Can We Send Money from Phonepe to Google Pay

Transferring money between digital wallets has become a common practice, and many users wonder if they can send money from PhonePe to Google Pay.

The good news is that it is indeed possible to transfer funds between these two popular platforms.

Both PhonePe and Google Pay utilize the Unified Payments Interface (UPI), which allows for seamless transactions across different apps.

To initiate a transfer, users can utilize several methods, including entering the recipient’s UPI ID or scanning a QR code.

This flexibility makes it convenient for users to send money to friends or family who prefer using Google Pay.

Before proceeding, it’s essential to ensure that both the sender and recipient have linked their bank accounts to their respective apps and have an active internet connection.

Also Read:

Fake Google Pay Screenshot

How to Find Your CRED UPI ID

UPI Cash Withdrawal ATM Near Me

Delete Your Google Pay Transaction History

Google Pay Pending Transaction Error

How to Fix Error Code U28 in Google Pay

How to Hide Mobile Number in Google Pay

VPA Address in Google Pay

U66 Error in Google Pay

Can We Send Money from Phonepe to Google Pay

In this article, we will explore the step-by-step process of sending money from PhonePe to Google Pay, highlighting the necessary requirements and tips to ensure a smooth transaction.

Whether you are new to digital payments or looking to streamline your money transfers, understanding these methods will help you navigate the process with ease.

How to Send Money from PhonePe to Google Pay

In today’s digital age, transferring money between different payment platforms has become increasingly convenient and seamless.

If you’re looking to send money from PhonePe to Google Pay, follow these simple steps:

Prerequisites

- Make sure you have both the PhonePe and Google Pay apps installed on your device.

- Ensure that you have added a bank account to your Google Pay account for the transfer.

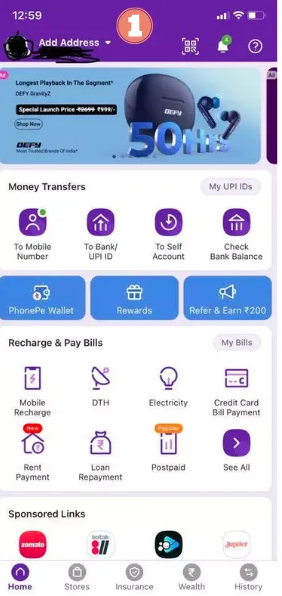

Step 1: Open the PhonePe app

Launch the PhonePe app on your smartphone and log in to your account.

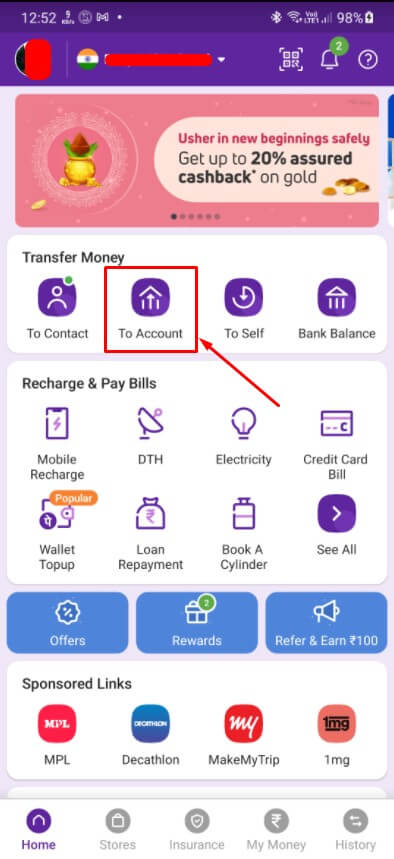

Step 2: Navigate to the account settings

Locate and tap on the “Account” icon, usually found at the bottom right corner of the screen. This will take you to your account settings.

Step 3: Select UPI settings

Within the account settings, find and select the “UPI” or “Bank Accounts” option.

