How to Complete KYC in PhonePe

Mobile payment platforms like PhonePe have made financial transactions incredibly convenient and secure in today’s digital age.

However, to fully utilize all the features and benefits of PhonePe, users need to complete the KYC (Know Your Customer) process.

KYC is a mandatory verification process that ensures the authenticity of users by verifying their identity through valid documents.

This process not only enhances the security of your account but also increases your transaction limits and unlocks additional features.

Completing KYC on PhonePe is a straightforward process that can be done directly within the app.

Whether you are a new or existing user, following a few simple steps will help you complete your KYC quickly and efficiently.

In this article, we will guide you through completing your KYC on PhonePe, the documents required, and the benefits of having a verified account.

How to Complete KYC in PhonePe

KYC plays a crucial role in safeguarding user information and preventing fraudulent activities.

By authenticating the identity of its users, PhonePe ensures a trusted and seamless experience for individuals seeking to make hassle-free transactions.

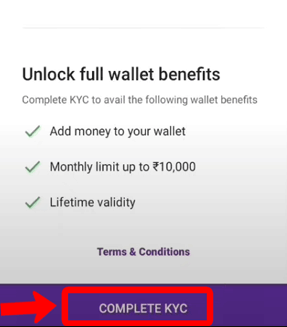

Completing your KYC on the PhonePe app unlocks several benefits, including:

- Enjoy higher wallet and increased transaction limits for sending and receiving money.

- Access additional features like investing in mutual funds.

- Protect your account and transactions from potential fraudulent activity.

- Fulfill mandatory customer identification requirements.

Types of KYC in PhonePe

PhonePe offers two main types of KYC:

- Minimum KYC: This is a basic level of KYC with fewer features and limits. You can typically complete Minimum KYC online by providing your Aadhaar number and verifying it through OTP (One-Time Password).

- Full KYC: This is a more comprehensive KYC process that offers higher transaction limits and access to all PhonePe features. Full KYC may involve submitting additional identification documents and, in some cases, an in-person verification step.

Documents Required for KYC in PhonePe

To complete the KYC process, you will need the following documents:

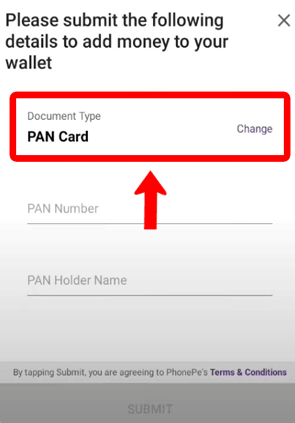

- PAN Card

- Aadhaar Card

- Any one of the below current address proofs (if the address on your Aadhaar is different from your current address):

- Voter ID

- Driving License

- Passport

- NREGA Job Card

- Letter from the National Population Register

Step-by-Step Guide to Complete KYC in PhonePe

Minimum KYC

- Open PhonePe: Launch the PhonePe app on your mobile device.

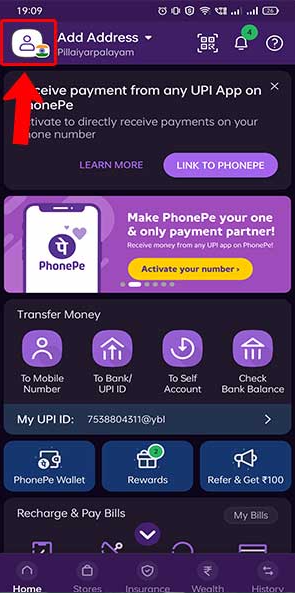

- Profile Access: Tap on your profile picture in the app’s top left corner.

- Find the KYC Section: Locate the “My KYC Profile” or “KYC Verification” section under “Payment Settings.”

- Start the Process: Tap on “Upgrade Wallet” or “Complete KYC.”

- Choose Minimum KYC: If given an option between Minimum and Full KYC, choose “Minimum KYC.”

- Provide Aadhaar: Enter your Aadhaar details in the designated fields.

- Verify Aadhaar: PhonePe will send an OTP to your Aadhaar-linked mobile number. Enter the OTP to verify.

Full KYC

Open PhonePe: Launch the PhonePe app on your mobile device.

Profile Access: Tap on your profile picture in the app’s top left corner.

Find the KYC Section: Locate the “My KYC Profile” or “KYC Verification” section under “Payment Settings.”

Start the Process: Tap on “Upgrade Wallet” or “Complete KYC.”

Choose Full KYC: If given an option between Minimum and Full KYC, choose “Full KYC.”

