePe using a credit card?

A: Yes, PhonePe employs advanced security measures to protect your transactions. Ensure you follow safety tips like using a secure internet connection and enabling two-factor authentication.

Q: Are there any charges for adding money using a credit card?

A: PhonePe typically does not charge for adding money using a credit card, but it’s advisable to check with your card issuer for any applicable fees or interest rates.

Q: What should I do if my transaction fails?

A: Verify your card details, ensure sufficient funds, and retry the transaction. If the problem persists, contact PhonePe support for assistance.

Q: Can I use international credit cards to add money to my PhonePe wallet?

A: PhonePe primarily supports domestic credit cards issued in India. For international cards, check with PhonePe support for compatibility.

Q: What is the maximum amount I can add to my PhonePe wallet using a credit card?

A: The maximum limit varies based on PhonePe’s policies and your credit card issuer’s limit. Check the latest limits in the app’s ‘Add Money’ section.

Conclusion

Adding money to your PhonePe wallet from a credit card is a straightforward process that offers convenience and flexibility. By following the detailed steps outlined in this guide, you can ensure that your wallet is always funded and ready for transactions. Remember to stay aware of any fees your credit card issuer may charge and always prioritize security when performing digital transactions. With these tips, you’ll be able to manage your PhonePe wallet efficiently and enjoy the seamless payment experience it offers.

By leveraging the detailed instructions and tips provided, you can maximize the benefits of using your PhonePe wallet and ensure a secure and hassle-free experience. Whether you are paying bills, transferring money, or shopping online, having a well-funded PhonePe wallet can make your digital transactions smoother and more efficient.