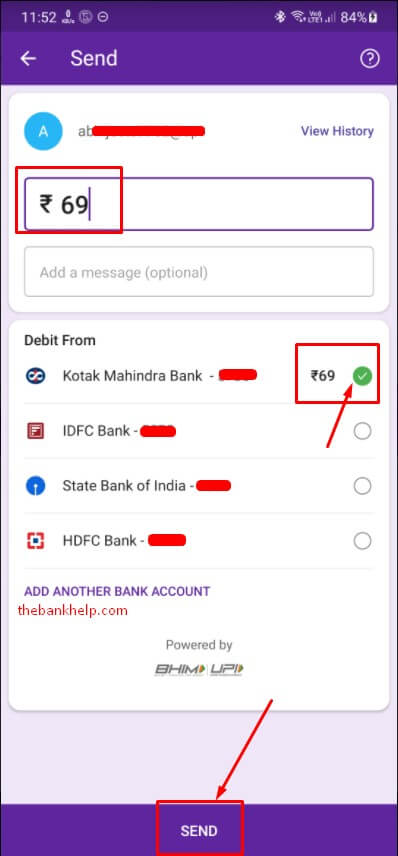

Step 5: Select “Pay using UPI ID”

Look for the “Pay using UPI ID” or similar option in the Phonepe app. This is usually located below the “Scan any QR code” option on the right side.

Step 6: Confirm the transaction

Review the payment details to ensure they are correct. If everything looks good, tap on the “Proceed to pay” button at the bottom to process the transaction.

And that’s it! By following these steps, you can easily send money from PhonePe to Google Pay using the Unified Payments Interface (UPI) system.

Remember to double-check the recipient’s UPI ID and enter the correct amount to ensure a smooth and successful transaction.

It’s important to note that transaction fees may apply depending on the policies of PhonePe and Google Pay.

It’s recommended to check their respective websites or contact their customer support for detailed information on any applicable fees.

Both PhonePe and Google Pay use secure encryption protocols to protect your transaction details.

However, it’s always a good practice to ensure that you are using the official apps from trusted sources and verify the recipient’s details before initiating the transfer.

If you encounter any issues during the transaction, such as a failed transfer or incorrect amount deduction, reach out to the customer support teams of both PhonePe and Google Pay for assistance.

They will be able to guide you through the process of resolving any problems.

Securing Your Transactions on PhonePe and Google Pay

When it comes to digital payments, PhonePe and Google Pay are two of the most popular UPI apps in India.

While these platforms offer convenience and speed, it’s crucial to take necessary security measures to protect your personal and financial information.

Here are some key steps to ensure your transactions are safe and secure:

Enable App Lock

Both PhonePe and Google Pay offer app lock features to add an extra layer of security to your account.

On Google Pay, you can enable either a screen lock or a Google PIN to access the app. Similarly, PhonePe allows you to set a passcode, fingerprint, or pattern lock to protect your account.

Use Biometric Authentication

Biometric authentication, such as fingerprint or facial recognition, provides a secure way to log in to your UPI apps.

Google Pay supports biometric authentication, making it convenient and secure to access your account. PhonePe also offers fingerprint and face unlock options for added security.

Keep Your UPI PIN Safe

Your UPI PIN is the key to your money, so it’s essential to keep it safe and secure.

Never share your UPI PIN with anyone, even if they claim to be from your bank or the app’s customer support. Additionally, avoid entering your PIN on any website or app that you don’t trust.

Verify Payment Details

Before making a payment, always double-check the recipient’s details, including their name, UPI ID, and mobile number.

Both PhonePe and Google Pay offer features to verify the recipient’s identity to ensure you’re sending money to the intended person.

Be Cautious of Phishing Scams

Phishing scams are a common way for fraudsters to trick you into revealing your personal information.

Be wary of suspicious emails, text messages, or calls claiming to be from your bank or payment app.

Never click on links or attachments from untrusted sources, and always verify the legitimacy of any request for your personal information.

Keep Your Device Secure

Your device is also a potential target for hackers, so it’s crucial to keep it secure.