Provide PAN and Aadhaar: Enter your PAN and Aadhaar details in the designated fields.

Verify Aadhaar: PhonePe will send an OTP to your Aadhaar-linked mobile number. Enter the OTP to verify.

Upload Proof of Address: Scan or take a clear photo of your proof of address document and upload it.

Video Verification: In some cases, PhonePe might ask you to complete a short video verification. Follow the on-screen instructions, which usually involve showing your face and your ID document to the camera.

Await Approval: The KYC process usually takes 2-3 business days to complete. PhonePe will notify you once your KYC is approved.

Important Points to Remember

- Ensure that the documents you upload are clear and legible. Blurry or unclear documents might cause delays in approval.

- Provide correct and updated information. Any mismatch in details could lead to rejection of your KYC application.

- If the address on your Aadhaar differs from your current address, use a valid proof of address document.

- While video KYC is not always mandatory, be prepared for it as an additional verification step.

KYC Verification Status

To check your KYC verification status on PhonePe:

- Tap the Wealth at the bottom of your PhonePe app home screen.

- Tap My Portfolio at the top of the screen.

- Tap the My Account icon on the top right of your screen and your KYC verification status will be displayed.

Transaction Limits Based on KYC Status

The transaction limits on PhonePe vary based on the KYC status of the user. Here is a table summarizing the limits:

| KYC Status | Per Transaction Limit | Daily Limit | Monthly Limit | Yearly Limit |

|---|---|---|---|---|

| Full KYC | ₹200,000 | ₹400,000 | ₹1,000,000 | ₹3,000,000 |

| Min KYC | ₹10,000 | ₹10,000 | ₹120,000 | ₹120,000 |

| No KYC | NA | NA | NA | NA |

Updating KYC Details

If you need to update your KYC details in PhonePe, you can contact PhonePe customer support for assistance. They will guide you through the process and provide the necessary instructions.

Common Issues and Solutions

Incorrect KYC Details

If PhonePe finds that the KYC details you provided are incorrect, they can deactivate your wallet or take other necessary actions. Ensure that all details entered are accurate and up-to-date.

Using Someone Else’s Documents

KYC verification in PhonePe should be completed using your own valid documents. Using someone else’s documents is against the terms and conditions and may result in account suspension.

Multiple Accounts

You cannot use the same document to complete KYC for multiple PhonePe accounts. Each account needs to have a separate and unique KYC verification.

Contacting Customer Support

For any issues related to KYC, you can contact PhonePe customer support. Here are the contact details:

- Phone Number: +91 226 872 7374

- Email: [email protected]

- Customer Support Hours: Mon-Fri 10 am to 7 pm

FAQs

Why is KYC necessary for PhonePe?

KYC (Know Your Customer) is necessary for PhonePe to comply with regulatory requirements, enhance security, and enable features like higher transaction limits and wallet usage. It helps verify the identity of users and prevents fraudulent activities.

What documents are required to complete KYC on PhonePe?

You will need a valid government-issued ID proof for completing KYC on PhonePe. Acceptable documents include Aadhaar card, PAN card, Passport, Voter ID, or Driving License.

Can I complete KYC on PhonePe using Aadhaar?

Yes, you can complete KYC on PhonePe using your Aadhaar card. You must provide your Aadhaar number and authenticate using an OTP verification sent to your registered mobile number.

How long does it take to complete KYC on PhonePe?

The KYC process on PhonePe typically takes a few minutes if you have all the required documents and information ready. Once submitted, the verification process may take a short while.

What should I do if my KYC verification fails on PhonePe?

If your KYC verification fails, ensure that your provided details match those on your ID proof. Check for any errors or discrepancies and retry the process. If the issue persists, contact PhonePe customer support for assistance.

Can I use PhonePe without completing KYC?

You can use PhonePe for basic transactions without completing KYC. However, completing KYC is required to access certain features like higher transaction limits, wallet usage, and full benefits of the app.

Conclusion

Completing KYC in PhonePe is a straightforward process that ensures the security and authenticity of your account.

Following these step-by-step instructions, you can easily complete your KYC verification within the PhonePe app.

Remember to have the required document handy, double-check the entered information, and submit accurate details to avoid delays or issues during the verification process.

Once your KYC is completed, you can enjoy enhanced features, higher transaction limits, and a more secure digital payment experience.

By adhering to the guidelines and ensuring that your KYC details are accurate, you can make the most of the services offered by PhonePe.

Whether for personal or business purposes, completing your KYC is crucial in ensuring a seamless and secure digital payment experience.