Install a reliable security app, keep your operating system and apps up to date, and use a strong password or PIN to lock your device.

Additionally, avoid using public Wi-Fi networks for sensitive transactions.

Monitor Your Transactions

Regularly check your transaction history on PhonePe and Google Pay to ensure there are no unauthorized activities.

If you notice any suspicious transactions, immediately report them to your bank and the app’s customer support.

By following these security measures, you can help protect your personal and financial information while using PhonePe and Google Pay for your digital transactions.

Remember, staying vigilant and taking proactive steps is key to maintaining the safety of your money in the digital age.

Common issues with PhonePe and Google Pay transactions often arise from user errors, technical glitches, or banking restrictions.

Understanding these issues and their solutions can enhance user experience and ensure smoother transactions.

Common Issues

- Insufficient Funds: One of the primary reasons for transaction failures is insufficient balance in the linked bank account. Users should ensure that they have enough funds to cover the transaction amount, including any fees that may apply.

- Incorrect Details: Entering incorrect UPI IDs, bank account numbers, or other recipient details can lead to failed transactions. It is crucial to double-check all entered information before confirming a payment.

- Internet Connectivity: Transactions require a stable internet connection. Users should verify that their device is connected to the internet, as poor connectivity can disrupt the transaction process and lead to failures.

- App Issues: Outdated versions of the PhonePe or Google Pay app can cause functionality problems. Regularly updating the app through the Google Play Store or Apple App Store is recommended to avoid bugs and enhance performance.

- Bank Limits: Each bank imposes daily transaction limits. If a user attempts to exceed these limits, the transaction will fail. Users should check with their bank regarding any restrictions that may apply to their accounts.

- Technical Glitches: Occasionally, the UPI system may experience downtime or technical issues, resulting in transaction failures. Users should be patient and try again after some time if they encounter such problems.

Troubleshooting Tips

- Verify Account Status: Ensure that the linked bank account is active and properly configured in the app. If there are issues, users may need to contact their bank for assistance.

- Check Transaction History: Users can review their transaction history within the app to confirm whether a payment was successful or failed. This can provide clarity on the status of their transactions.

- Reset UPI PIN: If a user enters their UPI PIN incorrectly multiple times, they may be temporarily locked out from making transactions. Resetting the UPI PIN can restore access.

- Contact Customer Support: If issues persist, users should contact the customer support of PhonePe or Google Pay. They can provide specific guidance based on the user’s account and transaction history.

- Use Alternative Payment Methods: If a transaction fails, users can try making payments using a different bank account or method to complete their transaction successfully.

By being aware of these common issues and following the troubleshooting tips, users can mitigate problems and enhance their transaction experience with PhonePe and Google Pay.

Transaction Limits in PhonePe and Google Pay

The National Payments Corporation of India (NPCI) has set a daily transaction limit of ₹1 lakh (Rs 100,000) for all UPI apps, including PhonePe and Google Pay.

This limit applies to both peer-to-peer (P2P) and peer-to-merchant (P2M) transactions.

For new users, an initial UPI transaction limit of ₹5,000 is applicable for the first 24 hours on both PhonePe and Google Pay.

Customers can increase their transaction limit by contacting their bank and requesting a limit expansion, subject to their risk profile.

It’s important to note that the UPI transaction limit is separate from the bank account balance.

The transaction limit represents the maximum amount that can be transferred through the app in a day, while the bank account balance reflects the total available funds.

Transaction Fees and Interchange Charges

As per the new guidelines by NPCI, customers do not have to pay any interchange fees for UPI payments made through Prepaid Payment Instruments (PPIs) for P2P and P2M transactions.

However, merchants will have to pay an interchange fee ranging from 0.5% to 1.1% on UPI transactions above ₹2,000 made through PPIs.

The interchange fee varies depending on the type of transaction:

- Fuel: 0.5%

- Post office, telecom, utilities, agriculture, and education: 0.7%

- Supermarket: 0.9%

- Insurance, mutual funds, and railway: 1.1%

It’s important to note that the interchange charges only apply to PPI merchant transactions, and there is no charge to customers. Individuals making personal transactions using UPI are not charged any fees.

As per the new guidelines, PPI issuers like PhonePe and Google Pay are required to pay a wallet-loading service charge of 0.15% to the remitter banks for recharging wallets with over ₹2,000.

For example, if you recharge your PhonePe wallet with more than ₹2,000, PhonePe will pay a 0.15% service charge to your bank.

In addition to the daily transaction limit, NPCI has also set a limit on the maximum number of UPI transactions per day.

As per the new regulations, a person can make up to 20 transactions in a day, after which they have to wait for 24 hours to start transacting again.

FAQs

1. Can I Directly Transfer Money from PhonePe to Google Pay?

Yes, you can transfer money from PhonePe to Google Pay using the UPI system.

The money is sent from your bank account linked to PhonePe to the Google Pay account linked to the recipient’s bank account.

It’s important to note that the transaction is facilitated through the Unified Payments Interface (UPI), not directly between the apps.

2. What Information Do I Need to Send Money from PhonePe to Google Pay?

To send money from PhonePe to Google Pay, you will need the recipient’s UPI ID or the mobile number linked to their Google Pay account.

This allows the UPI system to identify the correct bank account associated with the recipient’s Google Pay.

3. Are There Any Fees for Transferring Money from PhonePe to Google Pay?

Generally, UPI transactions between PhonePe and Google Pay are free.

However, some banks may impose charges if you exceed a certain number of free transactions per month. It’s always a good idea to check with your bank for any applicable fees.

4. What Should I Do if My Transaction from PhonePe to Google Pay Fails?

If your transaction fails, first check your internet connection and ensure that you have entered the correct UPI ID or mobile number.

If the problem persists, you can check the Transaction History in PhonePe to verify the transaction details.

Contact PhonePe or Google Pay customer support if you need further assistance.

5. Is There a Daily Transaction Limit for Sending Money from PhonePe to Google Pay?

Yes, UPI transactions have a daily limit, typically set at ₹1 lakh per day across all UPI apps, including PhonePe and Google Pay.

This limit is determined by the Reserve Bank of India (RBI) and individual banks. Be sure to verify your specific bank’s limit.

6. Can I Reverse a Payment if I Sent Money to the Wrong UPI ID on Google Pay?

If you accidentally send money to the wrong UPI ID on Google Pay, it’s crucial to contact the recipient and your bank immediately to request a reversal.

However, whether the money can be refunded depends on the recipient’s cooperation and the bank’s policies.

7. How Long Does It Take for a PhonePe to Google Pay Transaction to Complete?

Most UPI transactions, including those from PhonePe to Google Pay, are processed instantly.

However, delays can occur due to issues with the bank’s servers or a poor internet connection. If the transaction takes longer than expected, check your Transaction Status in PhonePe and wait a few minutes before retrying.

Final Words

In conclusion, transferring money from PhonePe to Google Pay is a straightforward process thanks to the seamless integration provided by the Unified Payments Interface (UPI) system.

By using the UPI ID or the mobile number linked to the recipient’s Google Pay account, you can quickly and securely send money from your bank account via PhonePe.

Both platforms are equipped with robust security features like Two-Factor Authentication and Transaction Encryption, ensuring that your transactions remain safe and private.

While most transfers are instant, it’s important to be mindful of the transaction limits set by the Reserve Bank of India (RBI) and your specific bank, typically capped at ₹1 lakh per day.

Additionally, although UPI transactions between these apps are generally free, it’s advisable to verify any potential charges with your bank.

In case of any issues, such as entering the wrong UPI ID or facing transaction failures, both PhonePe and Google Pay offer customer support to help resolve problems.

Overall, the ease and convenience of transferring money between these two popular platforms make them a reliable choice for digital transactions in India.